Sizable quantity

One of the things that we notice from trade data provided by the World Trade Organization (WTO) is the dominance of manufactured goods in total merchandise trade in generating income for exporting countries. Countries that export a sizable quantity of manufactured goods benefit from the hog’s share of export revenues, about two-thirds of the global income from trade. At the same time, countries that export agricultural products get the least out of global export revenues, an estimated 11 per cent. Exporters of primary commodities like fuels and minerals do better than agricultural producing countries since they share 22 per cent of the global revenues. One must wonder what such knowledge means for a country like Guyana which has relied for its entire independent life on agricultural and primary commodities for its livelihood. While commodity exports produced benefits for Guyana, it also has been the source of much anxiety over the years.

Anxiety

The anxiety that Guyana faces in the trading arena does not come only from the type of commodities that it produces and sells abroad and the uncertainty in the prices that it gets for the products. Anxiety comes also from the very limited number of commodities that it exports in meaningful quantities. An analysis done over the 10-year period 2006 to 2015 revealed that eight products featured prominently in the export revenues of the country. These eight products are well known with six out of the eight consisting of agricultural or primary commodities. The main destinations of those products were Canada, USA, Caricom, UK and Venezuela. The Table below shows the distribution of the export revenues earned from the five countries.

While international trade is important, the above-named five markets have played important roles in Guyana’s economic development. They have been constants in the economic lives of Guyanese and important to their business endeavours and wealth creation efforts. This reality is reflected in the observation that trade with the five countries is equivalent to 72 per cent of the income earned by the country over the period.

While the trade relations are beneficial to Guyana, one could see some risks that continue to produce anxiety within the country. The market range of exports is very narrow. A decrease in demand by any of those countries leaves Guyana’s exports vulnerable. Just imagine what would happen to Guyana if it lost the Canadian or US markets or any part thereof to competitors. It is not only the industries serving those markets that will suffer. The decline will reverberate throughout the entire economy. Guyana encountered that experience with the withdrawal of the rice demand by Venezuela that existed under the PetroCaribe arrangement. Policy decisions coming out of those five markets are very important with 76 per cent of the country’s export revenues on the line.

Motivation

But the motivation to diversify products and markets is not limited to the concerns about heavy dependence on a narrow range of products and the risks to market access. They are also about jobs and the accumulation of wealth. The country needs to be able to produce more than it currently produces if it is to bring the unemployment numbers down. It needs to do so in the quantities that are demanded and with the quality and price that will ensure its sale. The domestic market does not offer such expanded opportunities. It is the foreign market where Guyana must look for increased opportunities to sell more products. The domestic market is too small. Guyana has been looking for new markets and finding them either on its own as in the case of the Partial Scope Agreement between Brazil on the one hand and Guyana and St Kitts/Nevis on the other; or through Caricom, as is the case with trade agreements with Colombia, Costa Rica and Cuba.

Despite their availability on favourable terms, these markets have not generated the type of outcome that Guyana needs from them. Three things stand in the way of taking advantage of the new markets. The first thing is inadequate infrastructure. Producers must be able to get their products to the people who need them. If there are no roads or good roads to get produce from the farm or factory to the market then trade would be impossible or would be most inefficient. This is the situation facing Guyana and the market available to it in Brazil. Only part of the road from the coast to the northern part of Brazil is easily passable. The rest of it varies from difficult to treacherous since it cannot be termed an all-weather road. For years the improvement of this connector from Georgetown to Lethem has been paved with good intentions. That does not work for trucks and vans laden with heavy goods to get safely between the two extreme points. Finally, it looks as if something will happen. Earlier this year, it was announced that money was received from the British, a major trading partner of Guyana’s, that would make it possible to complete part of the road and even with a bridge across one of the rivers.

Perishable products

Such an outcome could serve as a motivation for Guyana to look for money to have the remainder of the road completed. The completion of an all-weather road will bring increased traffic from both Brazil and Guyana. It will be cheaper for Guyanese producers to export larger quantities of goods at a lower average cost than they can do now. One suspects therefore that the revenue that could be gotten from exporting produce to Brazil lags behind the cost of producing and distributing the goods. Persons who might have perishable products to export run a greater risk of trying to do business through the inadequate road corridor between Georgetown and Lethem. Until the road is completed and the various administrative measures are fully in place, the Brazilian market is likely to remain an exceedingly slow growing one.

Transhipment mechanism

The infrastructure problem is larger than meets the eye. Despite years of importing and exporting goods through the ports of Georgetown, sea transport remains a major hindrance to export trade. The shipping volumes that come out of Guyana are not large enough for very large ships to dock at any port in Guyana. That is one part of the problem. The other part of the problem has to do with the infrastructure to accommodate such large ships if we had the volumes to put in them. Major port activities take place on the Demerara River which is too shallow to accommodate extremely large ocean-going vessels. The consequence of this situation is the use of smaller ships and reliance on the transhipment mechanism to get goods to and from Guyana. As simple as such a course of action seems, it hinders the reach of certain products from Guyana to the Caribbean and the rest of the world. A case in point is that of honey. The transhipment place for goods coming out of Guyana is Trinidad and Tobago. However, Trinidad and Tobago does not permit honey from Guyana to enter its territory.

With such experience, it is clear that Guyana needs to have greater control over its shipping arrangements where larger ocean-going vessels could dock and transport cargo directly to destinations that could accommodate such ships. All of Guyana’s principal trading partners can accommodate very large ships. Guyana has not done enough to have equivalent capacity to help it expand its trading volumes. A deep-water harbour becomes an extremely important piece of infrastructure to make it happen.

Technology

One additional point needs to be made and it is about technology. Guyana has lamented its inability to export products with higher value-added. This is partly linked to the issue of energy. But the greater problem seems to be insufficient investment in developing new products including ones that use less energy than is currently the case. Guyana’s solution to its energy problem has not been to lower energy inputs into its production process. It has not been about producing products that reduce energy inputs. Instead, it has been about reducing energy costs. Quite often that meant buying and using less fuel in production. This often led to lower output. Choices by local producers on how they allocate resources are major considerations in the value-added contribution to export products. Until those choices include the production of high-quality goods that use less energy, the expansion of value-added exports will be impeded.

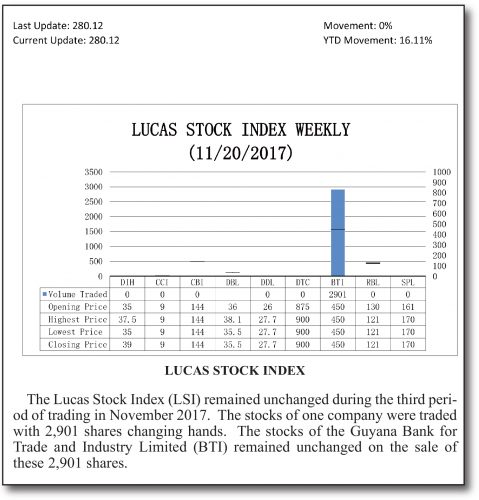

Writer’s note: This will be my last article for Stabroek News. I made this decision with a heavy heart, but wish to take this opportunity to thank all readers for their support, thoughtfulness and guidance over the years. I also wish to thank Stabroek News, my Editor and Editor-in-Chief and staff for giving me this opportunity to share my thoughts and opinions on many economic and financial matters for 10 years which were all intended to broaden our vision about Guyana and on how to make it a better place for each one of us. However, I will continue to publish the Lucas Stock Index.