Guyana continues to play a significant role in ExxonMobil’s growth plans and the company yesterday said that appraisals of all eight wells discovered here offshore have not yet been completed and would mean that the 4 billion barrels of oil equivalent recently announced could climb further.

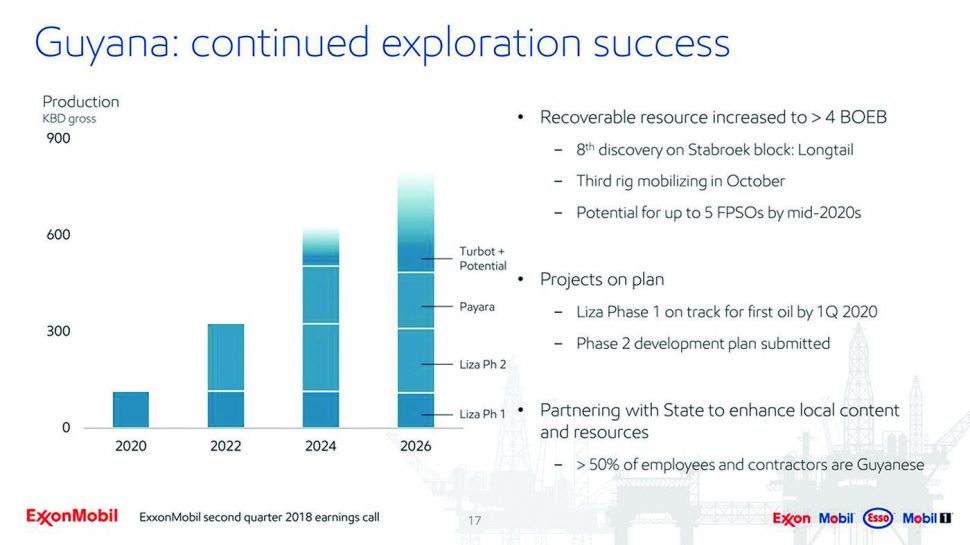

“Estimated gross resources for the block, pending assessment of the latest discoveries, is now more than 4 billion oil equivalent barrels. That is up from the 3.2 billion, I communicated in March,” Neil Chapman, Senior Vice-President of the company, yesterday said as he reported on the company’s quarterly earnings.

“Going back to Guyana and Ranger. We have some more appraisal wells to go in Ranger. We know, of course, from our discovery, that we have a considerable resource. We are not in a position where we can quantify that right now,” he later said in response to a question posed by an analyst.

ExxonMobil’s Senior Director for Government and Public Affairs Deedra Moe told Stabroek News that specific estimates have not yet been released on Ranger because there are additional wells to be appraised but a figure was included in the 4 billion figure that was released.

“We are going to go back in and see some additional appraisal wells to see fully. We did include an estimate in the updated resource estimate. But to be able to fully say that Ranger is X amount, we are going to have to fully do some appraisal wells in that area,” she said.

A subsequent filing to the United States Securities and Exchange Commission also stated that the company continued to rapidly advance the Liza Phase 1 project with the start of development drilling offshore Guyana. “Development drilling began in May for the first of 17 wells planned for Phase 1, laying the foundation for production startup in 2020. The company and its (partners) have so far discovered estimated recoverable resources of more than 4 billion oil‑equivalent barrels on the Stabroek Block,” it said.

While the US oil major’s profit fell short of the Wall Street stock market projections, which saw a 3% percent fall in its share price yesterday, it recorded second quarter earnings of US$4 billion, up some 18% from the US$3.4 billion it recorded last year.

Chairman and Chief Executive Officer of ExxonMobil Darren W. Woods explained that Guyana forms a key part of the company’s strategies to see its earnings climb significantly over the next decade. “Key projects in Guyana, the U.S. Permian Basin, Brazil, Mozambique and Papua New Guinea are positioning us well to meet the objectives we outlined in our long-term earnings growth plans. The high quality of these resources, combined with our strengths in project execution and innovation, will generate strong value over time,” he said.

Much of what was discussed about Guyana at yesterday’s second quarter earnings conference call was stated in a release on Monday from the company but Senior Vice-President Chapman expounded and answered questions posed from financial analysts representing various companies.

Giving a breakdown of its Guyana exploration activities, Chapman explained, “We made the eighth discovery on the Stabroek Block with the Longtail discovery well, which encountered more than 256 ft of oil bearing sandstone and established the Turbot area as a potential hub for over 500m oil equivalent barrels recoverable. We are currently making plans to have a second oil exploration vessel offshore Guyana, bringing our total number of drill ships on the Stabroek Block to three. The new vessel—we plan it will operate in parallel to the Stena Carron to explore the block’s new high value additional prospects. The collective discoveries on the block today establishes the potential for now up to five FPSOs [Floating Production Storage and Offloading vessels] producing over 750,000 barrels per day by 2025.”

He reminded of his March announcement, when he had first outlined that the company would be bringing an addition FPSO here later this year, taking the total number to three, as he underscored its significance.

Chapman added, “The Liza-1 phase 1 project is progressing very well. Predrilling at the development well started in May, with the Noble Bob Douglas rig. We have batch drilling wells for maximum efficiency and we have completed the top hole sections on six wells to date and are now working through the intermediate hole factions. Conversion work on the FPSO, the Liza Destiny in Singapore, is progressing well. We remain on track for first oil, early 2020.” The Liza Destiny is expected here by the last quarter of this year but the company has not yet disclosed which of its subcontractors will be responsible for manning it.

Chapman also repeated that the Liza-5 well successfully tested the northern portion of the Liza field and, along with the giant Payara field, will support a third phase of development in Guyana. The Payara operation scheduled for 2019 will use an FPSO vessel designed to produce approximately 180,000 barrels of oil per day, as early as 2023.

He played up the partnership that the company continues to work to build with this country’s citizenry and government, telling investors that plans are also on stream to increase the number of Guyanese Exxon uses in its operations.

“We have a strong focus of partnering with the Guyanese and enabling workforce and supply development for its growth and the success of Guyana’s new energy industry. About 50 percent of ExxonMobil’s employees contractors and subcontractors are Guyanese. A number that will continue to grow as operations progress,” he said.

“And we have opened the centre for local content development in Georgetown to promote the growth of small and medium sized businesses,” he added.

The Stabroek Block is 6.6 million acres (26,800 square kilometers). ExxonMobil affiliate, Esso Exploration and Production Guyana Limited, is the operator and holds a 45 percent interest in the Stabroek Block. Hess Guyana Exploration Ltd. holds 30 percent interest and CNOOC Nexen Petroleum Guyana Limited holds 25 percent interest.