The role of corporate

governance

The previous essay established the developmental context under which we address the essential question of this series: could Guyana escape the natural resource curse? The best measure we have of development is perhaps the Human Development Index (HDI) and its iterations such as the Gender Development Index and inequality-adjusted HDI. At a minimum, escaping the natural resource curse should involve moving up these rankings and not just how many upscale homes are built in heavily guarded gated communities. The World Economic Forum now has an Inclusive Development Index. Although Guyana and Caribbean countries are not yet ranked, improvement in inclusive development would be a great step in the right direction and not just how many new shiny cars appear on the heavily congested roads. Who knows, perhaps Guyana will plan better than Trinidad and Tobago where it takes about three hours during peak driving to get from St Augustine campus, UWI, to Central Bank of Trinidad and Tobago.

In my opinion, whether Guyana evades the curse will depend on three broad scenarios. First, how much money will Guyana actually receive from ExxonMobil? This question is important because Guyana’s hinterland geography and coastal plain will require large sums of money to build infrastructure for serving the small and dispersed population. In other words, the per person infrastructure spending will be very high, particularly in the rural and hinterland regions. This is not a problem a compactly populated country like Barbados, for instance, faces. I argue below that we should appreciate the corporate governance structure motivating ExxonMobil, and multinationals in general, as we ponder how much money Guyana will receive.

Second, how well will the Guyana government spend those monies? The latter question becomes even more important because the Guyana government becomes the conduit of development, collecting royalties and profit shares and spending them. Third, what institutional mechanisms, including a complete constitutional do over, will be implemented so as to minimize the harmful effects of pro-ethnic strategic voting? Since this form of voting will not go away, will there be a new constitution that minimizes the harmful misallocation of resources the present constitution engenders?

The rest of this column will explore the first question, which is probably best addressed by simulating numerical possibilities of American dollar revenues the country is likely to receive given what we presently know. However, this is a fairly heavy academic exercise that I am willing to address in the coming months. Instead, let us examine the corporate governance framework under which multinational corporations like ExxonMobil operate. Studying this corporate governance structure would help us to realize the fundamental conflict of interest which exists between ExxonMobil and its shareholders on the one hand and a host country such as Guyana on the other.

Highlighting this conflict of interest is not meant to raise suspicion or pick on ExxonMobil; no single person can demean one of the world’s most powerful multinational corporations with ongoing deep connections to Congress and the White House. The purpose is to emphasize that the task of economic development does not rest on the benevolence of ExxonMobil – as there will be none – but on the ability and astuteness of the Guyanese political class since they control almost every aspect of Guyanese life.

Corporate governance can be defined as a set of legal and economic frameworks that specifies how the cash flow rights of a company are distributed among shareholders (the owners), managers and other stakeholders. There will be no need for corporate governance if managers and owners were the same for all businesses. However, in many instances the interest of the managers and CEO may not coincide with that of the owners or shareholders. Therefore, there are rules to pin down the behaviour of management.

ExxonMobil operates within the so-called Anglo-American corporate governance framework, which promotes the singular objective of maximization of shareholders’ value through the maximization of profit and even market share. Therefore, a multinational corporation (MNC) like ExxonMobil does not exist to promote any other social agenda within the country it is headquartered, let alone the economic development of the host country. The purpose of the MNC is to get the best possible return for their shareholders regardless of the implication for the environment or labour. Labour relations, by the way, are not even an afterthought in the Anglo-American corporate governance framework. As a matter of fact, I would argue that the singular objective of profit maximization (along with the disregard for stable employment) is at the centre of the hollowing out of the American middle class and the rise inequality. Nevertheless, it is usually easier to blame immigrants instead of questioning the framework of the Anglo-American corporate governance agenda.

There are times when the self-serving interests of management might be promoted over those of the shareholders. These are addressed by several institutional and legal mechanisms such as having a board of directors or payment to CEO in terms of stock options. For us to figure out where Guyana stands – in terms of profit share – in this grand outline of corporate governance, we should keep an eye on two factors: (i) How is the conflict of interest between CEO and shareholder addressed? (ii) How does the singular objective of shareholder wealth maximization affect the share of profit?

Stock options – a form of payment in the salary package to the CEO – are one tool used to address the conflict of interest between managers and shareholders. The stocks (shares) essentially present the CEO and managers a skin in the game. They become shareholders themselves, thus supposedly aligning their interests with that of thousands of other shareholders. However, the practice results in the adverse incentive of overly focusing on short-term stock price, which swells the wealth of all shareholders including the managers.

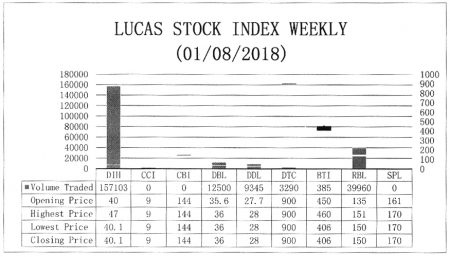

The Lucas Stock Index (LSI) increased 2.591 percent during the fourth period of trading in January 2018. The stocks of three companies were traded with 29,144 shares changing hands. There was one Climber and no Tumblers. The stocks of Republic Bank Limited (RBL) rose 11.11 percent on the sale of 20,000 shares.

In the meanwhile, the stocks of the Banks DIH (DIH) and Demerara Tobacco Company (DTC) remained unchanged on the sale of 8,500 and 644 shares respectively.

Stock price maximization over the short run becomes even more important if we believe the world’s demand for fossil fuel will level off or decline, thereby reducing the long-term price. There are different projections for when peak demand will likely occur. However, one th

ing is more certain: developing countries like India have already achieved a sizable middle class which will not tolerate excessive pollution as is happening now in New Delhi. They will demand a different energy-industrial policy than what was used before.

Therefore, if world demand will peak within 20 years, it makes sense for oil companies to exploit as much crude oil in the short and medium term since the future rate of growth of oil price will be less than the risk-free rate of interest. This basic insight comes from economist Harold Hotelling’s rule first proposed in 1931. It might be helpful, therefore, to view the fast-tracked exploitation of low-sulphur Guyanese crude oil in this context.

With respect to the second factor above, debt financing is often used to boost leverage (the ratio of debt to equity) and therefore the return on equity capital when the market price of assets increases (marked to market). The latter is consistent with the short-term policy of getting the highest possible return for shareholders. However, it drains the company of cash flow, thereby leaving less for other claimants on the corporation’s income stream. Financial engineering, a subfield of study in economics, can be used to influence the amount of free cash flow available for claimants. The recent IMF report warned about exactly the latter financial scheme. Furthermore, in the United States, financial engineering was used since 1980 to drain these free cash flows away from labour towards the wealthiest financiers; hence creating an increasingly unequal country with an angry population.

In the next column, we will address the question of how likely present and future Guyanese governments will spend the revenues in the best possible manner.

Comments: tkhemraj@ncf.edu