Dear Editor,

The Berbice Bridge Company Inc (BBCI) has held both the PPP and APNU responsible for not honouring increases in tolls pursuant to the Berbice Bridge Act and the Concession Agreement. The Berbice Bridge is a PPP project which has been heavily criticised by APNU+AFC. In fact, in 2013, even before the tolls were scheduled to change, APNU sought to politically sabotage the Berbice Bridge by proposing a motion in Parliament to reduce tolls. This motion was passed in May of 2014 and proposed reducing tolls by over half. APNU’s actions scared investors in the bridge, who became concerned both about their existing investment and about reinvesting funds back into the bridge. By 2015, when a larger toll increase was needed, elections deferred all decisions. In the resulting change, from the PPP to the APNU+AFC Government, APNU+AFC inherited a problem of their own making.

In 2014, when I was President, we met with the Berbice Bridge Board with the objective of finding ways to avoid a toll increase while at the same time ensuring that the Berbice Bridge was able to honour its obligations. We viewed the toll levels like the way GPL handled its tariffs to maintain a constant level of tariffs, despite rising and falling oil prices. Our solution was simple—given that tolls were only going up to secure cash to reduce debt, Government would support investors, reinvesting some monies at a lower interest rate, and have this repaid in the last few years of the bridge concession. Under this scenario, tolls would not go up, but it would also not go down as quickly as projected. Other solutions included increasing the life of the concession, but this was viewed as less preferable than solutions possible over the remaining life of the concession.

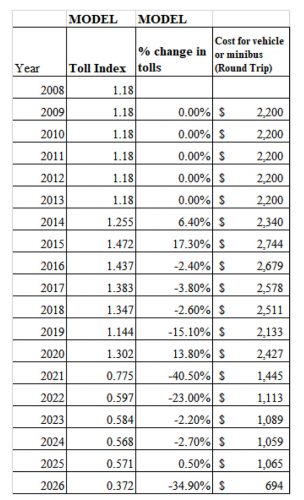

In 2006, every investor received a financial model that contained a toll index. I have no doubt that the PPP has no objection to this model being made public. The financial model showed that tolls would remain constant until 2014. In 2014, tolls were scheduled to increase by 6.4 per cent and again in 2015 by 17.3 per cent. Thereafter, tolls would start dropping. The table below shows the toll index and the percentage change in tolls from the prior year. The last column shows how much a vehicle would pay based on this toll index and using the tolls in existence since the start of the bridge. Despite the modest increase in 2014 and 2015, it fell in the following years, such that by 2019, tolls were projected to be lower than in 2008 when the bridge opened.

The key reason tolls were scheduled to go up from 2014, was that debt repayment started in 2014. Prior to 2014, only interest was being paid. But as debt was repaid, less money was needed for interest expense. By 2019, tolls were projected to be lower than 2008, and by 2021, tolls were projected to be substantially below where it was in 2008, falling over 40 per cent over 2020. In 2026, the bridge would be handed back to Government at no cost, and fully repaid. By that time, tolls would be almost negligible.

