This week’s column and the next will attempt to evaluate the pros and cons of small mini-oil refineries. This is being done with a view to appraising their effectiveness in the Guyana-specific economic landscape and not simply as an abstract theoretical evaluation.

To begin, if one considers that at the end of the 20th century, there were as many as 725 oil refineries operating worldwide (a number that is considerably reduced today (circa 650)). And further, since that time, a number of new oil refineries have been proposed (some have been operationalized, some denied, and some are still at the proposal stage seeking finance), then this would suggest that overall, probably a thousand or more feasibility studies on proposed oil refineries would have been completed worldwide, in recent decades. All this material would certainly have informed the discipline of energy economics.

Performance and economics

Available literature on energy economics reveals that the performance of mini oil refineries, similar to their conventional counterparts, is treated as a function of 1) their location; 2) their vintage (or level of complexity as previously discussed); 3) the availability of investment funds at the ‘right price’; 4) the available supply of crude oil for the refinery; 5) the specifications and requirements associated with the products the refinery intends to produce; 6) applicable environmental laws, regulations, and standards; and 7) what are termed by industry analysts as “other applicable” regulatory standards. This last item (7) would consist of a variety of official incentives, including tax expenditures and other sanctioned financial/credit facilitation.

This performance relation immediately directs attention to, at least, seven central economic concerns, which clearly should be addressed when undertaking an economic appraisal for the establishment of every type of oil refinery, whether teapot, mini, conventional or mega. These seven concerns are first, the product slate. This term refers to the range/quality/specifications of the petroleum products the refinery expects to produce.

Second, the crude slate. This term refers to the expected type/quality/specifications of the crude oil supply available for processing at the refinery under consideration. Third, the configuration of the refinery. This term can be summarily expressed by the Complexity Index, which we have already addressed, together with the capacity of the refinery expressed as barrels of oil processed per day (bbl/d).

The fourth economic concern is the location of the markets for the petroleum products the refinery expects to sell. This would obviously impact on the refiner’s marketing and distribution costs.

The fifth concern is the location of the crude slate. Since this is the primary input into oil refinery processing, proximity to crude supply would be a major factor affecting refining costs. Sixth, the range and type of government incentives on offer to the refinery is also crucially important, as this would affect its operating costs.

Finally, there are the logistical and distributional concerns. These directly impinge on transportation, storage and other related matters concerning the movement and distribution of both inputs into the refinery and the products it produces for its intended markets.

Trends

The 21st century has witnessed significant volatility in the global oil market. This has put considerable pressure on refinery margins (profit). Thus, for example, since 2000 annual oil prices have ranged from a low of just under US$23 per barrel in 2002, to a high of just over US$91 in 2013. By 2016 the annual West Texas Spot oil price had averaged US$43.33.

The resultant price squeeze on refining margins, had, not surprisingly, slowed investments in the sector. In turn this has introduced some amount of caution in the refining sector.

One response to this caution, which was observed during the 2010s, was a resort to establishing small refineries as an expedient and temporary measure to fill gaps appearing in the supply-demand balance for refining products. Thus in the very different, but yet huge refining markets of both China and the United States this trend can be readily observed.

The Oil and Gas News in its May 2016 Report on ‘Refining Technology Crude Oil Blending’ had pointedly observed that “even in China, where past Governments have sought to banish the so-called “teapot” refineries in favour of larger more sophisticated facilities operated by the country’s national oil companies (NOCs), the swing has now moved into reverse”. The article went on to indicate that modular, mobile or mini-refineries had by then become a frequent feature of the oil refining landscape.

Further, it also observed that, perhaps more significantly (and for a host of the Chinese different reasons), this trend has also appeared in other parts of the world, including as I have previously indicated, a wide swathe of African, Asian, and Latin American countries, along with the United States, which as we noted, is the world’s largest oil refining nation.

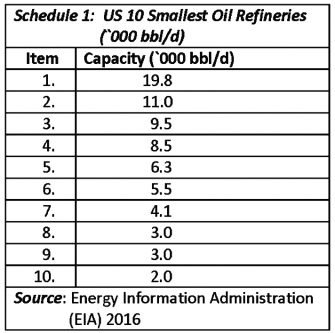

Schedule 1 below shows the size of the ten smallest US refineries, as of mid-2016, in descending order of magnitude.

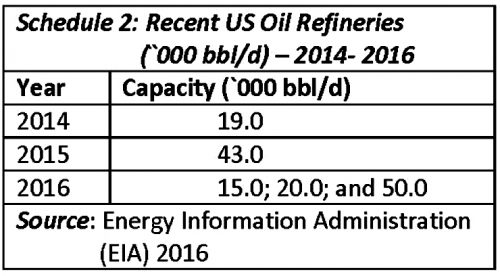

As I indicated a similar trend is evident in the USA. Thus the five recent US refinery plants that have been established over the 2014-16 period, are “simple, small refineries”. These are indicated below in Schedule 2.

Further, the International Energy Agency (IEA) had observed in its brief, The Case for Modular/Mini-Refineries: “Despite the generally poor returns from petroleum refinery investment, modular mini-refineries, from simple diesel production units to more sophisticated cracking refineries are increasingly becoming a flexible and cost effective supply option”. The article indeed goes on to specify appropriate situations for these types of refineries, such as remote locations, and those where there is a need for rapid adaptation to local area demand.

This IEA’s recommendation underscores the article’s observation that the petroleum refining sector had been, and still is, undergoing “significant rationalization over the last three decades”. The article also claimed that the prior two decades (1980s and 1990s) had seen increased competition among refineries, declining margins, and cuts in the number of refineries. These considerations I have previously highlighted.

This discussion continues next week.