In the Executive Summary, it was stated that there were overpayments totalling $79.738 million to 79 contractors against measured works. However, it is not clear whether any mobilisation advances were deducted before arriving at the overpayments. A mobilisation advance is usually given for large contracts to enable contractors to acquire the necessary machinery and equipment and to mobilise them to the project work sites. The advance is recoverable over the life of the contract by way of deductions from each valuation certificate. Therefore, any attempt to match the value of physical works before they are completed, against payments made, will not give a true reflection of the extent of any overpayment, if any.

Today’s article discusses the oil revenues expected to flow in 2020; the feature address by the former Prime Minister of Trinidad and Tobago at the recent Guyana Manufacturing and Services Association’s annual presentation award dinner; and the Green Paper on the proposed Natural Resource Fund (NRF). At the time of writing, the Bill for the NRF has been published in the Official Gazette. This will be the subject of our next column.

Expected Oil Revenues in 2020

The Minister of Finance is reported to have stated that in 2020, the Government is expected to receive US$300 million from ExxonMobil in respect of royalty and profits from the production and sale of crude oil. The Production Sharing Agreement provides for receipt by the Government of two percent royalty and 50 percent profit computed on a monthly basis after the deduction from the sale proceeds up to a maximum of 75 percent of costs. Costs in excess of the amount so deducted are to be carried forward to the following month. The agreement is silent on what happens to the unrecovered cost at the end of the project, that is, at the end of approximately 18 years when the oil resources will be completely exhausted.

Assuming that 120,000 barrels of crude per day are extracted and sold at US$50 per barrel and that 300 days are worked, the royalty for 2020 will be US$36 million. The difference of US$264 million, or US$7.33 per barrel, represents Guyana’s share of profits. Therefore, total share of profit will be US$528 million or US$14.67 per barrel. The total cost of production will be US$1.696 billion, of which the recoverable cost is US$1.272 billion or US$35.33 per barrel. This means that US$424 million, or US$11.78 per barrel, will be carried out forward to 2021. The actual production costs will therefore be US$47.11 per barrel, which represents a small margin of profit of US$2.89 per barrel.

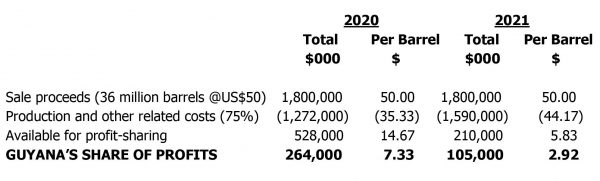

Assuming the same level of production, costs and sales for 2021, the Government’s share of profits will be reduced to US$105 million, as shown below:

[Note: The figure of US$1.590 billion shown as 75% of production and related costs for 2021 is calculated as follows: 75% of US$2.120 billion (US$1.696 billion + US$424 million) = US$1.590 billion]

We, however, do not know the breakdown of the estimated operating expenditure and the recovery of the cost of investment. Media reports indicated that the investment in the Liza 1 well is US$4.4 billion. It would have been particularly helpful if these costs are disclosed so the estimated revenue that the Minister spoke of can be viewed in context. In addition, there is the liability to ExxonMobil of an estimated US$900 million in pre-contract costs. It is not clear how this amount will be repaid. Further, the volatility of oil prices in the last six weeks has seen a significant dip from US$76 per barrel (crude oil WTI) to US$56.46, a 26 percent drop. Further, with the Paris Accord on climate change in force, we are likely to see in the coming years a significant shift away from the use of fossil fuels towards renewable energy sources, such as solar, wind and hydro-power.

We therefore need to temper our expectations of the amount of oil revenues that will flow in the first five years or so since production is not likely to peak until the latter half of the 2020s, then tapering off as we approach 2038. What happens then will depend on not only how much oil revenues we are able to save but more importantly how well we are able are able to diversify the economy, both of which are necessary to avoid a downward spiral of the economy when oil resources are completely exhausted.

Presentation by former Prime Minister of Trinidad and Tobago

Reflecting on the experiences of Trinidad and Tobago, former Prime Minister of the twin-island republic and Leader of the Opposition, Mrs. Kamla Persad-Bissessar, echoed the views of many, including International Monetary Fund, that the proposed NRF, alternatively known as Sovereign Wealth Fund (SWF), should only be used for rainy day planning and not to supplement recurring expenditure. Mrs. Persad-Bissessar is reported to have stated that “[y]our SWF has to be seen as an insurance policy. It should not be seen as a cash cow that anytime you have a financing deficit in your budget that you would dip into it and come back out.”

Mrs. Persad-Bissessar further stated that recurrent expenditure brings no return or development and suggested there should be provision to prohibit drawdowns for recurrent expenditure. If such a provision is not in place, such drawdowns for recurrent expenditure have the potential to significantly destabilise the national economy. She also warned that Guyana must be prepared for two shocks – output and price shocks.

We cannot agree more with the sentiments expressed by Mrs. Persad-Bissessar. As will be observed, the contents of the “Green Paper” has addressed some of the concerns expressed.

