Suffice it to state that from a governance perspective, for the Head of the Special Purpose Unit of NICIL, established to privatise aspects of the operations of GUYSUCO, to also be the chairman of GUYSUCO presents a conflict of interest in view of GUYSUCO’s now reporting relationship with NICIL. This arrangement can adversely affect the proper functioning, independence and professionalism of the GUYSUCO board. It can also stifle independent and critical thinking as well as the expression of and due reflection on diverse views in a decision-making process, which is the raison d’être for having boards in place. One recalls the previous head of NICIL chairing several State boards that had reporting relationships with NICIL, with disastrous consequences.

In relation to the transfer of responsibility for the petroleum sector from the Natural Resources Ministry to the Ministry of the Presidency (MoP), we hope that the arrangement is a temporary one, pending the establishment of the Department of Energy, eventually blossoming out into a full-fledged Ministry. The MoP has historically not been a technical Ministry or Department, save and except matters relating to the functioning of the Public Service, national security and defence. Care should therefore be exercised in ensuring that the MoP is not over-burdened by assuming direct responsibility for areas that are clearly the remit of core Ministries under oversight from subject Ministers and with reporting relations to the Cabinet. This is consistent with the way governments are organized and structured for the delivery of public services.

In passing, we have been at pains to point out that the appointment of Ministers to State boards should as far as possible be avoided since such boards have reporting relationship with the concerned Minsters. When this happens, there is a blurring of responsibility for policy on the one hand and oversight on the other.

Now for today’s article. The Kaieteur News had reported that ExxonMobil submitted an invoice to the Government in the sum of US$460 million for the reimbursement of costs incurred prior to January 2016 under the 1999 Petroleum Agreement with the oil giant. This, along with other concerns raised over time by the newspaper, might have prompted Exxon to place an advertisement last week in which it made the following statements:

(a) The US$460 million is not a trap. It was successfully invested in discovering

Guyana’s oil future;

(b) Limited duty-free concessions applicable to oil operations will keep

developments costs low, giving the Government higher revenues from oil;

(c) The Government has extensive access rights with seven days’ prior notice. This is

required for safe access to petroleum activities;

(d) The Government has strong audit rights which allow for comprehensive and

detailed annual inspection of all books, accounts, invoices and inventories in

order to verify charges and credits;

(e) The Government secured new royalty, higher annual block rental and training

fees, a new environmental and social fund, in addition to a signature bonus; and

(f) The Agreement does not exempt Exxon from any new tax laws or otherwise. It

only ensures economic stability between the Government and Exxon.

The US$460 million pre-contract costs

Annex C of the 2016 Production Sharing Agreement (PSA) states that the amount of US$460,237,918 refers to costs incurred in petroleum operations pursuant to the 1999 Agreement up to 31 December 2015. It defines pre-contract costs as contract costs, exploration costs, operating costs, service costs, general and administrative costs, and overhead charges as defined in the 1999 Agreement. The Annex further stated that Exxon is to be reimbursed “such costs as are incurred under the 1999 Agreement between January 1, 2016 and the effective date which shall be provided to the Minister or on before 31 October 2016 and such number agreed on or before 30 April 2017”.

It is not clear whether the Government honoured the payment of US$460 million; what checks were carried out to verify the accuracy and reasonableness of this amount; and who carried out such checks. Nor is it clear whether Exxon submitted a further invoice covering the period 1 January 2016 and the “effective date”. Assume that 100,000 barrels of crude oil will be initially produced per day. At US$50 per barrel, the payment is equivalent to approximately 15 years of royalty that the Government will be receiving. While we would have so far received US$19.6 million from Exxon (US$18 million as signature bonus, US$1 million annual licence rental, US$300,000 for training and US$300,000 annually for support for environmental and social projects), we are now presented with a bill for US$460 million, equivalent to G$94.990 billion. Where is the money coming from, considering that the Consolidated Fund is in overdraft to the tune of approximately G$150 billion? Would it not have been better for the pre-contract costs to have been included as part of the “recoverable contract costs” deductible from the monthly production of crude oil over the life of the project? Also, if Exxon had not struck oil, would it have submitted that invoice to the Government for reimbursement?

Duty-free concessions

Exxon and its sub-contractors are exempt from “duty, VAT or other duties, taxes, levies or imposts, all equipment and supplies required for Petroleum Operations including but not limited to drillships, platforms, vessels, geophysical tools, communications equipment, explosives, radioactive sources, vehicles, oilfield supplies, lubricants, consumable items as well as items listed on Annex D”. This annex to the PSA contains a list of items covering seven pages without quantities being stated. However, fuel imports will attract a ten percent excise tax.

It is therefore not entirely accurate to state that Exxon has been granted limited duty-free concessions. While these concessions have the effect of keeping costs down, Exxon stands to gain overwhelmingly more because of the way the PSA has been structured, as discussed in last week’s article.

Access rights

The Minister (or his authorized representatives) is entitled to observe the petroleum operations and to inspect all assets, records and data kept by Exxon. However, he must give seven days’ notice of his intention to do so. Therefore, the surprise element that is associated with inspections is lost. While acknowledging the importance of safety in conducting inspections, we believe that 24 hours’ notice would have been more appropriate.

