Buoyed by the support of the banking sector, the National Assembly just after nine last night passed the Financial Institutions (Amendment) Bill which is aimed at modernising the financial architecture of the country.

The opposition argued that the amendments to Part VIII of the Bill infringe on the constitutional right of financial institutions to due process and stressed that Article 37 (2)(i) which grants the Bank of Guyana (BoG) the power to resolve an institution if it has reasonable cause to believe that the licensed financial institution or its executive officers have engaged or are engaging in criminal activities punishable by imprisonment of six months or more, in such a manner as to threaten the interests of depositors was a clear indication of such infringement.

Jordan however read for the House two letters from representatives of the banking sector. The first was dated June 27, 2018 and expressed the bankers’ desire to be granted 14 days to review the bill while the second dated June 29 rescinded this request and noted that BoG governor Gobind Ganga had been able to allay their concerns. These letters followed a June 25th news item in Stabroek News in which former President Donald Ramotar expressed grave reservations over the bill.

Jordan yesterday accused the opposition of attempting to orchestrate pressure from the Private Sector to frustrate the debate and passage of the bill.

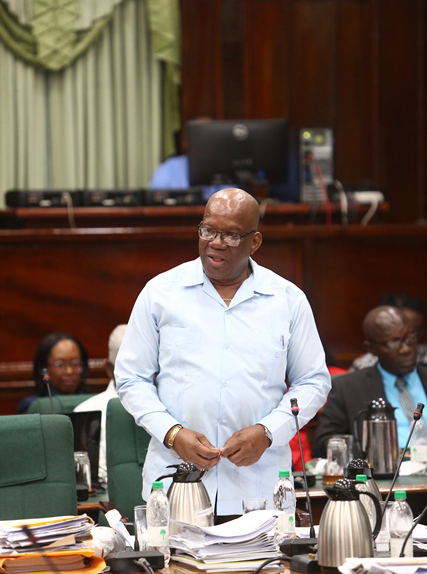

In presenting the bill for its second reading the Minister explained to the House that the amendments were drafted partly in response to recommendations made in the 2016 Financial Sector Assessment Programme (FSAP).

“It was recommended that Part VIII be amended to provide resolution powers to the Bank of Guyana and to the extent possible limit the court’s ability to reverse those decisions,” Jordan said, adding that the amendments closely align with the 12 key attributes of effective regimes of resolution of financial institutions which had been issued by the Financial Stability Board (FSB) in October 2014 which are considered to be best practices. The FSB is an international group that monitors and makes recommendations about the global financial system

He stressed that these set out the core elements identified as necessary for an effective resolution regime which allows the authorities to resolve institutions in an orderly manner without taxpayers’ exposure to loss from solvency support while maintaining continuity of their vital economic functions.

He went on to detail how each key attribute, Scope; Resolution authority; Resolution powers; Set-off, netting, collateralisation, segregation of client assets; Safeguards; Funding of firms in resolution; Legal framework conditions for cross-border cooperation; Crisis Management Groups; Institution-specific cross-border cooperation

agreements; Resolvability assessments; Recovery and resolution planning and Access to information and information sharing were provided for in the amendments tabled.

The Minister stressed that the intention to modernise Guyana’s financial architecture was indicated in the last two budgets speeches and is a continuation of measures begun by the previous administration in 2004 after that year’s FSAP.

Despite these assurances the parliamentary opposition which indicated its support for the bill in principle expressed grave reservations with the powers granted the BoG.

PPP/C MP Irfaan Ali argued that whilst Guyana cannot have a system with significant delays in the liquidation process it also cannot limit the powers of the judiciary which he argues the bill does since it limits the court’s ability to reverse BoG decisions.

Referencing the board of the Guyana Bank for Trade and Industry (GBTI) whose members are currently appearing before the High Court, Ali claimed that executive control and abuse of powers was exercised in this case and cited a possibility that similar abuses can be realized through the legislation.

He stressed that the Minister of Finance in some cases directs the action of the BoG which creates the chance for political interference and this leaves its decision open for political bias.

Why, he argued, did government not institute time limits for liquidation cases rather than limit the court’s ability to decide these cases.

Unfounded

The lone government speaker other than Jordan, Minister of Business Dominic Gaskin sought to argue that the opposition’s concerns were unfounded. He noted that while the previous iteration of the bill granted powers of resolution to the Minister of Finance the current bill grants that power to the Bank of Guyana. Further he argued that while a judicial appeal of the Bank’s decision does not delay the implementation of the decision an appeal is still possible.

The opposition was unimpressed by this argument with PPP/C MP Anil Nandlall arguing that the bills were brought not to rectify an identified deficiency in the law but to satisfy a conditionality of a US$35 million Development Policy Credit from the World Bank.

Nandlall stressed that all claims about a modernisation of the financial sector is a smokescreen used by a government trying to access funds balance of payment support to prop up a collapsing economy.

He repeated the concern that the power being given to the central bank was worrying and argued that the banking sector cannot be comfortable with the bill.

Accusing Jordan of making a perfunctory attempt at consultation on the bill only after the opposition raised the issue through letters and articles published in the Stabroek News, Nandlall posited that the bill would not survive the constitutional scrutiny which the banks would surely call for in the courts.

“The banks will never allow this to stand,” he declared.

Jordan however indicated that he would be placing his trust in the office of the Attorney General which drafted the legislation with international support.

“The legislation was drafted by the Attorney General’s office and they assured me that it was in keeping with our laws and constitution. I’m taking their assurance that nothing here limits the powers of the judiciary,” he told the house.

Jordan also dismissed the claim that the series of financial sector bills currently before the house were laid as a condition for being granted the World Bank credit. According to the Minister, Guyana already has the money and whether the bills pass or not the money is available for use as the documents have already being signed and its disbursement approved.