Dear Editor,

Let me begin by thanking Stabroek News for publishing my letter in your Sunday 21st Oct edition on the Berbice Bridge. I am however, surprised and disappointed, with SN’s editorial of Monday 22nd October, that quite frankly appeared one-sided, repeating many of the APNU+AFC and critics’ attacks on the bridge, including misconceptions and inaccuracies. At the onset of this note, let me recognize that in constructing this reply, I have consulted with various parties familiar with the technical and financial details, including Winston Brassington who held major responsibilities for this project in the early stages of development, construction and operation.

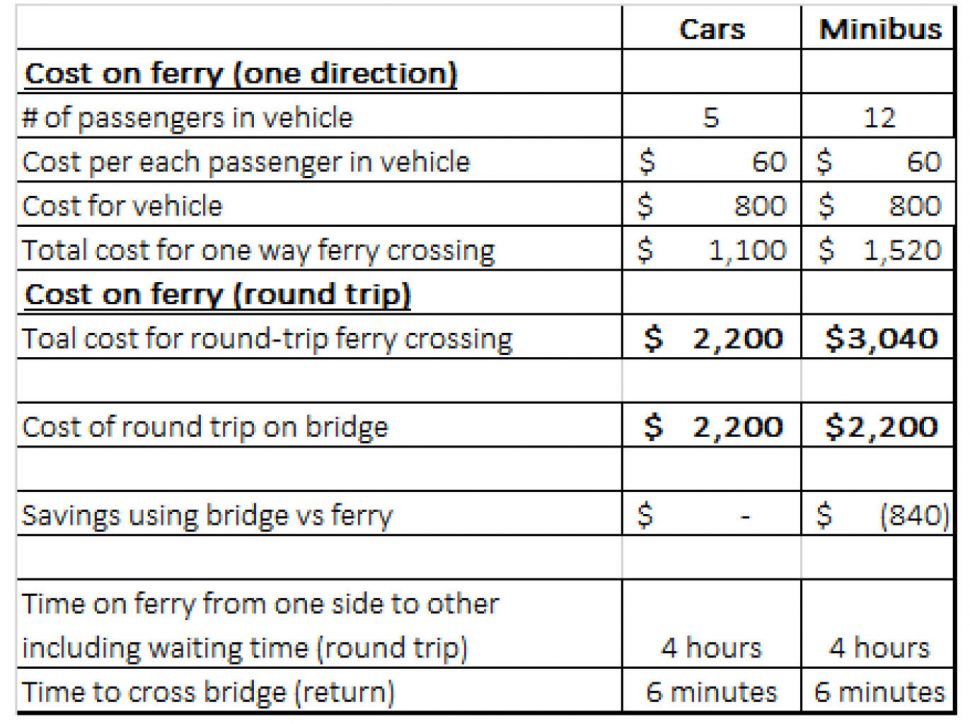

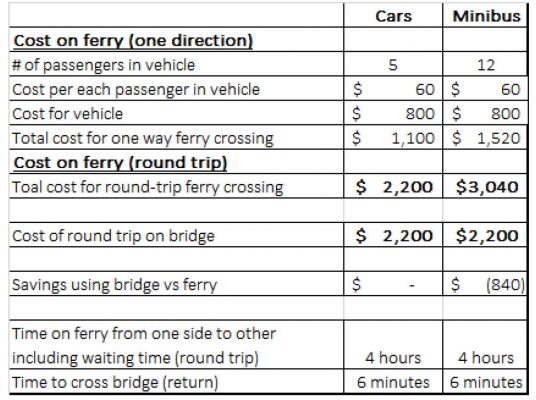

First, let me challenge the current misconception, that the Berbice bridge fares set in 2008, were set high. I will repeat what we in the PPP/C have said. The fares set for the Berbice Bridge are not materially different to that paid for the ferry. As the following table illustrates, for the vast volume of traffic, fares are comparable or below that paid for the ferry, notwithstanding the considerable convenience from the bridge.

Secondly, let me correct your statement that the bridge “…. didn’t attract the volume of traffic across the bridge that would have enabled it to make debt payments and provide the inscribed returns to its investors.” My letter provided a table that showed that revenue over the 2009 to 2017 period was in fact, greater than the projections by over $2 B. Given the constancy of fares, this result is directly the result of greater traffic than that projected. So, the fact is, the bridge not only generated the traffic projected; it exceeded it.

