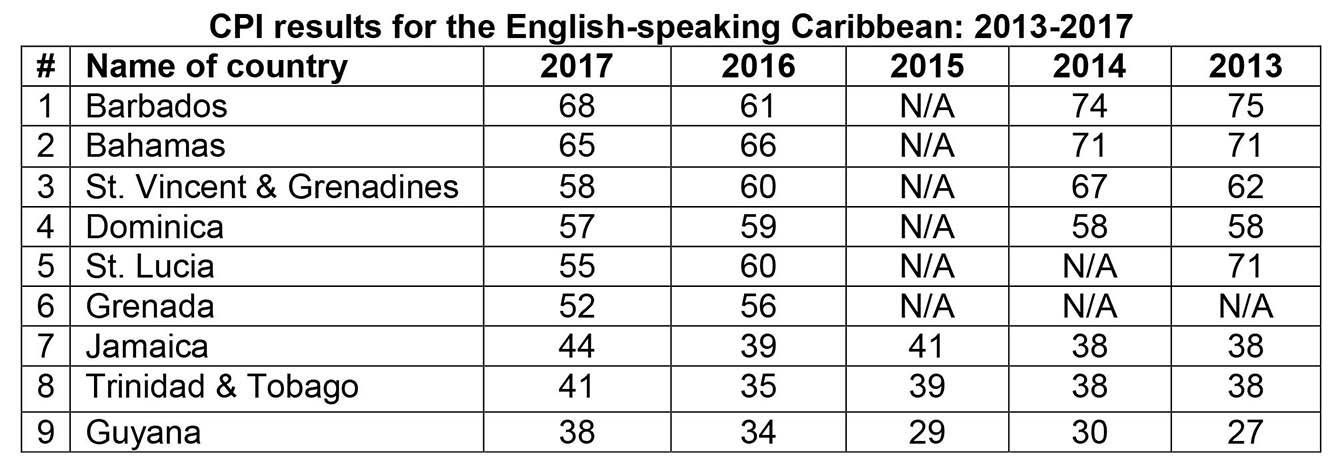

Guyana has moved four points up on the Corruption Perceptions Index (CPI) for 2017, from 34 to 38, with a ranking of 91 out of 180 countries surveyed. In 2016, it had recorded a five-point increase which was the third highest among all the countries surveyed. However, as shown in the table below, Guyana remains at the bottom of the table, compared with the other English-speaking Caribbean countries. Significantly more and sustained efforts therefore need to be made to reduce the extent to which corruption is perceived to exist in the Guyanese society.

Guyana’s natural resources belong to its citizens and should be exploited so as to ensure that they obtain the maximum possible benefits from such resources. Upon careful examination of the Agreement, however, the reverse appears true. The Agreement is overwhelmingly weighted in favour of Exxon, raising serious doubts about our negotiators’ ability to agree on a deal that is fair for both parties, and one that represents the best interest of the country. While we acknowledge that one of the key objectives of a company is the maximisation of shareholders’ wealth, the pursuit of such objective needs to be tempered with a social conscience, especially when negotiating agreements with poor developing countries like ours with little or no bargaining power and an inexperienced team of negotiators.

We noted that 75 percent of the monthly production and sale of crude oil will be used to offset the cost of production which includes all those costs relating to not only operations, service, general and administration as well as annual overhead charge but also exploration and development. This implies that for every 100,000 barrels of crude oil produced daily, 75,000 barrels would be applied to offset the above costs (known as cost oil). The difference of 25,000 barrels (known as profit oil) will be shared equally between Exxon and the Government. It would be interest to learn how the figure of 75 percent has been arrived at as well as how exploration and development costs will be allocated over the life of the project.

The Government’s fixed share of profit oil ignores the profitability of the project. According to the recent International Monetary Fund (IMF) report: (i) most Production Sharing Agreements around the world usually have a formula in which the government’s share increases as a function of production, a combination of production and prices, or an economic variable such as the ratio of cumulative revenue to cumulative costs, or the project’s internal rate of return; (ii) in many countries, the top tier government share of profit oil could be as high as 80 or 90 percent; and (iii) considering that Exxon’s tax liability has to be settled from the Government’s share of profit oil, the fixed 50 percent share is considered relatively low.

With crude oil prices climbing from approximately US$50 per barrel to US$62.65 as of last Thursday, Exxon is set to increase its profitability since it would need less than 75 percent of its production and sale to recover its costs. Of course, the reverse is true if the price falls below US$50. An official of Exxon is, however, reported to have stated recently that even if the price falls to US$40, Exxon will still be able to turn in a profit. The allocation of 75 percent of production to cost recovery therefore appears too high and is likely to result in Exxon achieving a windfall gain vis-à-vis Guyana’s share of profit oil.

We had expressed the view that the two percent royalty that the Government would be receiving is too low in comparison to what other oil-producing countries are receiving and suggested that a figure of at least seven percent would be more appropriate. The IMF report appears to support our view when it commented that in countries where advalorem rates are applicable, the rates vary from eight percent to 20 percent. The report cited Trinidad and Tobago where the royalty rates are between 10 percent and 12 percent while for the United States, the rate is 16.6 percent. Colombia’s royalty rates are between eight percent and 25 percent while for Brazil and Peru, the rates are 10 percent and five to 20 percent respectively.

