We made the above assessment in the context of the previous Administration’s failure to fully and properly discharge its stewardship and accountability responsibilities since 2011, as no Treasury Memorandum was issued for the years 2012 to 2014, setting out what actions the Government has taken or intends to take in relation to the findings and recommendations of the PAC. To compound matters, the quality of financial reporting over the years, as attested to by the Auditor General in his certification of the public accounts, has left much to be desired. As a result, the findings and recommendations of the Auditor General continue to repeat themselves year after year, as observed by the PAC in its 2000-2001 report.

We attributed blame entirely on the accumulated failure of successive PACs to bring their examination of the public accounts up-to-date and we were at pains to point out in previous columns that the public accountability process does not cease when audited accounts are produced. The timely deliberation on those accounts by the Legislature and the response from the Executive are indispensable elements in the accountability cycle in seeking to hold governments to account for the use of scarce public resources in the delivery of public services, as approved by the Legislature.

The present Administration has since tabled the Treasury Memorandum in response to the PAC report for 2012, 2013 and 2014 in which it gave the assurance, among others, of condign action against those responsible for overpayments to suppliers/contractors. The PAC is currently examining together the public accounts for the years 2015 and 2016 but it is not clear how soon the examination will be completed, and the related report issued. With the Auditor General due to begin his examination of the 2017 public accounts starting this week, it is very likely that many of the findings and recommendations contained in his previous reports will continue to repeat themselves.

The above observations reinforce the urgent need to advance the accountability timeframe so that all the stages in the process are completed (budget preparation, budget execution, half-yearly and annual reporting, comprehensive review by the Auditor General, PAC examination/reporting and the Government’s issue of the Treasury Memorandum), and prompt and appropriate action is taken to remedy the deficiencies contained in the Auditor General’s report before the next round of the audit cycle begins. Unless these actions are completed in a timely manner, the PAC cannot assure itself, and indeed the public, as to the effectiveness of its work in ensuring that funds approved by the Legislature for the execution of government programmes and activities were expended in an economical, efficient and effective manner and that good value had been obtained as regards outputs, outcomes and impacts.

Budget Transparency Action Plan

Following the change in Administration in 2015, the Government developed a Budget Transparency Action Plan (BTAP) with a view to improving the budget process and more generally to enhance transparency and accountability. The single most important item in the BTAP relates to progressively advancing the accountability timeframe so that the entire accountability cycle, including the issuing of the Treasury Memorandum, can be completed within 12 months of the close of the fiscal year. This was one of the recommendations made by the PAC in its report on the public accounts for the years 2000-2001. Once the timetable is advanced, the Government would be in a better position to assure itself and the public that it has fully discharged its stewardship and accountability responsibilities in a timely manner, subject to quality considerations referred to above. In addition, legislators will be able use the results as an important frame of reference when considering the budget for the following year. As it is, the budget is approved without any knowledge of how funds allocated for the previous year were utilized and to what extent the actual outputs, outcomes and impact were commensurate with those intended.

While we acknowledge the significant progress made on most of the items contained in the BTAP, such as having an early budget and enhanced mid-year reporting, we are anxious to witness similar progress as regards advancing the accountability timeframe. The Accountant General was required to submit draft public accounts for 2017 to the Auditor General by 31 March 2018 instead of 30 April 2018, with the Auditor General completing his examination and reporting to Parliament by 31 August 2018, instead of 30 September. The March deadline has passed, and we are unsure whether these draft accounts were submitted. Nor do we know how well the Auditor General has been able to reorganize his work to enable him to deliver one month earlier without compromising on quality and comprehensiveness. At the moment, he has a considerable amount of backlogged work to perform, especially as regards the audit of local government bodies.

With effect from 2018, the Ministry of Finance is required to work with the other institutions to achieve progressive improvements in the deadlines of the accountability cycle with the ultimate objective of achieving in the following:

(a) Accountant General to submit draft public accounts to the Auditor General by 28 February;

(b) Auditor General to report to Parliament by 30 June;

(c) PAC to complete examination and reporting by 30 September; and

(d) Ministry of Finance to issue Treasury Memorandum one month later; and

(e) Budget approval by 31 December.