Auditing rights

At the end of each calendar year, Exxon is required to prepare and submit several statements to the Minister within 120 days of the close of the year. The Minister shall have the right to audit these statements and related records not more than once annually. However, he must give 90 days’ notice prior to the commencement of the audit which also has to take place within two years of the end of the calendar year. Here again, we may want to question the rationale for such a lengthy notice to be given. Our experience is that, once financial statements are submitted for audit, a period of 30 days’ notice is not considered unreasonable. It is not clear whether the Government has appointed auditors. Suffice it to state that the Auditor General does not have the legal mandate to undertake such an audit since Exxon’s accounts are not part of the public accounts as defined by the Constitution.

The Minister may review items previously subjected to audit in earlier years. However, such a review must be only for verifying a matter arising in a later period which relates to the earlier year(s) in question. The review must also be carried out in conjunction with the annual audit and no sooner than 12 months following the previous audit. At the end of the review, the parties shall endeavour to conclude the outstanding matters, and a written report is to be submitted to Exxon within 60 days of the conclusion of the review.

Exxon is required to reply not later than 60 days following the receipt of the report indicating acceptance or rejection and providing explanations in the event of the latter. The Minister has a right to carry out further investigation within 60 days of Exxon’s response. If the parties are unable to reach agreement, the Minister’s claim is referred to the sole expert in accordance with Article 26 of the Agreement. If the audit claim is not settled, Exxon is entitled to recover the disputed amount pending final resolution of the claim.

The Minister is, however, not entitled to access to data/records which: (i) are statutory restrictions or disclosures; (ii) do not relate to petroleum operations; or (iii) are not customarily disclosed in auditing practice in the international petroleum industry.