Exxon’s exemption from the payment of income tax, value-added tax, corporation tax and property tax in respect of income from petroleum operations or from property held, remains a source of concern. While we acknowledge that some form of fiscal incentives is needed to attract investments, by all standards these exemptions are weighted too generously in favour of Exxon. To compound matters, the Minister responsible for petroleum is required to pay on behalf of Exxon, income and corporation tax on Exxon’s taxable income, out of the Government’s share of profit oil.

When one assesses the financial implications in terms of the net benefit to the country (i.e. royalty plus net share of profit oil minus the value of the exemption of various taxes), the inescapable conclusion is that Agreement is overwhelmingly a one-sided affair. It could very well be that aspects of the Agreement violate our laws, especially in relation to corporation tax, income tax, value-added tax and property tax. From an environmental perspective, it could also very well be that it would better to leave the crude oil under the seabed when all the above and other factors are considered. With an estimated 3.2 billion barrels the fossil fuel that Exxon has found so far, the analysis and calculations indicate that in excess of 1.5 billion tons of carbon dioxide will be released to the atmosphere from the use of such fuel!

Today, we conclude our examination of the key provisions of the Petroleum Agreement.

Use of local resources

In relation to the use of Guyanese resources, Exxon is required to undertake the following:

(a) purchase goods and materials locally subject to timely availability, quality and competitiveness of prices;

(b) employ local subcontractors based on commercial competitiveness and satisfaction of financial and technical requirements;

(c) establish appropriate tender procedures for the acquisition of goods, materials and services so as to ensure that local suppliers and sub-contractors are given adequate opportunity to compete; and

(d) make reasonable efforts to train local suppliers and sub-contractors in relation to participation in tenders and competing for contracts.

Employment and training

Exxon shall ensure the employment of Guyanese citizens with appropriate qualifications and experience in petroleum operations in Guyana. In addition, it is required for pay for each year during the period of the prospecting licence an amount of US$300,000 to cater for on-the-job training of Guyanese personnel nominated by the Government in Exxon’s operations in Guyana, including attendance at conferences and the acquisition of technical training materials.

Right of use of assets

Upon expiration of the Agreement, Exxon shall deliver to the Minister free of charge and in good condition, all installations, works, pipelines etc. as well as machinery and equipment used in the contract area. This also includes fixed assets used outside the contract area and movable assets whose costs have been fully recovered. For assets whose costs have not been fully recovered, Exxon shall sell to the Minister these assets at prices that represent the unrecovered costs.

Accounting and audit

Exxon is required to maintain accounting records in accordance with the procedures set out in Annex C to the Agreement and shall prepare quarterly statements relating to: (i) production volume; (ii) production value and price; (iii) expenditure and receipts; and (iv) cost recovery. These are to be submitted to the Minister within 30 days of the close of the quarter. At the end of each calendar year, similar statements as well as a budget statement are to be prepared and submitted to the Minister within 120 days of the close of the year. Both the budget statement and the expenditure and receipts statement must distinguish between exploration, development and operating costs. The Minister shall have the right to audit these statements and related records once annually. However, he must give 90 days’ notice prior to the commencement of the audit which also has to take place within two years of the end of the calendar year.

The production statement is to include, among others, production and sale for each field and in aggregate for each contract area. In terms of value and pricing, Exxon is required to provide the necessary calculation, including sales by third parties. The cost recovery statement must include: (i) recoverable contract costs brought forward from the previous quarter; (ii) recoverable contract costs incurred for the quarter in question; (iii) quantity of cost oil taken and disposed of by Exxon; (iv) contract costs recovered for the quarter; and (v) recoverable contract costs carried forward to the next quarter. Separate statements are to be prepared for each field.

Social responsibility and protection of the environment

Exxon shall comply with the provisions of Guyana’s Environmental Protection Agency (EPA) Act 1996, especially in relation to environmental authorisation. It is also precluded from initiating exploration or developmental activity in areas outside the contract area which the EPA may determine to be sensitive or protected.

Stability of Agreement

The Government is precluded from amending, modifying, rescinding, terminating or otherwise altering the Agreement, including its renegotiation, without the prior written consent of Exxon. Given the generous nature of the Agreement in favour of the oil giant, it is highly unlikely that Exxon will agree to any form of renegotiation. The Government, for its part, has indicated that it would not proceed along this route. In addition, after the signing of the Agreement, there shall be no imposition of any new arrangements, including the promulgation of new laws or the amendment of existing laws, which will adversely affect the economic benefits accruing the Exxon. If this were to take place, the Government shall take prompt and appropriate measures to restore such benefits. In particular, Exxon is exempted from the imposition of any new taxes, royalties, fees, charges, value-added tax or other imposts.

Signature bonus

Exxon shall pay the Government a signature bonus of US$18 million within 15 days of the effective date of the Agreement to a government bank account at the Bank of Guyana designated by the Minister of Finance.