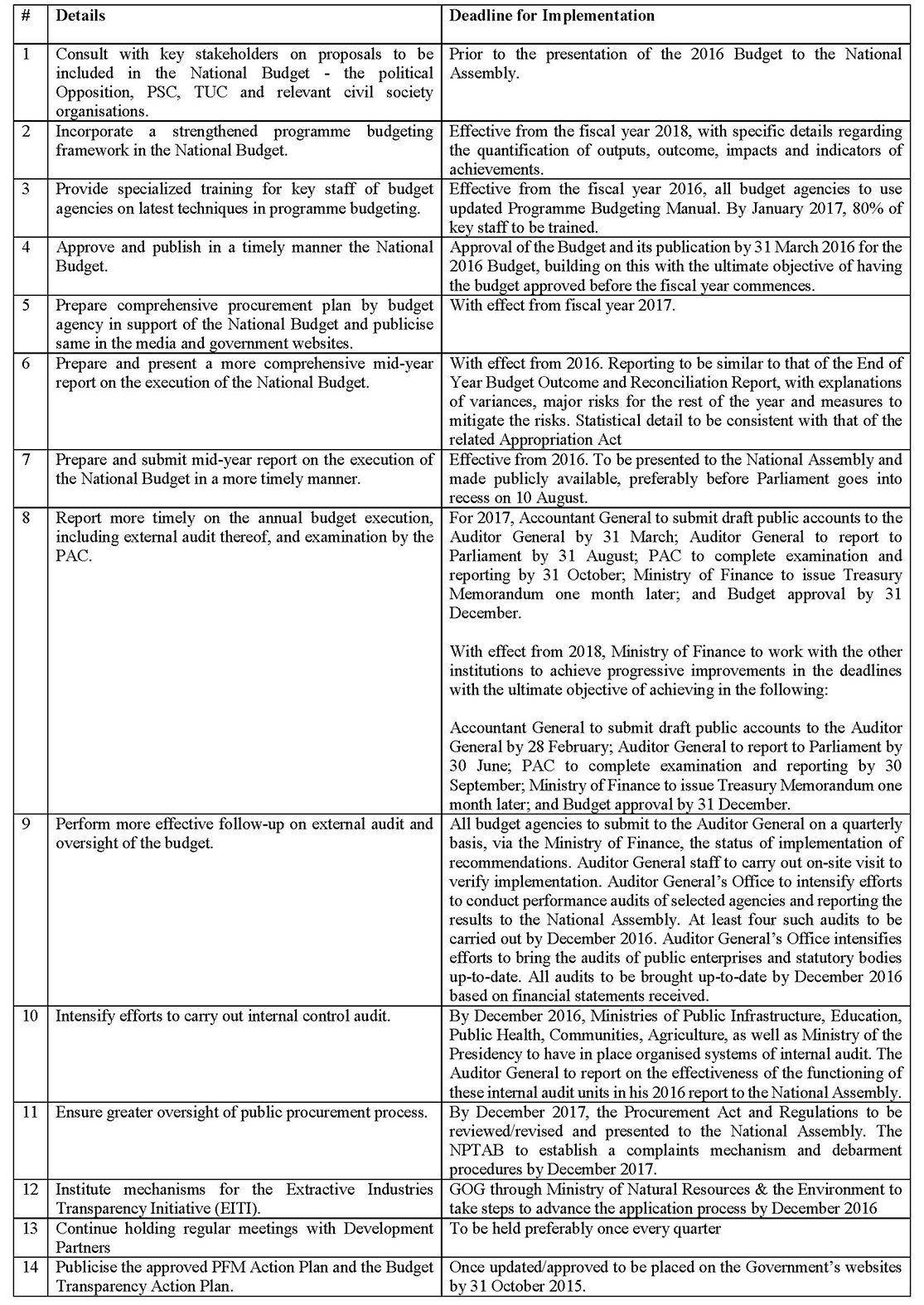

The Plan, which can be found at the Ministry of Finance’s website, covers the following 14 action items along with their respective deadlines for implementation:

2. Incorporate a strengthened programme budgeting framework in the National Budget. Effective from the fiscal year 2018, with specific details regarding the quantification of outputs, outcome, impacts and indicators of achievements.

3. Provide specialized training for key staff of budget agencies on latest techniques in programme budgeting. Effective from the fiscal year 2016, all budget agencies to use updated Programme Budgeting Manual. By January 2017, 80% of key staff to be trained.

4. Approve and publish in a timely manner the National Budget. Approval of the Budget and its publication by 31 March 2016 for the 2016 Budget, building on this with the ultimate objective of having the budget approved before the fiscal year commences.

5. Prepare comprehensive procurement plan by budget agency in support of the National Budget and publicise same in the media and government websites. With effect from fiscal year 2017.

