Introduction

Figures contained in the 2017 financial statements of Esso Exploration and Production Guyana Limited indicate that the three-party set up of Esso, Hess and CNOOC Nexen will spend well over five hundred billion dollars ($500,000,000,000) up to December 2019. The three companies signed a sweetheart deal with then Minister of Natural Resources Mr. Raphael Trotman one year after Esso’s parent ExxonMobil had announced the world’s largest oil find in 2015.

Put another way, if US$10 (approximately $2,100) of this sum is applied to every barrel of oil, it will require over two hundred and forty million barrels of oil before the full sum is recovered. On the more positive side, once these costs, which are recoverable costs under the 2016 Agreement, are recovered, only ongoing capital expenditure and operating costs will be charged to cost oil for the remaining 4 billion barrels of oil.

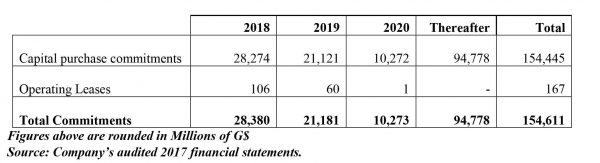

Readers of this column will recall that in Column #44, I challenged the veracity of the ExxonMobil’s pre-2016 pre-contract cost of US$460 million or approximately $96 billion which Esso and its two partners had reported to have spent at December 2015. Audited figures of the three companies up to 2017 December showed a total expenditure of $354 billion. Consistent with international accounting standards, referred to as IFRS, Esso has set out its capital commitments for the years 2018, 2019, 2020 and thereafter. Here is a restatement of those commitments.

The financial statements of Esso’s partners, CNOOC Nexen and Hess did not include such detailed disclosures. The financial statements for Hess which are stated in United States Dollars – and not in Guyana Dollars as required by law -disclose no commitments, while in the case of CNOOC the disclosures relate only to commitments after two years. Financial statements however, are not required to disclose all projected costs – only those for which the entity has contracted – and therefore actual expenditure could be substantially higher.

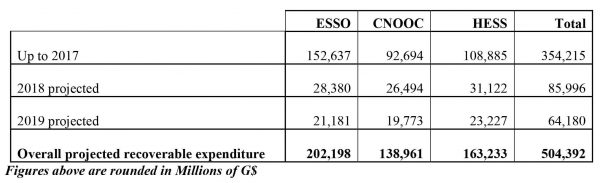

I have therefore done some extrapolation to estimate the total pre-production costs of the three companies to the end of 2019, the year before commencement of oil production by assuming that the same level of expenditure as a percentage of the expenditure to date incurred by Esso will be incurred by the other partners.

Projected Cost to 2019 for the three partners

Recoverable cost of $354.2Bn at the end of 2017 was derived from the actual expenditure to date as disclosed in the partnering companies’ financial statements. This increases to $504.4 billion at the end of 2019 based on our (limited) estimates.

