The National Assembly on Wednesday passed amendments to the income and Value-Added Tax (VAT) laws to implement pro-mised changes, including the electronic filing of tax returns and the reduction in the tributor’s tax for the gold mining sector.

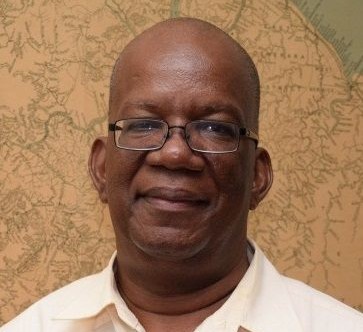

Government used its majority to pass the amendments, which were brought by Finance Minister Winston Jordan.

Once enacted, the Income Tax (Amendment) (No. 2) Bill 2017 will effect several changes to the Income Tax Act, including the provision of a reduction in tributor’s tax from 20% to 10% with effect from the starting of this year, a scale of the rate for income tax (withholding tax) for the gold mining sector, and the exemption of vacation allowance from taxation for private sector workers. The planned reduction in the