6. Prepare and present a more comprehensive mid-year report on the execution of the National Budget. With effect from 2016. Reporting to be similar to that of the End of Year Budget Outcome and Reconciliation Report, with explanations of variances, major risks for the rest of the year and measures to mitigate the risks. Statistical detail to be consistent with that of the related Appropriation Act

7. Prepare and submit mid-year report on the execution of the National Budget in a more timely manner. Effective from 2016. To be presented to the National Assembly and made publicly available, preferably before Parliament goes into recess on 10 August.

8. Report more timely on the annual budget execution, including external audit thereof, and examination by the PAC. For 2017, Accountant General to submit draft public accounts to the Auditor General by 31 March; Auditor General to report to Parliament by 31 August; PAC to complete examination and reporting by 31 October; Ministry of Finance to issue Treasury Memorandum one month later; and Budget approval by 31 December. With effect from 2018, Ministry of Finance to work with the other institutions to achieve progressive improvements in the deadlines with the ultimate objective of achieving in the following: Accountant General to submit draft public accounts to the Auditor General by 28 February; Auditor General to report to Parliament by 30 June; PAC to complete examination and reporting by 30 September; Ministry of Finance to issue Treasury Memorandum one month later; and Budget approval by 31 December.

9. Perform more effective follow-up on external audit and oversight of the budget. All budget agencies to submit to the Auditor General on a quarterly basis, via the Ministry of Finance, the status of implementation of recommendations. Auditor General staff to carry out on-site visit to verify implementation. Auditor General’s Office to intensify efforts to conduct performance audits of selected agencies and reporting the results to the National Assembly. At least four such audits to be carried out by December 2016. Auditor General’s Office intensifies efforts to bring the audits of public enterprises and statutory bodies up-to-date. All audits to be brought up-to-date by December 2016 based on financial statements received.

10. Intensify efforts to carry out internal control audit. By December 2016, Ministries of Public Infrastructure, Education, Public Health, Communities, Agriculture, as well as Ministry of the Presidency to have in place organised systems of internal audit. The Auditor General to report on the effectiveness of the functioning of these internal audit units in his 2016 report to the National Assembly.

11. Ensure greater oversight of public procurement process. By December 2017, the Procurement Act and Regulations to be reviewed/revised and presented to the National Assembly. The NPTAB to establish a complaints mechanism and debarment procedures by December 2017.

12 . Institute mechanisms for the Extractive Industries Transparency Initiative (EITI). GOG through Ministry of Natural Resources & the Environment to take steps to advance the application process by December 2016

13. Continue holding regular meetings with Development Partners To be held preferably once every quarter

14. Publicise the approved PFM Action Plan and the Budget Transparency Action Plan. Once updated/approved to be placed on the Government’s websites by 31 October 2015.

As regards item 4, the present Administration must be credited for ensuring that the National Budget is prepared and approved before the fiscal year begins as there are obvious advantages, the most important being in the area of procurement. Prior to 2016, the budget was not approved, and funds not made available, until the end of the first quarter of the year. In the circumstances, Budget Agencies had eight months within which they were expected to utilize funds earmarked for a 12-month period. When this happened, by the time the half-year came around, the desired level of progress was not achieved in relation to allocations for infrastructure works. This was confirmed by the Ministry of Finance in its 2017 Mid-Year Report:

The Public Sector Investment Programme, which is financed by both local and foreign funded sources, expended $15.8 billion during the first half of 2017, reflecting a 19.8 percent increase over the first half of 2016. This represents only 27.9 percent of the PSIP‟s budgeted allocation of $56.8 billion. The locally-funded projects were primarily constrained by delays in the project implementation as a result of a dearth of procurement planning, apparent lack of capacity, and delays in the tender process. This resulted in only 26.8 percent of the budgetary allocation of $34.6 billion expended at half year.

In order to make up for lost time and to get back on track, there was an acceleration of expenditure in the last quarter of the fiscal year not only to meet targets of performance but also to exhaust budgetary allocations since all unutilized funds had to be refunded to the Consolidated Fund. In such a haste, all sorts of breaches took place especially in the area of procurement, such as poor selection of suppliers/contractors, overpayment to suppliers/contractors; defective works performed; the absence of performance bonds and guarantees for mobilisation advances; and absence or non-enforcement of penalties for delays. There were also several instances where Heads of Budget Agency failed to refund unspent balances.

To be continued –