Royalty

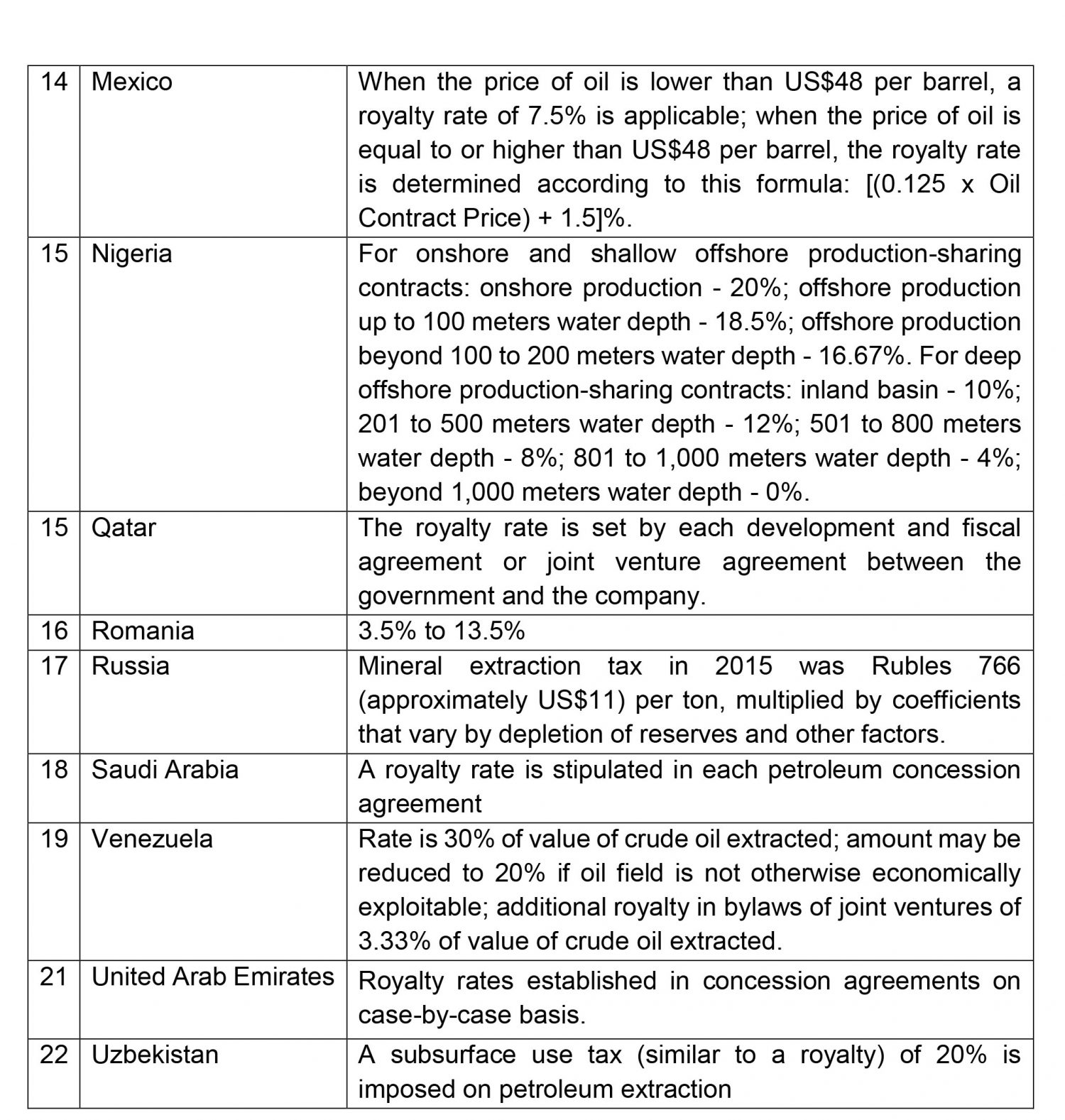

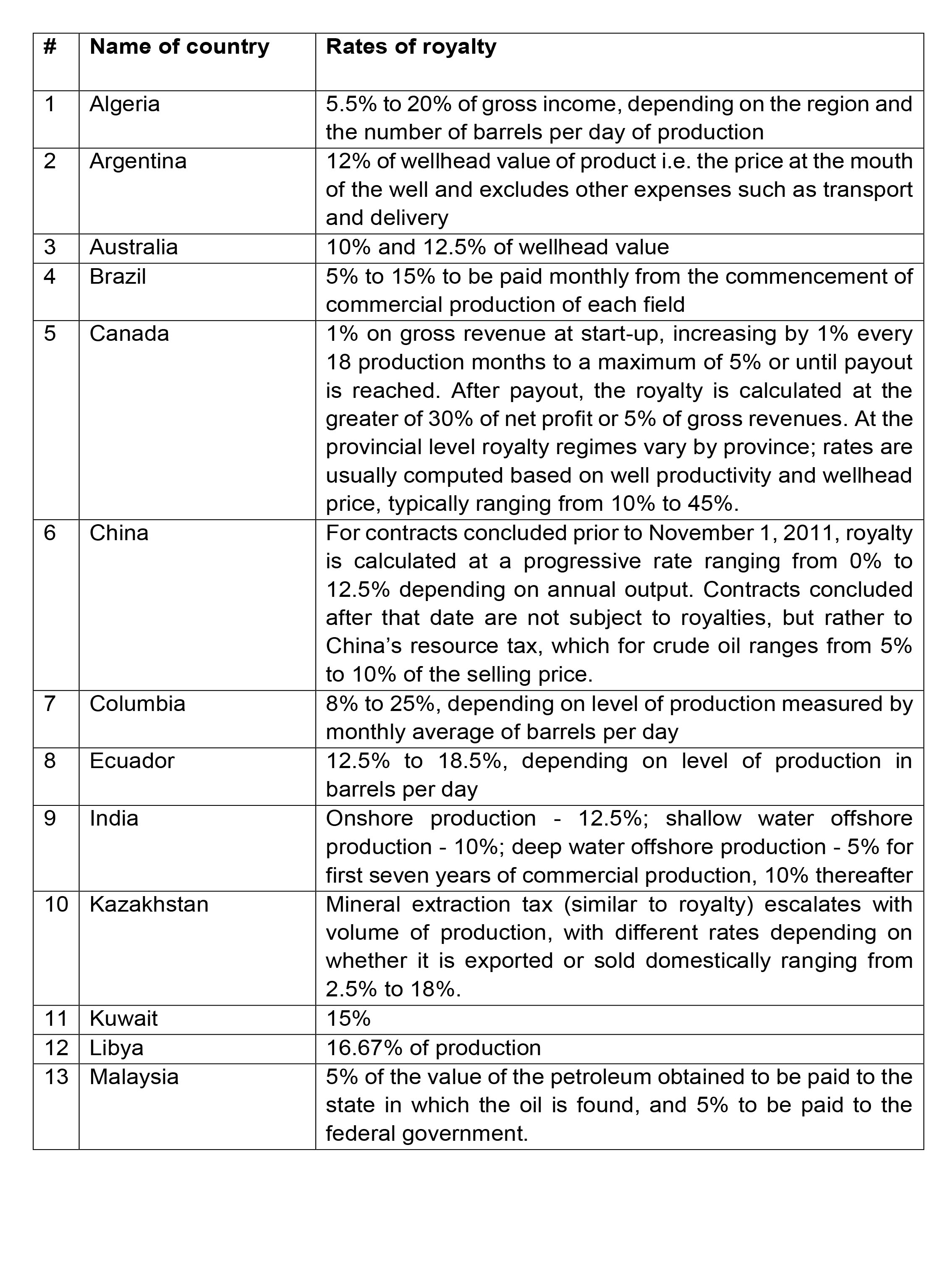

Much has been written about the inadequacy of the two percent rate of royalty that the Government will be receiving and need no further comment. We nevertheless reproduce the following table extracted from a previous article based on the information published by the Law Library of Congress in relation to the experience of other countries:

New tax laws

After the signing of the PSA, the Government is precluded from imposing any new arrangements, including the promulgation of new laws or the amendment of existing laws, which will adversely affect the economic benefits accruing the Exxon. If this were to take place, the Government shall take prompt and appropriate measures to restore such benefits. While the advertisement argues that Exxon is not exempt from any new tax laws or otherwise, the effect is the same.