Projected Revenue

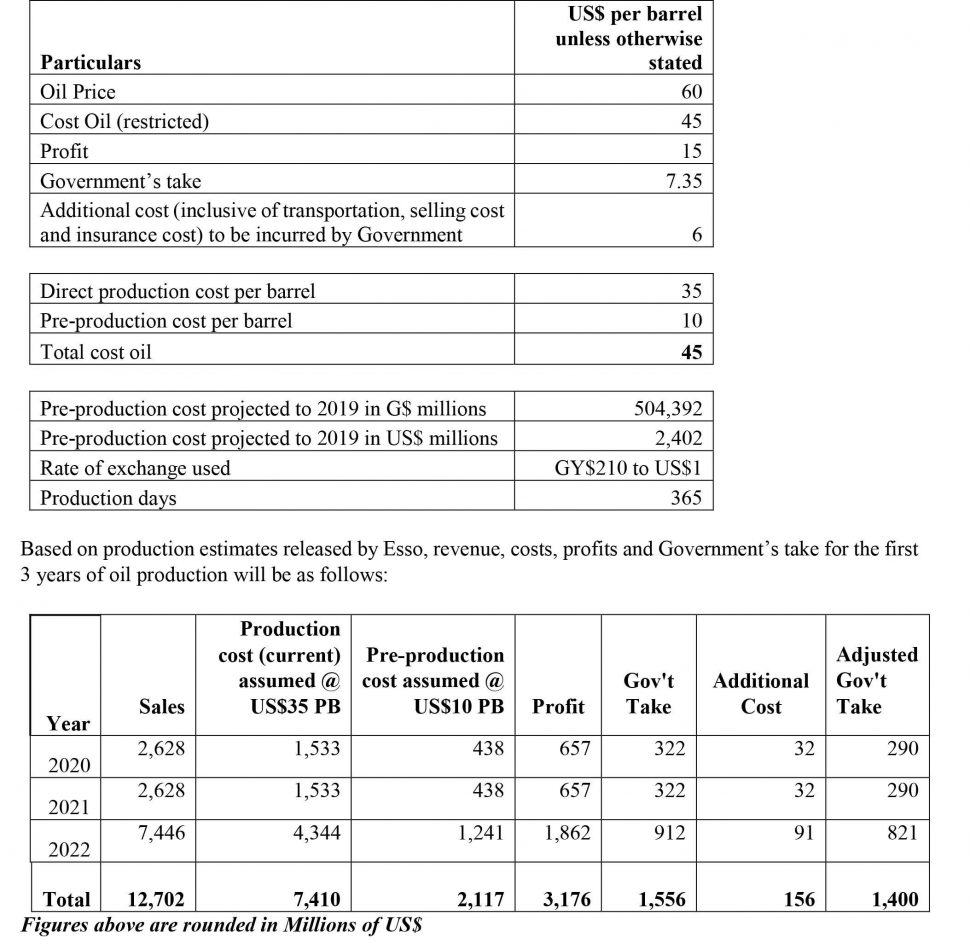

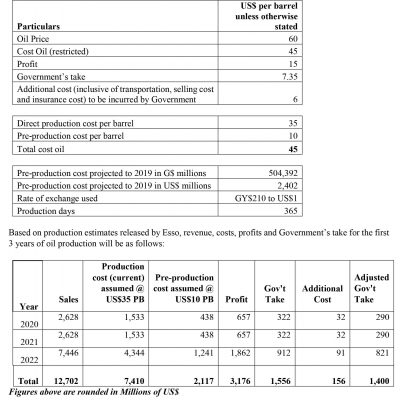

So what does all of this mean for revenue? As with the pre-production cost, a number of assumptions are needed to project income from production, production costs, profits and ultimately the share of profits which will be received by Guyana. The following table provides details of the assumptions used:

What these estimates show is that total pre-production costs will not be recovered in the first three years of the project and therefore Guyana will likely only receive the guaranteed minimum profit oil and royalties of 14.25% of sales. Of this amount, the Government will probably spend 1.425% in selling and other costs, leaving the country with 12.825% of sales.

And it does not escape us that out of the Government’s take, it has to pay the taxes of the oil companies. Of course, all this means is that there is no reduction but merely a redistribution of the total take into Oil Revenue and Corporation Tax. That is the nature of the contract signed with the Oil Companies.

Conclusion

Naturally, I advise caution in the use of the numbers produced above. There is a troubling absence of some basic information such as the projected cost of production, transportation, refining and sales cost and the most unpredictable unknown – the price of oil. Budget 2019 will be presented this coming Monday and it is hard to see how the Minister can keep dodging some offering some assumptions-based projections. In fact, this is expected in the Medium Term Revenue in Volume 2 of the Estimates.

My best estimate of US$290 million in years 2021 and 2021 suggests that Guyana will have to wait a while longer. This calls for some expectations management but it is unlikely that the Government will do so with elections approaching.