Green Paper on the Natural Resource Fund

On 8 August 2018, the Minister of Finance presented to the National Assembly a paper entitled “Green Paper Managing Future Petroleum Revenues and Establishment of a Fiscal Rule and Sovereign Wealth Fund.” In introducing the paper, the Minister stated that SWFs play a crucial role in the management of natural resource revenues in the context of three broad objectives, namely stabilisation, savings, and domestic development. Stabilisation is necessary to guard against the volatility of commodity prices and the unpredictability of production levels. To achieve this, a portion of revenues will be invested in safe and liquid assets external to the domestic economy.

In terms of savings, the objective is to ensure the equitable distribution of benefits between the current and future generations from the extraction of non-renewable resources. Given the uncertainties surrounding the future of fossil fuels, it is necessary for savings to begin from day one of production. However, this must be balanced with the need to invest in order to overcome the obstacles (human, physical and technological) that restrict Guyana from realising its full potential. The Minister, however, cautioned about the need to avoid the resource curse at all costs.

According to the Green Paper, the Natural Resource Fund will be held at the Bank of Guyana, and oil revenues will be deposited into a special U.S. dollar account to be invested “in overseas assets that would serve to ensure that the country has a long-term stable source of income which would allow for the Fund to meet its stabilisation and intergenerational savings objectives”. The Bank of Guyana will be the Operational Manager of the NRF and will manage the Fund in accordance with the Operational Agreement and Investment Mandate to be developed by the Ministry of Finance. The Ministry will have overall responsibility for the Fund, including withdrawals for the Annual Budget, as approved by the National Assembly based on a fiscal rule to be developed. The withdrawn amount will be transferred to the Consolidated Fund.

Given the present configuration of the National Assembly and to enable the political Opposition to have a say as to the quantum of withdrawal from the NRF, it may be appropriate for the approval to be based on a super majority of the Assembly of, say 60-70 percent of the votes. Alternatively, the Public Accounts Committee could examine any proposal for withdrawal from the NRF and make a recommendation to the Assembly.

The fiscal rule, to be known as the “Economically and Fiscally Sustainable Amount (EFSA)”, will be determined by a Macroeconomic Committee, taking into account inflation, exchange rate, economic growth, public spending and the external debt. The Committee will comprise of five officials appointed by the Minister. There will also be a seven-member Sovereign Wealth Committee to advise the Minister on the Investment Mandate to be developed by the Ministry with the assistance of a Senior Investment Advisor and Analyst who will also assist the Minister, among others, in monitoring the financial performance of the NRF.

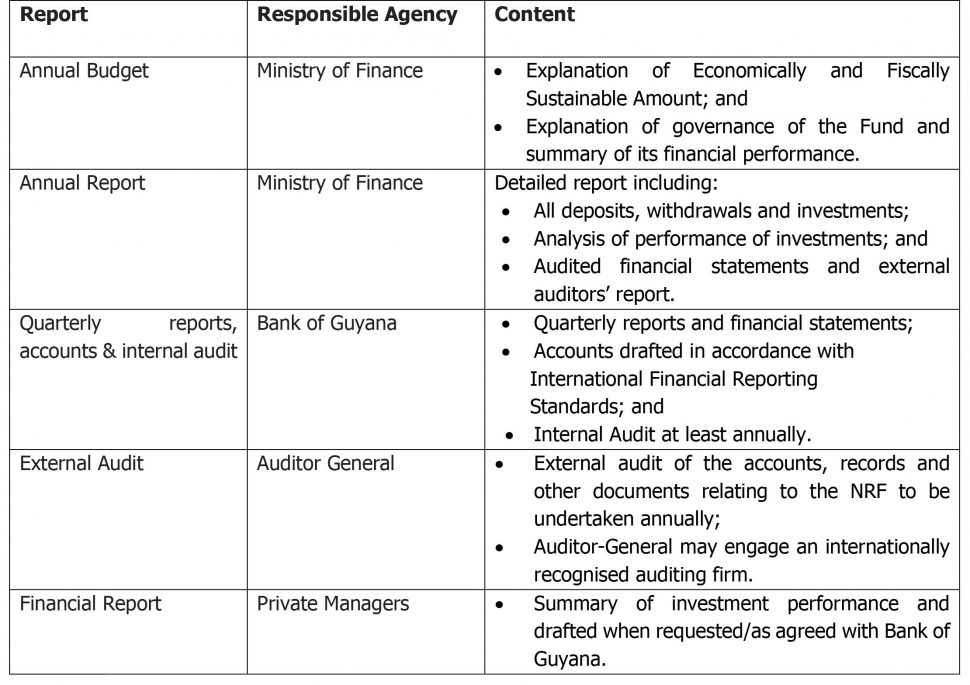

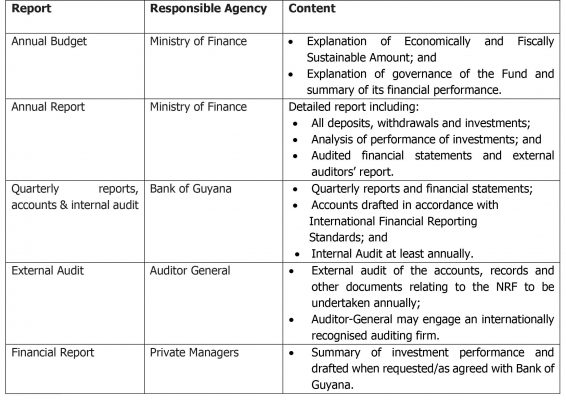

The reporting and auditing arrangements of the NRF are set out as follows: