Column 41 which appeared two weeks ago looked at the paltry share capital of the three foreign oil companies which signed the 2016 Petroleum Agreement for the Stabroek Block. The annual returns of two of the three companies showed that their exploration costs were financed by loans from their parent companies. Since one of those companies – Hess Guyana Exploration Guyana Limited (Hess) – had not filed annual returns since its registration in 2014, it is not possible to determine the source of its financing. Still, it would be a safe bet that it too will finance its operations by inter-company borrowings.

This column has not been the only expression of concerns about this strategy of low equity injection and high borrowings being pursued by the three contractors. Mr. Godfrey Statia, Commissioner General has indicated that the Revenue Authority would be paying particular interest in the practice and will no doubt seek to use his discretionary powers to disallow some of those costs. Other countries discourage such practices by what are called thin-capitalisation rules (see column 41).

The challenge for the Commissioner General are not insignificant: no thin-capitalisation rules; a court system that generally avoids getting involved on how companies structure their finances; the tax exempt status of the oil companies; and the jurisdictional overlap between the Revenue Authority and the Petroleum Commission whenever that Bill is pursued in the National Assembly. Of course, inter-company loans are only one tool used by businesses to shift profits from high tax to no/low tax jurisdictions since there is an infinite number of ways to shift income or charge or shift expenses.

Battle of wits

The Commissioner General has already indicated that the Revenue Authority will be strengthening its capability to deal with the challenges posed by the accounting practices of the oil companies. This may very well turn out to be a battle of wits as the oil companies will have extremely high quality staff with decades of international experience of creative accounting. He may also find that the rules of accounting under International Financial Reporting Standards are not as prescriptive as he may wish and that widely differing accounting policies pursued by different companies are all considered IFRS-compliant.

Countries do however have the sovereign power to make, repeal and amend fiscal legislation but Guyana runs into the wall of the everlasting stability clause in which the sovereignty of the Parliament is compromised in relation to the oil companies.

Different strokes

So let us see how Esso Exploration and Production Guyana Limited and CNOOC/NEXEN deal with interest in their 2016 financial statements. The total intercompany debt of Esso in 2016 was $76,879 million of which approximately $60,000 million was incurred in 2016. An obvious question is whether the Guyana branch is being charged interest on massive debt. An equally obvious answer is that we do not and cannot know because of the sparse information offered in the financial statements. Here is what those statements say about intercompany debt:

“This amount represents amount due to Home Office as well as intercompany loan utilised to fund petroleum operations.”

If we look further we note that General and Administrative costs are stated at $2,118 million. Except for Legal and professional fees of $168 million, there is no breakdown of this huge amount and one will have to speculate whether or not any interest cost is included in this amount.

Let us now look at the 2016 financial statements of CNOOC/Nexen which incidentally are audited by the same auditing firm. The intercompany liability in the balance sheet of $52,040 million is described as Due to affiliate and refers to a Note 4 to the financial statements. And this is what Note 4 states:

“The Branch owes the company, for advances to fund the Branch’s exploration activity. The amount due to the company is unsecured, non-interest bearing, and has no fixed terms of repayment.”

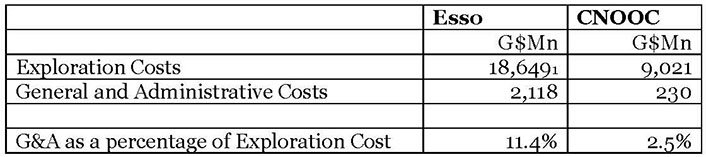

Here it is, two parties to the 2016 Petroleum Agreement treating vital information in very different ways. And what about the income statement? The difference is huge: CNOOC has only $230 million in General and administrative expenses which is barely 10% of the $2,118 million charged by Esso for General and Administrative costs! This huge gap cannot be explained by the relative scale of the operations of the two companies. If the Dry Hole Cost of $5,143 million charged by Esso is disregarded, Esso incurred a total of $18,649 million in Exploration costs compared with $9,021 million incurred by CNOOC over the same accounting period.

Expressed another way, for every $100 spent by Esso on Exploration costs, it spends $11.4 in General and administrative expenses. In the case of CNOOC however, for the same $100 spent on Exploration costs, that company spends a mere $2.5.

This disparity cannot be explained on account of the scale of operations: Esso’s exploration costs were just over two times that of CNOOC. And while part of this disparity is necessarily attributed to Esso’s role as the Operator, the gap seems more than significant and certainly requires some extensive explanations. Indeed, there seems to be a strong case for far more disaggregated accounting with the Operator Esso providing more meaningful information.

Having witnessed the recklessness with which the Government and Minister Trotman blindly accepted a whopping US$460 million as pre-contract costs, and how tolerant they have been of the refusal of one of the Contractors to meet its statutory obligations with respect to the annual filing of returns and accounts, it would be wishful thinking to believe that the Government will get serious with the three contractors.

Three years after the announcement of the discovery of petroleum, Trotman and the Government have not been able to take a single action in relation to the emerging sector, pass a single piece of legislation or call out a single oil company. In the process, they have shown themselves wholly lacking in managing a petroleum economy and the country’s relationship with the three oil companies. The Guyana Revenue Authority has its work cut out. The country is in for a rough ride. More than ever, Every Man, Woman and Child in Guyana better Become Oil-Minded.