Following the examination of 10 submissions, only five companies have entered bids for three shuttered sugar estates and a pall was cast over the process yesterday after Demerara Distillers Limited (DDL) announced that it was not pursuing its interest in the Enmore operations.

Very little information was available yesterday on the companies which have entered bids. The low number of bids is in sharp contrast to earlier assessments from government officials that there were scores of interested companies from the region and further afield

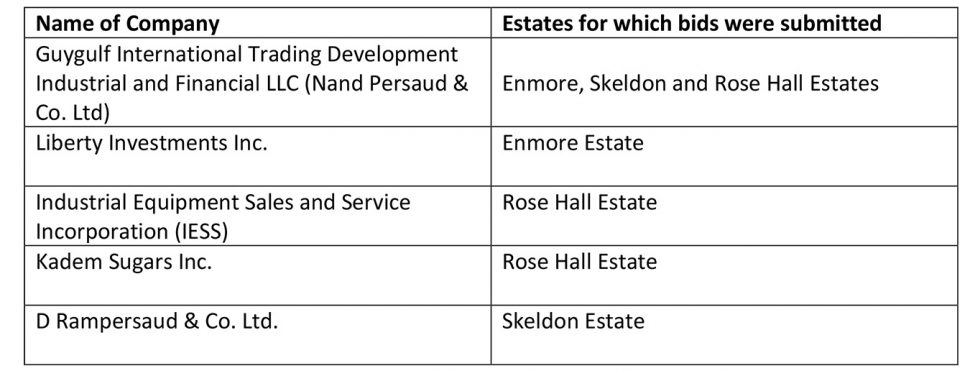

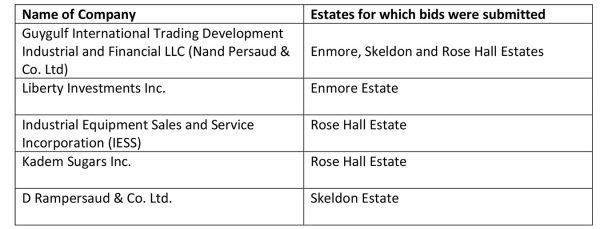

The names of the companies, released by the Special Purpose Unit (SPU) of the National Industrial & Commercial Investments Limited (NICIL), and the respective estates tendered for are shown in the table below.

DDL had long expressed interest in the Enmore Estate for its molasses needs but it issued a statement yesterday saying that it was unable to find a model that would “properly fit” within its current investment and development strategy.

DDL said that it came to its decision after much deliberation and expending considerable time and financial resources in undertaking due diligence to determine the level of investment required to turn around the Enmore Estate.

The Private Sector Commission (PSC) had visited the Enmore estate and had also signalled interest in its purchase but it, too, did not submit a bid. Several efforts made to contact head of the PSC, Desmond Sears, proved futile as calls to his mobile and business numbers went unanswered.

Chief Executive Officer of DDL Komal Samaroo, when earlier contacted by Stabroek News, said that it was not that the company was not interested in the estate.

“It is not that we are not interested, we are interested,” Samaroo said, before explaining that a subsequent statement would give reasons for the decision.

The statement quoted him as saying, “We respect the process being conducted by the SPU and PwC, and will continue to pay keen interest in those developments and outcomes.”

Samaroo added, “if the estate is sold, we will quickly engage the new owners to ensure that we secure supplies of molasses for our distillery. Should the estate remain unsold, we would equally reengage to determine if there is a model that works for our shareholders.”

The company also explained that it was not only because of its need for molasses that it was interested and that it felt a corporate duty to preserve the sugar industry. “As a responsible corporate citizen, DDL was clearly interested in the preservation of the sugar industry in Guyana because it is deeply rooted in who we are as a nation and as a people. Moreover, the sugar industry is seen as inextricably linked to DDL’s rums, for which the value of participating in the industry’s survival is crucial to preserving those links,” the statement said.

“In fact, DDL’s interest in Enmore is driven primarily by its need for molasses for its core business as a distillery. The shortfall in molasses experienced after the closure of three GuySuCo estates severely impacted DDL’s ability to meet its commitments to local and export customers,” it added.

Opportunity

But while the company could not see the estate as part of its current investments, it said “Nevertheless, DDL remains committed to participate, should the opportunity become available in the future.”

It would have to wait until the existing process is completed and only if that fails and government goes to other options could it be given that opportunity again.

Managing Director (Deals) of PricewaterhouseCoopers (PwC) Tax and Advisory Services Limited Wilfred Baghaloo had attributed the lower than expected number of bids to uncertainty over the functionality of the estates and concerns about competition from the state-owned GuySuCo.

“The major concerns of potential bidders related to regulations that are needed to ensure fair competition [with] government, that is, the legacy, GuySuCo,” he told reporters on Thursday, the day after the tender opening that saw the 10 submissions.

“Part of the concern was that a lot of people were worried—‘What are we really buying? Are we buying scrap metal or going concerns?’ There was also concern about the regulatory environment…‘How do we compete with government?’” he added.

PwC, was contracted by the SPU and last year began doing valuations of the assets of GuySuCo in order to secure prospective investors.

He had explained also that he could not give the names of the bidders until the documents were sorted and it was determined if the ten envelopes were individual bids or multiple bids from one company. But while he could not name the companies, he said local and regional companies dominated the submissions as only one bid came from an international company. That international company, Baghaloo said, is registered in Florida but has Middle Eastern connections.

Asked why the country registration of the companies was not given as is done in Guyana when bids are opened, he said, “We are still going through the high volume of documents etc provided.”

Asked about his statement that only one foreign company had bid, Baghaloo reasoned, “it depends on definitions…we are still going through the high volume of documents submitted by some of the bidders. A company registered in the USA or St Lucia is not necessarily a foreign company if the owners are citizens of another country. We will have to look behind the corporate structure for substance over form.”

After the bids have been submitted and evaluations completed, it will be Cabinet that will make a final decision. “PwC would give the score, because they will use a scoring system for the business plans as they evaluate them in terms of technical and financial aspects and that sort of thing. They will look at the bids, score, make their evaluation and recommendations but we still have to submit to Cabinet,” Head of NICIL Horace James had previously explained, while noting that Cabinet will make a decision on the information that PwC and the steering committee submits.

“I hope we are talking early next year. Yes, I hope by then [the end of February] that we would see them sold off,” he added, when asked about an expected completion date for the divestment process.

The sale of the estates can be a lifeline for the thousands of sugar workers who have been laid off after government closed the estates at the end of last year. GuySuCo retains the Uitvlugt, Albion and Blairmont estates.

PwC has reminded that the government reserves the right to not accept any bid received and could opt to reopen the process should it be deemed necessary.

Baghaloo said that there should be no premature despair over the number of bids received. “Let’s see if these bids have substance and if the bidders meet the established criteria,” he said.