Introduction

As matters presently stand, and in order to be precise as well as taking into account the discussion concerning a Guyana state-owned oil refinery has lasted for several weeks (since August 20, 2017) it is perhaps prudent that today’s column starts by summarizing my two recommendations. Under Decision Rule 1, I had posited: there can be no serious economic objection to private investors (local or abroad, separately

The purpose of the caveat is primarily to ensure the oil refinery decision is based on commercially feasible criteria, thereby avoiding Guyanese taxpayers/consumers/and other economic agents, providing “subsidies” to the owners/controllers/operators of such ventures. Indeed, I went further and had posited that, if such investors are prepared to take all the risks associated with a local-owned refinery, in the sense that I used the term local, they should be fully entitled to the rewards, where these are forthcoming under our laws.

It would be useful to remind readers at this point that I had been at pains also to indicate the true essence of a refinery considered to be “local”. Local does not only reside in the form of legal ownership, but more decisively in the manner of control, management, and operationalizing.

Decision Rule 2: Recap

Similarly, Decision Rule 2 was prompted by three basic considerations. First, the damning results of the commissioned Pedro Haas feasibility study, although I have only accessed the Power Point version. Second, my appreciation of “refinery economics”, as I had reviewed this over several columns in the past. Third, my similar appreciation of empirical studies of local content requirements (LCRs) as applied to the petroleum sector.

The Haas feasibility study made evident that, a state-owned oil refinery producing about 100,000 barrels/day would likely cost US$5 billion. This is 1.6 times Guyana’s current GDP and more than five times the average annual current expenditure/revenue in the National Budget. And, further there is the highly probable destruction of more than half of this investment during the project life, because of its negative rate of internal return.

What Next: Option One

These two decision rules do not end here, however. They raise the question of what next? And, several options spring to mind.

One option clearly is the various private investors’ proposals to construct modular mini refineries. Clearly these should be allowed, or indeed encouraged, as long as investors are made aware of the fact that there will be no “out-of-the-ordinary” (special) state support. Support within the existing regulatory framework and Guyana’s trade agreements could be afforded. However, special claims, like the selling of crude input below effective “world market prices” should not be facilitated. The same applies for the pricing of refined products. Domestic consumers should not be asked to pay prices above their import and distribution costs, under the prevailing regulatory regime.

Option Two

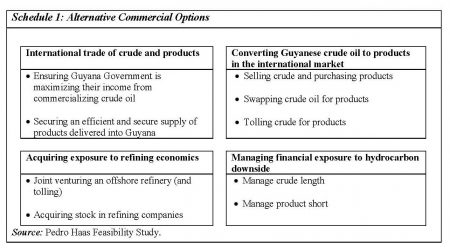

A second option would be the pursuit of the several “alternative commercial options” as proposed in the Haas study. These are listed in Schedule 1 below. They recommend initiatives in the following areas: International Trade (Crude and Refined Products); Investment in Refinery; Specialist Trade in Guyana’s Crude; and, Trading in Hydrocarbons Markets.

Option Three: Natural Gas

The third option has had relatively little public discussion and debate. I believe however, Guyana needs to visit (revisit) this, but perhaps from a different strategic standpoint.

To recall, although from the very inception of this series back in September 2016, I have been referring to the petroleum sector as the “natural gas and oil sector”, very little has indeed been said about natural gas. I shall try to correct this now, as it is linked directly to the recommendation that I wish to advance.

Natural Gas

Guyana’s natural gas refers to the fossil fuel (hydrocarbons) gas associated with (found in close proximity to) as well as not associated with the rock formations that bear the oil finds. Today natural gas is no longer flared, but is utilized to generate value after being processed to remove impurities and to meet desired specifications for its usage. Such processing typically yields multiple by-products. Of specific importance however, one usually finds that where it is commercially/economically feasible, pipelines are constructed to transport natural gas to the end user. Indeed, worldwide, natural gas is presently a major source of electricity generation (and co-generation); the latter often in combination with renewable energy sources. Of relevance to Guyana, there is also petroleum based cogeneration!

There are two major considerations that promote the use of natural gas. First, it is widely considered to be an “affordable” fuel. Second, although it is by no means a “green” energy source, it is known to be the “cleanest” of the fossil fuels, by a wide margin. Typically, it is less “dirty”, as it emits carbon dioxide at levels about one-third lower per unit of energy released than other fossil fuels.

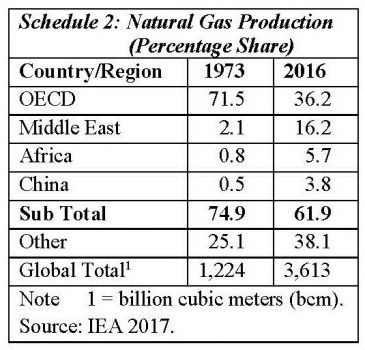

Schedule 2 gives a snapshot of global/regional natural gas production over the past four decades, and more. The expansion in global usage from 1,224 in 1973 to 3,613 billion cubic metres in 2016 shows a near trebling in amount during this period. While the OECD countries accounted for 71 percent of consumption in 1973, by 2016 although larger in number they only accounted for 36 percent. In that period the Middle East expanded its supply by nearly eight-fold; Africa expanded by more seven-fold; along with China. However, these four Countries/Regions accounted for about three-quarters of global natural gas production in 1973, but less than two-thirds by 2016!

Conclusion

Next week I shall continue this line of reasoning as regards natural gas (option three).