As repeatedly urged, readers need to be familiar with the basic structure/features of global oil refining, if they wish to

Top refineries

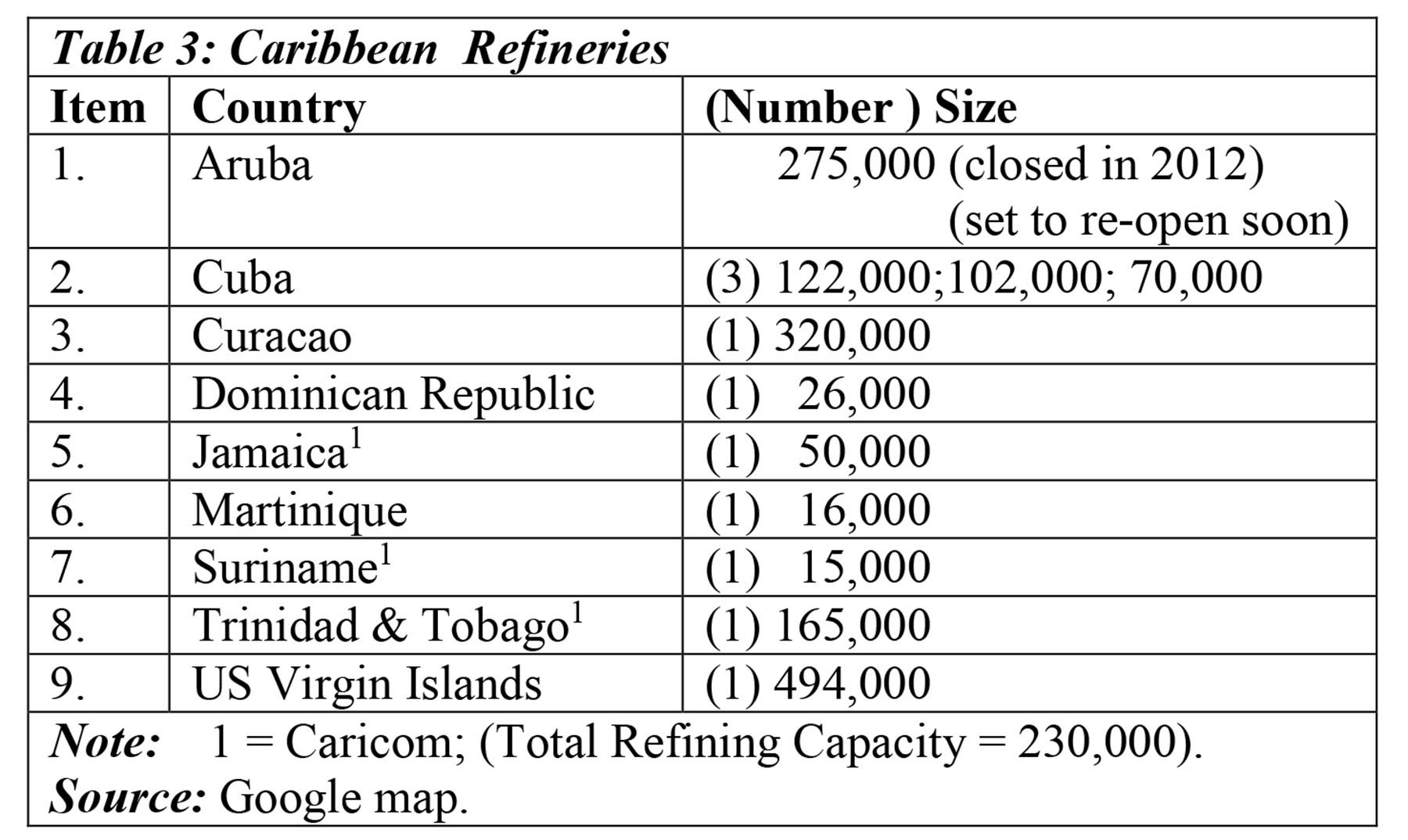

Table 1 lists the top ten oil refineries worldwide. Their basic descriptive statistics reveal the range of values is 0.72; 10 countries produce on average 7.3 million barrels per day (mln b/d) at a simple average of 0.73 mln b/d. Data variation is modest. The variance is 0.05; mean deviation is 0.18; and, standard deviation is 0.23. The coefficient of variation is 0.31 and therefore the relative standard deviation is 31.06 per cent.

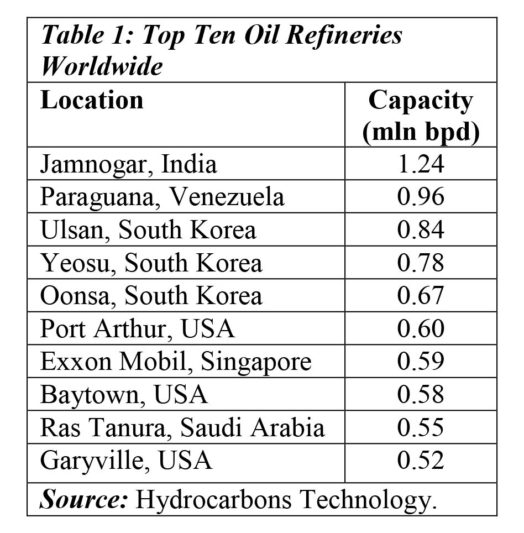

Table 2 shows estimates of refining capacity by countries. The data range is greater; with the USA (number 1) refining about 7.2 times number 10. Simple average output for the ten countries is 5.6 mln b/d. And, more importantly, ranking of refining capacity by country differs from the ranking by refinery size.

