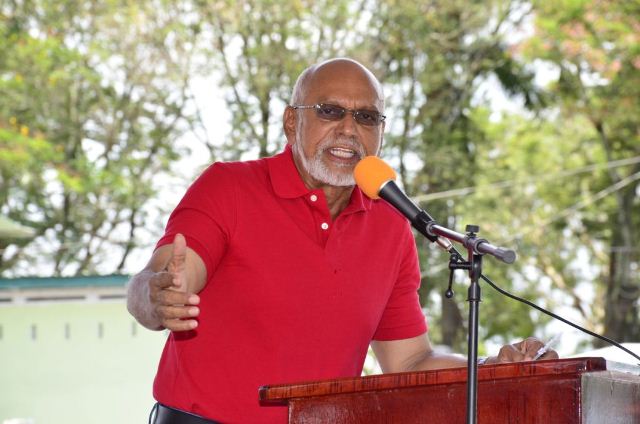

With the Financial Institutions (Amendment) Bill 2018 likely to be passed in the National Assembly today, former President Donald Ramotar believes the possibility that it could be used to sanction banks without them having recourse to the courts has been overlooked.

Ramotar is calling on banks, the banking association, the private sector and the public to familiarize themselves with the Bill and speak up before it is too late as he believes that the move is a calculated bid to target certain banks.

“This bill allows them to arm themselves with powers that will allow them to extort more money from the banks. To let them know who the boss is,” Ramotar told Stabroek News yesterday.

“Already they have GBTI (Guyana Bank for Trade and Industry) on the back foot. The next would be Demerara Bank and the Bank of Baroda … Later the others would inevitably follow. In the light of this clear and present danger, I am shocked that the Private Sector Commission or the Bankers Association have not said anything about this. This is a silence, I am sure, they may live to regret,” he added.

Brought to the House in the name of Minister of Finance, Winston Jordan and first read on April 26th 2018, the bill is set for a second reading today when the National Assembly meets at 2pm.

Its Explanatory Memorandum states that it seeks amendments to four sections of the Principal Act while there are proposals for the repealing of the same number of sections.

Jordan believes that the existing bank insolvency regime does not distinguish between corporate failures and banking failures, as both are subject to a form of commercial insolvency law and in a number of respects, the commercial insolvency law model is ill-suited to deal with the failure of banks.

“The corporate insolvency model uses judicial instead of administrative proceedings with all the attendant delays,” the Explanatory Memorandum states.

The amendments are for sections 11, 33, 33A, 33B and Part VIII of the Principal Act. Repeals are for sections 33C, 33D, 33E and 33F of the Principal Act.

“Clause 2 of the Bill amends section 11 of the Principal Act. The (Central) Bank may revoke a licence issued under section 6 to carry out banking business or financial business if the bank or other institution provides the (Central) Bank false information, fails to pay the fee prescribed under section 6(8), or where the institution fails to comply with any condition contained in its licence or if the (Central) Bank decides to initiate compulsory liquidation. Clause 3 amends section 33 of the Principal Act giving the (Central) Bank the power to issue orders, directions and monetary penalties to a financial institution where in the opinion of the (Central) Bank a licensed financial institution or any affiliate, director, officer, employee or agent of the financial institution in conducting the business of the financial institution, is committing or pursuing or is about to commit or pursue any act or course of conduct that is an unsafe or unsound practice or a violation of any law, or order, direction, notice or condition imposed in writing by the (Central) Bank,” the Explanatory Memorandum states.

“Clause 4 substitutes a new clause 33A for the previous one in the Principal Act providing for the appointment of a controller with a view to preserving or restoring the financial position of a licensed financial institution and to take measures to restore the sound and prudent management of the business of that institution with powers including the power to assist in an advisory capacity in management meetings, to advise the financial institution and to oversee execution of orders by the (Central) Bank. Clause 5 substitutes a new clause 33B for the previous one in the Principal Act providing for recovery and resolution planning. The content of recovery and resolution plans shall be determined by the (central Bank. Clause 6 repeals sections 33C, 33D, 33E and 33F of the Principal Act. Clause 7 substitutes Parts VIII and VIIIA for Part VIII of the Principal Act,” it adds.

But Ramotar says that while government may argue that the amendments and repeals are needed to tighten oversight of the banking bodies, he believes that it is specifically designed to in the future close down banks that are not in support of the government of the day’s posture.

He reasoned, the “APNU+AFC regime will move to amend the Financial Institutions (Amendment) Bill to give the Bank of Guyana powers to administratively close down banks. At the moment the banks still have recourse to the courts if the government tries to close them. The amendment will put an end to this. The first matter that comes to mind is what has prompted the regime to amend the Act. No one has made any complaints nor was no issue aired publicly to justify such a change. No doubt the regime may argue that the USA or the UK has this provision, therefore, they want it as well. That, however, is be comparing cheese and chalk,” he said.

“It is well known that those countries do have strong independent regulatory bodies. They are not only technically strong but capable to standing up to the Executive to defend their constitutional rights. They have been so established that the Executive hardly attempts to try to influence them. Under the APNU+AFC regime we see that the similar conditions do not apply in Guyana. This regime has established itself as being extremely vindictive and abusing state power for partisan political interest and absolute control, it is on these grounds that I am telling you that this Bill needs to watched,” he added.

He pointed to charges against officials of GBTI, for allegedly failing to comply with a court order that was issued by the High Court for the production of documents for an ongoing criminal investigation, saying he has no doubt that banks with similar stances will be targeted.

“The charges against GBTI trying to humiliate its Board of Directors and senior staff, marching them in court, leaving them standing, even when seats were available is spiteful, vindictive and simply vicious. What has prompted this seeming attack on GBTI? … This is a warning to the private sector. They must shut-up or pay for any protest actions. They want people to go on their knees before the “kings and queens” of PNC/APNU regime,” Ramotar charged.

“I am telling you that all Guyanese, regardless of race, religion or political persuasion will suffer. It is time for all peace loving and democratic forces to stand up before it is too late because this amendment of June 25, 2018 is only another in a long line of ominous signs,” he said.