Targets

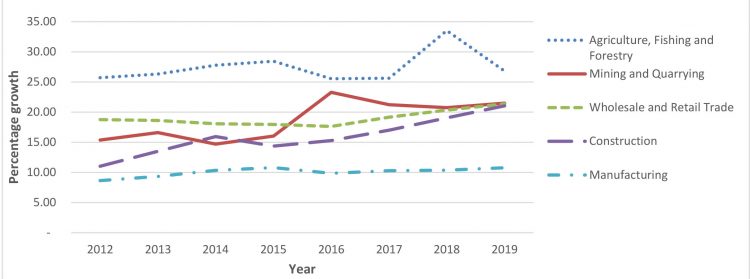

Overall real growth is projected at 4.6% in 2019. The following graph presents the percentage of contribution to GDP at 2006 prices by various sectors:

Source: Estimates of the Public Sector

The primary industry groups are addressed separately below. Construction is projected to record growth of 10.5% compared to 12.0% growth estimated in 2018. Transportation and Storage sector is projected to record growth of 3.5% in 2019.

Monetary Policy & Inflation

The rate of inflation (Urban Consumer Price Index – Georgetown) for 2019 is projected at 2.5% compared to the projected rate for 2018 of 2.0%. See Ram & McRae’s comment 10 below.

Balance of Payments

Overall balance on the balance of payments is expected to reflect a surplus of US$15 million from a deficit of US$180.7 million in 2018. On the trade side, merchandise exports are expected to increase by 4.1% to US$1.5 billion, while merchandise imports are expected to increase by 0.8% to US$1.7 billion. The principal contribution to exports is gold accounting for US$0.8 billion, with bauxite, sugar and rice accounting for US$0.4 billion. The only identified item of imports is fuel of US$0.5 billion, while “Other” accounts for US$1.3 billion. Import of services is projected at US$424.6 million, and private transfers of US$319.8 million, resulting in a net deficit of US$361.2 million on the current account. See Ram & McRae’s comment 11 below.

The capital account is projected to have a surplus of US$376.2 million in 2019 (US$283 million in 2018). A net inflow of US$351.6 million is expected from medium and long term capital while a net outflow of US$10.1 million is expected on short term capital.

Ram & McRae’s comments

1. The policy targets are unduly specific and contribute to the long list of Unfinished Business identified in this Focus. In fact, many of the areas identified form part of the day-to-day functions and processes of any modern government while there is also significant overlap in between the 10 heads. The ultimate absurdity is that the procurement of 100 LED street lamps find their way in a Budget of $300,000 million!

2. The year 2018 sees a drastic decline in the international reserves from US$581 million to US$477 million, a matter of some concern but one which is not receiving any attention from the Government. A ballooning overdraft and increasing debt domestically coinciding with depleting reserves internationally is a recipe for trouble even with First Oil approaching.

3. Focus has been advocating for this for some time and therefore welcomes the move but cautions against its selective use and manipulation.

4. Astoundingly, the Minister admits that the Medium Projections contained in Volume 2 of the Estimates do not include any projections for oil revenue, raising the question whether his Ministry has engaged with the Department of Energy or made its own independent calculations. This is not a matter of choice but of law.

5. There is no indication of the process and time frame for concluding this important policy document or making it available to the public.

6. The Administration has implicitly contracted out the petroleum depletion policy to Exxon and its partners under a Petroleum Agreement that allows exclusive decision-making by the oil companies.

7. It is probably intentional that the Minister did not set any timeframe for the commencement and conclusion of the process and that he was careful to assign responsibility to the Prime Minister.

8. Seems that the Minister is underestimating what Public Sector Accounting Standards require for their execution and that only a handful of countries in the world that have applied them in full.

9. Despite the exhaustive agenda identified by the Minister, there is no place for the poor, the unemployed and the marginalised whose interest will lie in trickledown economics.

10. Both the 2018 inflation rate and the projection for 2019 are surprising. The Government’s inexorable reversal of the fundamental principles of VAT taking an endless stream of products out of VAT means that we have returned to the cascading effect of the Consumption Tax and consequential impact on prices. Closer examination of the Urban Consumer Price Index shows food and clothing increasing by 3.4% and 4.5% respectively while footwear and repairs decreased by 5.8%!

11. Our exports are still heavily based on our traditional sectors, while fuel and lubricants is a key component of imports. It is unfortunate that of imports, 75% are stated under the heading ‘Other’.