The Memorandum of Understanding (MoU) between the Governments of Guyana and China on the Silk Road Initiative and its maritime component encompasses free market principles and envisages the expanded use of the local currencies of the two countries.

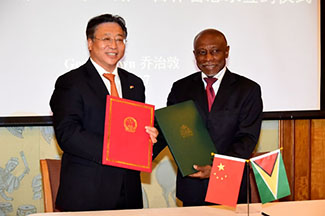

The MoU signed on July 27, 2018 was finally released by the Ministry of Foreign Affairs on Tuesday, October 30.

It contains 15 clauses in six articles which outline the areas of co-operation between the two countries within the framework of the Silk Road Economic Belt and the 21st Century Maritime Silk Road Initiative.

According to the document, in recognition of the political consensus to jointly promote the Belt and Road initiative the two countries have decided and agreed to cooperate in the areas of policy co-ordination, facilities connectivity, unimpeded trade and financial integration.

Specifically, the provisions call for the two countries to regularly communicate and promote the synergy and integration of their major development strategies, planning and policies as well as strengthen communication and coordination of the respective important or major policy framework.

“Parties will co-operate and exchange ideas regarding infrastructure connectivity and development in areas of mutual interest, including roads and railway networks, bridges, civil aviation, maritime transport, harbours and ports, energy and telecommunications,” the MoU explains.

It further provides for the two countries to enhance international trade and investment initiatives and expand two-way investment and trade flows between them, further deepen investment, trade and industrial co-operation and encourage their businesses to build, operate and/or participate in industrial pacts and economic and trade co-operation zones.

In the area of financial Integration the parties are tasked with expanding the use of their respective local currency in investment and trade based on the investment and trade demands, strengthening the exchanges and co-operation between their currency and financial regulators and promoting the mutual establishment of the financial institutions between the two countries.

In order to realize this provision a cooperation mechanism will be established to handle and manage financial risks and crises as well as increase cooperation between the banking sector and institutional investors.

Additionally the parties may conclude cooperation agreements on education, culture, health, tourism, public welfare or other relevant fields.

The MoU further specifies different modes through which this cooperation may be realized including high-level visits through existing exchange mechanisms, bilateral cooperation, free market principles and the promotion of public-private partnerships as well as the provision of investment and financing support through diversified channels and other agreement or protocols for co-operation in specific fields.

The document also provides for the settlement of disputes through amicable and friendly consultation via diplomatic channels as well as the length of the agreement which is set at three years with automatic renewals of three-year periods indefinitely unless terminated by either party via a written notice at least three months in advance.

It is unclear why the document was not released on July 27th when it was signed.