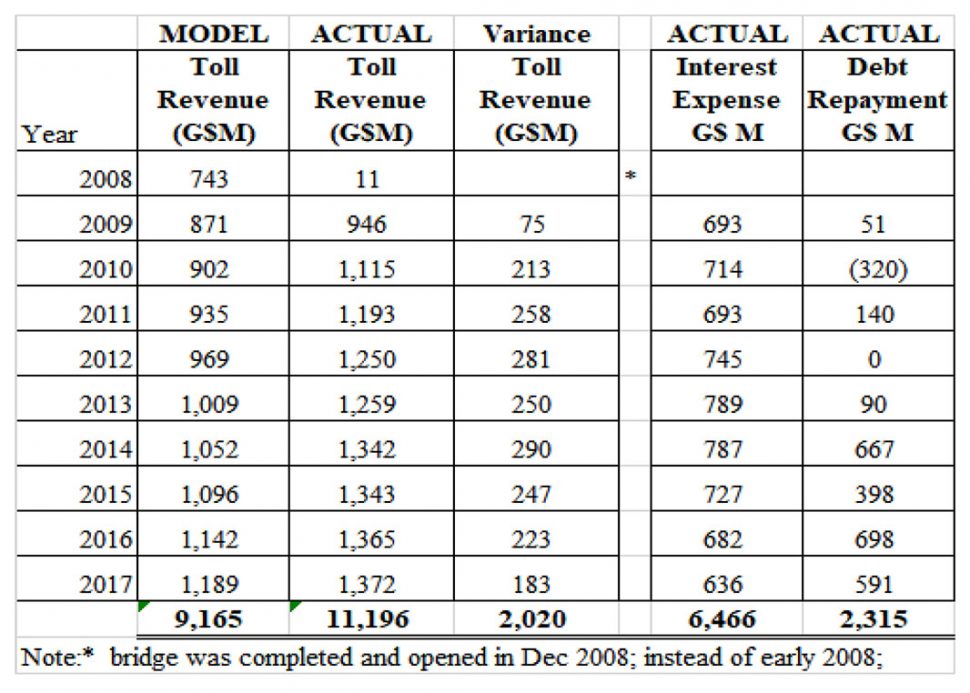

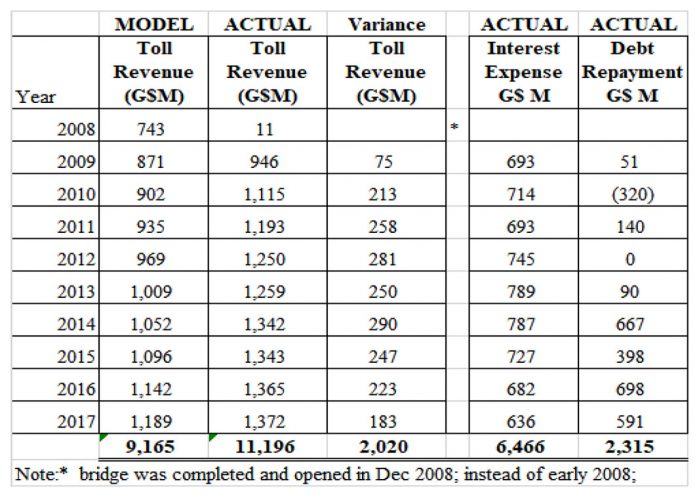

Some persons have argued that the Berbice Bridge financial model was flawed. We in the PPP believe the opposite. The bridge has performed largely as projected. In fact, as the following table (based on audited financial statements of BBCI) shows, in every year, toll revenue was greater than projected. The table shows that as the Berbice Bridge repaid debt, its interest expense started to reduce. In fact, during the 2009-2017 period, actual revenue was G$2 billion more than projected revenue. During the same period, the BBCI repaid over $2.3 billion in debt. Annual interest expense which peaked in 2013 at $789 million, was reduced to $636 million in 2017, a reduction of $150 million. This trend would continue as debt is repaid.

Had APNU not sought to sabotage the Berbice Bridge project by its opposition and Parliamentary motion, solutions to resolve the timing of debt repayment would easily have been agreed by the PPP and the BBCI to avoid toll increases.

But we all know that the APNU motion sabotaged this and held the BBCI hostage.

The bridge financing made sense. It did not have a Government guarantee and truly attracted a broad range of private sector interests. Today, the pending default can threaten major financial institutions. Despite the PPP having a record of honoring contracts, such as GTT, Omai, Barama, and Aroaima, APNU seems bent on dis-honoring contracts or failing to negotiate acceptable compromises to both sides. Our entire financial sector is now exposed.

And so, the current impasse could have been avoided. Solutions were readily available if APNU+AFC only showed the will. But political stubbornness and vindictiveness against the PPP now leaves the BBCI facing debt repayments without the resources to pay these. Is APNU pushing the BBCI into bankruptcy?

Yours faithfully,

Donald Ramotar

Former President