Caricom refining

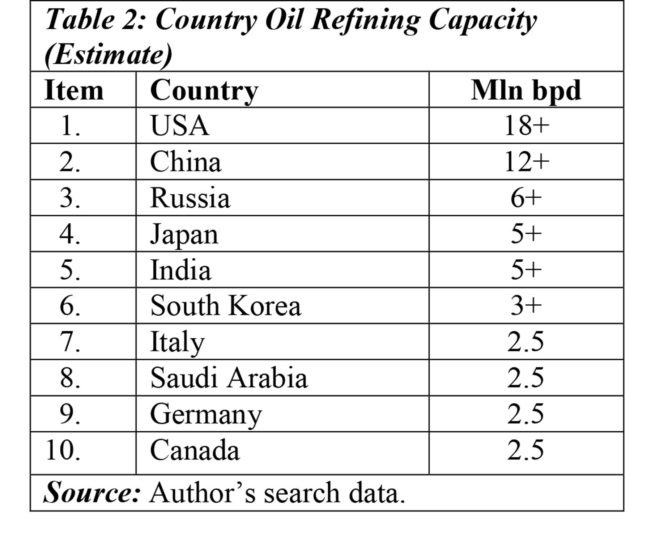

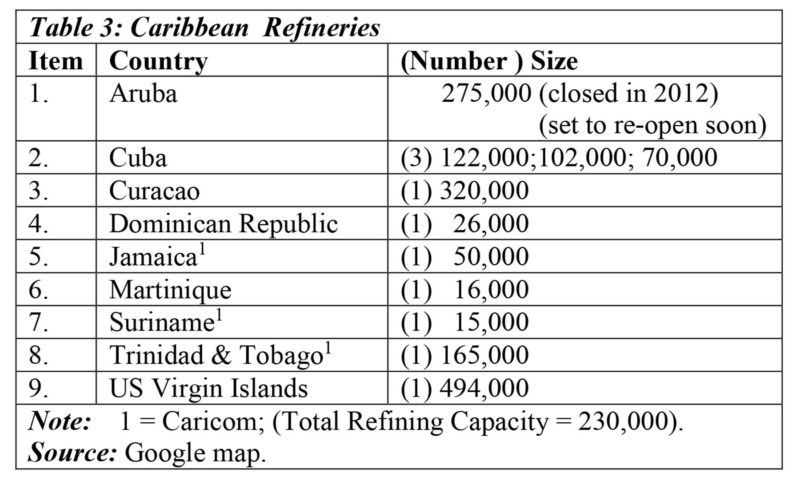

Presently, there are nine Caribbean oil refineries, with three located in the Caricom sub-region. Total Caribbean refining capacity is 1.3 mln b/d; and for the Caricom sub-region, 230,000 b/d. Available estimates suggest that only about 60-70 per cent of this capacity has been available.

The size/range of Caribbean refineries is from a low of 15,000 in Jamaica to 320,000 b/d in Curaçao. Of note, the Aruba refinery, with a capacity of 275,000 b/d was closed in 2012, but there are plans to reopen the complex. There are also plans for a second refinery to be built in Jamaica. Cuba has three refineries, with capacities of 122, 102 and 70 thousand b/d.

Usually, those Caribbean countries with smaller refineries focus on domestic markets, while those with larger refineries focus on exporting. Some analysts argue the region’s unique island location and proximity to global transportation routes, offer scope for expansion of export based oil refining.

US small refineries

As an introduction to my coming assessment of the pros and cons of a Guyana oil refinery, such global data are helpful, directing attention to the marginal status of a Guyana oil refinery. This marginality indicates that input/output prices facing a Guyana refinery should reflect its ‘price taker’ status. Sadly, this is the fate of small countries, which as buyers and sellers will remain price takers, unless exceptionally, they trade in unique products. That is, products for which the small country is a dominant buyer or seller. While, as a rule, this axiom remains true, there is need to establish how small size operates in specific markets.

I have observed that, worldwide, small refineries are common, and not confined to small countries, which cannot offer economies of scale. This is revealed in the United States’ oil refining industry. Currently there are 141 operable oil refineries in the US. Of these, two are idle and 139 operating. This amount and the ratio of idle to operable have held true more or less for the years 2012-2016. Table 1 shows three of the top ten global refineries are located in the US.

The US Congressional Research Service (CRS) had submitted a Report in August 2014, entitled: Small Refineries and Oil Field Processors: Opportunities and Challenges. That report indicates that from the mid-1980s up to its 2014 publication, 114 oil refineries had been closed in the US. This closure reflected a period of industry-wide refinery consolidation, noted last week as a global trend led by Central and Western Europe and the US. Further, between 1977 and mid-2014 no significant refineries were built in the United States. The US, Energy Information Administration (EIA) reveals that since then, four refineries were built with the following capacities: 42,000, 19,000, 25,000 and 46,200 b/d.

The US Small Business Administration defines a small refinery as one that refines less than 125,000 barrels per day and employs less than 1500 persons. This status provides them exemptions from federal regulations (mainly environmental and health related).

However, the key observation is that, almost one-half of US refineries produce less than 125,000 b/d! These small oil refineries make up about 21 per cent of total US refining capacity. The information indicates the enormous range of refinery size even in the huge US refining market (18 mln b/d). Furthermore, the EIA reveals only four small refineries were built over the 2014-15 period, suggesting that the importance of small refineries has been maintained.

Conclusion

As I shall develop at some length next week, oil refineries do not only vary widely in terms of size (capacity) but, perhaps more crucially in terms of their capability for producing petroleum based products. It is therefore significant that the CRS study offers the observation: “Small refineries face many of the same economic, market, and environmental factors that affect large refineries, but they may also benefit from exemptions in complying with certain federal regulations”. As an aside this violates WTO free trade rules and openly supports local content requirements (LCRs).