On the issue of the projected rate increases in the model, let me state that the Berbice Bridge engagement in 2014 was not the result of an application for a rate increase. In fact, this application only came in March of 2015 per the BBCI full page release on Sunday last. When my Government met the Berbice Bridge Board in 2014, the Board expressed the position that they wished to avoid an increase, and our discussions focused on the options to achieve this. While we recognized the need to find a medium-term solution on the bridge finances, you should note that that the actual revenue in 2014 (and every year) was greater than the projected revenue in the model and that the company in fact paid down in 2014, $667 M in debt as evidenced in BBCI’s 2014 audited statements. There is little doubt that the APNU Parliamentary motion to reduce the toll by more than half, and the repeated APNU+AFC actions of attacking the bridge model, complicated the situation and made difficult any tariff increase. This was the reality as viewed in 2014 by both the owners of the bridge and the Government.

When the 2015 rate application was submitted by the Berbice Bridge board, it was a mere two months from elections. In less than 2 months, it become an APNU responsibility as Government, who instead of engaging meaningfully with the BBCI, forced a subsidy in January 2016, that in no way benefitted the Berbice Bridge. APNU also put in place free crossings by boat, to compete with the bridge, all intended to undermine the bridge revenue and

operations. In the BBCI release, they themselves stated that when they signed in good faith the Commuter Subsidy Agreement of January 2016, the promised engagement on the tolls did not materialize. Today, over 3.5 years since elections, APNU+AFC has ignored the BBCI and its financial woes.

To add insult to injury, during the ensuring period post-elections, apart from the 10% subsidy agreement, which is cash neutral to the BBCI, the APNU Government imposed a 14% hike in electricity and water rates, removed a host of exemptions for VAT, and imposed a range of taxes that have ballooned government revenue on the backs of the consumers and the public at large. Such actions reflect gross hypocrisy, and a total lack of care for what the true cost of living is for Berbicians (or Guyanese). The closure of Rose Hall and Skeldon sugar estates in Berbice and the mismanagement of the rice sector only exacerbated the situation. And let us not forget the Government forging ahead with a new Demerara bridge (using a PPP model) at an estimated cost of US$175M which will be largely funded or guaranteed by Government, or the airport at a cost exceeding US$150M, when it is stifling the private sector investment of over US$40M in the Berbice Bridge, without even attempting to honour the Concession Agreement or find a compromise. And while we are it, let us also not forget that the Government gave a full Government guarantee for the borrowing of G$30B in funds by the Guysuco-NICIL SPU, of which over G$16B is sitting in the bank costing taxpayers 4.75% annual interest.

SN’s editorial then refers to the elephant in the room by stating the NIS has seen no return from the Berbice Bridge. Quite to the contrary, it can be argued that despite dividends not being paid on the common shares or in recent years on the preferred shares, that the NIS average return on its total investment in the BBCI, is one of the highest returns on its entire investment portfolio. NIS owns 20% of the bonds and subordinate debt in the bridge which has seen interest payment made each year. One should ask the NIS to show for each year of its investment in the bridge, how much was garnered and what rate of return this represents on its total investment; you can then compare this to its 1-2% on Treasury bills or other investments. And any amount not paid to date to NIS, remains an IOU that is secured against the bridge with a value more than US$40M.

I note your reference to critics of the bridge project such as Ram and Goolsarran. The facts will show that the criticisms are based on some of the same fallacies that I have addressed—the tolls being higher than the ferry (it is not) or the traffic being below expectations (it is not). Post completion of the bridge, Mr. Ram has reversed some of his prior criticisms.

For every major project in this country, there are critics. From the Berbice Bridge, the Marriott Hotel, the Amaila Falls, or the Cheddi Jagan airport expansion, to name a few. It is easy to be a critic. But who takes the credit for what is built. When we attack every public-private project, why would we expect financial institutions to fund these and other projects in the future. Ultimately, it is Guyanese who will be the losers. Our banking system has US$1.5B that is not lent out to the private sector; instead of finding options to utilize these vast financial resources, the political risks of doing business with Government ends up resulting in our national savings deposited in local banks, being instead invested overseas or in Treasury bills. And for those who borrow from the banks, the prime lending rate is over 10 %, almost 10 times that of the average deposit rate or the 1-year Treasury bill rate.

The Berbice bridge model had tolls projected to fall significantly as debt is repaid. But while over $2B has been used to reduce debt as of the end of 2017, there is a shortfall in debt to be repaid. We believe that there is a solution to allow the BBCI debt to be repaid before 2027 when the concession is scheduled to end, without increasing the tolls from its 2008 level, or requiring Government subsidies.

The solution using 2017 figures—total toll revenue was G$1,372M; operating expenses (maintenance, employment and overhead) were G$269M; the remainder sum of G$1.1B per annum, represents net cash flow for interest/dividends and debt payments.

With this level of cash flow we have the basis for a solution of the problem. The only obstacle is the arrogance of this regime. Arrogance seems to be the cover for incompetence that has characterized this APNU+AFC regime.

Yours faithfully,

Donald Ramotar,

Former President

Republic of Guyana