Today’s column wraps up the discussion started last week on the general economic characteristics of oil refineries. After completing that I will proceed to discuss the specific instance of mini refineries. The wrap-up will seek to 1) elaborate on the crack spread (introduced last week); and 2) address briefly the technics of markets and contracts for crude oil and refined products.

Profit, crack spread

The word ‘crack’ derives from the technical basis on which oil refineries make money. The refinery cracks (or breaks) the long-chain of hydrocarbons, which constitute crude oil, into shorter-chain higher valued petroleum-based products. The word ‘spread’ describes the differential between the sale price of an oil refinery’s products, and the cost it incurs for its crude oil inputs. A refinery’s operating costs, income tax payments, and so on would cut into this spread, which therefore, makes it a good approximation for the profit or margin earned by refineries.

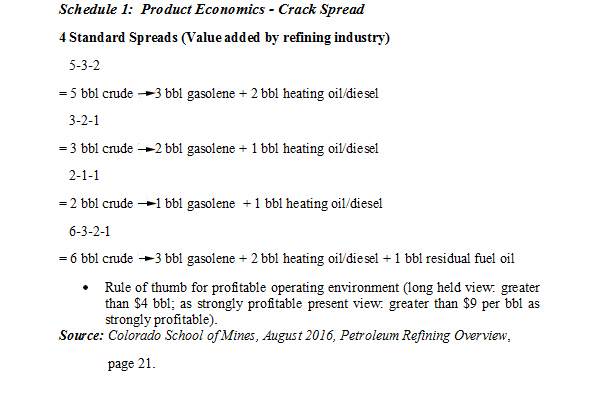

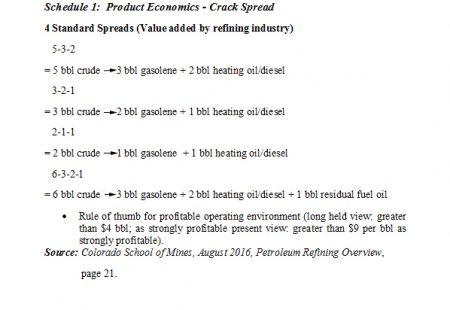

Following last week’s column, a colleague has sent me a copy of a restricted publication from the Colorado School of Mines: Petroleum Refining Review, 2016. Schedule 1, reproduced below, is taken from this publication. The Schedule provides the rule of thumb used by US investors for profit-making in the oil refinery business. The rule of thumb varies by regions and countries, as they are intended to apply only in their respective financial markets. The major determinant of the crack spread is the ratio of crude oil the refinery processes and the different refined petroleum-based products it produces.

However, both the price of crude oil and refined petroleum-based products can fluctuate independently of each other over short periods of time. This is attributable to supply and demand imbalances which can arise from a multitude of factors, including political, economic, geo-political, and environmentally-driven ones.

Over the decades this independent fluctuation has created opportunities for financial investors to earn money by exploiting volatile oil prices. Trading by such financial investors, together with commodity traders (in both refined products and crude oil), create a hedge that oil refineries use in order to reduce uncertainty and their exposure to risks, arising from independently fluctuating prices of crude oil and the refined products it yields.

Markets, contracts

Spot contracts are those where trading takes place at current market rates. These contracts specify quantities, locations, and time (usually short-term, 10-25 days). Forward contracts have customized future delivery dates that also specify volumes and location for delivery. Future contracts are financial instruments designed for taking delivery of an underlying oil contract at a specific settlement date. These last contracts are part of the family of derivatives, so termed because their value derive from the underlying instrument. In these markets there are both commercial traders (those in the oil business) and non-commercial traders (such as investment banks, speculators, and pension funds).

Mini-oil refineries

In this section, I shift the focus towards addressing the economic characteristics of the petroleum-refining segment known as mini-oil refineries, as distinct from the general class of oil refineries. There are found in the literature, a large number of specific economic characteristic features. To make these manageable I have condensed them into a dozen main categories, which I shall present in the course of the remainder of this column and conclude next week.

Economic feature: 1 For starters, apart from their size, mini-oil refineries typically embrace three added physical attributes. They are built as modules, mounted on skids, and pre-fabricated in an engineering factory environment. These features have been specially adapted for mini-refineries, and because of their physical characteristics several potential economies follow. One is that being pre-fabricated and modular allows their assembly in controlled factory environments. Engineering experts further claim this allows for improved engineering quality and standardization.

Additionally, their modular form has stimulated the growth of specialist firms seeking to exploit economies of spacing, made possible in controlled environments. Engineers also indicate mini-refineries are faster to build and better able to secure on-schedule construction and delivery. Finally, being mounted on skids, facilitates on-site delivery.

Accompanying the above are disadvantages and risks. One such is that, ultimately, the plant has to be set up on site. And, if mistakes or errors in specifications occur, these can be costly to rectify. Cramping at the on-site location has also been reported as a risk in several evaluations of such refineries.

Economic feature 2: A second advantage of mini-refineries is that, since the early 2000s, there has been a rapid explosion in the number of specialist engineering firms which operate in this sector. This has generated intense competition and sustained efforts to contain their construction costs. These specialist firms have also shown constant innovation and improvement in standards. And, perhaps most importantly, their services have expanded considerably over the years. Today, several firms offer turnkey supplies covering, design, engineering, procurement, plant fabrication, equipment, parts, general contracts for local site construction and assembly set-up, commissioning, supervision, start-up as well as arranging local installation and sub-contractors for other services. Some firms also provide essential utilities (power and water), feasibility studies, and joint credit/financing.

Conclusion

Next week I present the remaining ten economic features.