I would go as far as to make a controversial point, which is nowhere in the scholarly literature, that a Guyanese constitutional overhaul can be seen as a crucial social technology. An enlightened constitution that decrees (i) co-operation and (ii) credible electoral threats from independents can be seen as embodying a set of ideas that produce a social good: the minimization of the harmful effects of strategic pro-ethnic voting. Strategic voting means that about 85% of Guyanese vote not because they particularly love their respective political party or leader, but to keep the other side out from power because they perceive an economic security dilemma. This is the source of the prisoners’ dilemma trap I wrote about a few years ago.

Many economists might not agree with my aggregate or social technology as the concept is mainly seen as a micro or firm-level issue. I maintain that the ability to innovate on existing technologies or imitate and even invent new ones is hindered by the present macro political structures in Guyana. Therefore, why can’t we view enlightened constitutional engineering as a socio-economic technology?

Innovation, therefore, is the ability of the managers and entrepreneurs of the firm to tweak existing technologies. The entrepreneur or CEO may invest in research and development so as to come up with new ways of improving on existing production knowledge. Technology and the innovation process are really knowledge-based.

To emphasize this point further, consider two firms with the same machines. In spite of the similarity of machines, one firm has a greater productivity. This is a clear case of one firm being inefficient relative to the other. The obvious culprit here is the manager or entrepreneur of the inefficient firm lacks the knowledge of how to combine the workers and machines optimally. This scenario played out between General Motors and Toyota. GM tried emulating Toyota’s manufacturing technology, but just could not achieve the same productivity. This scenario can be extrapolated to the entire nation, and probably relevant to my parallel socio-economic technology.

When the history of GuySuCo is written it will be clear that the reason for the demise of the industry was not really the loss of preferential prices, but the depreciation of the stock of knowledge embodied in the industry’s research labs, field management and general knowledge of the factory and field processes. This stock of knowledge is vital if the industry is to innovate by transitioning to other outputs such as bulk alcohol, public drainage, molasses, ethanol and bagasse power; all while maintaining the most versatile feedstock sugarcane. No political leader in Guyana since the 1980s asked the kind of questions necessary to keep the stock of knowledge intact. The newer bright ones returning with a proper master’s get this, however.

The Global Innovation Index (GII) is published by INSEAD, a business school based in France, Abu Dhabi and Singapore. It measures innovation using input and output factors of innovation. This index recognizes that firm-level innovation is dependent on many factors at the macro level as well as the micro.

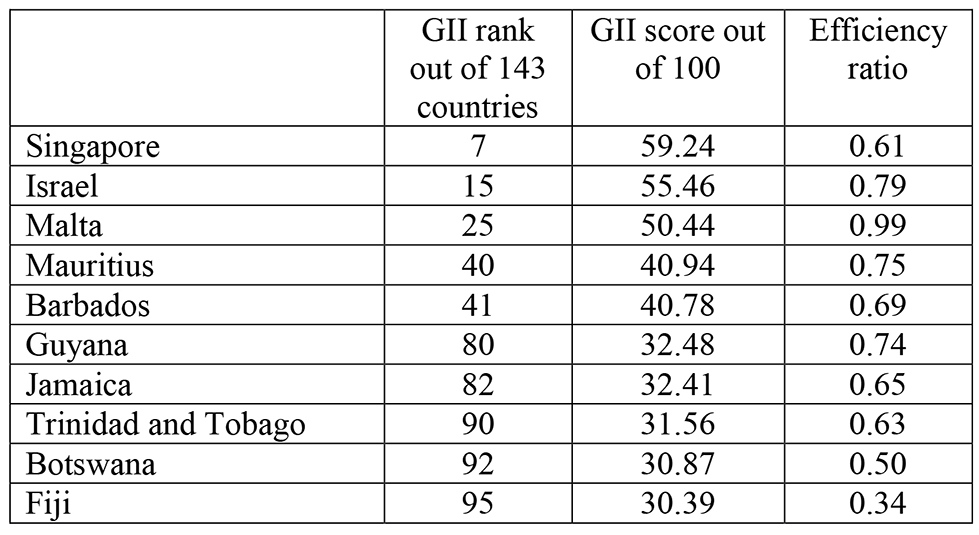

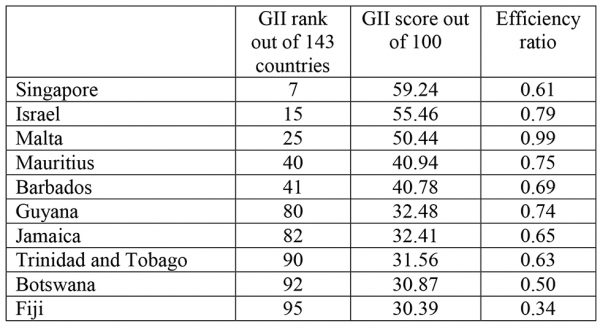

The table shows data from the 2014 report. Other reports have since emerged, but I chose 2014 because Guyana, as well as several Caribbean economies, was last included in that year. The index is made up of input and output factors of innovation. The input factors include institutions such as political, regulatory and business conditions. For example, the political dimension includes government effectiveness and safety. However, it says nothing about whether the constitution and electoral framework of the country are consistent with political stability in an ethnically bi-communal society such as Guyana. The regulatory environment, bankruptcy laws and business environment make up other institutional factors.

Human capital and research capacity form another input pillar. This includes graduates in engineering and the sciences, spending on research and development, university ranking and others. Infrastructure forms the third input pillar. It includes the usual factors such as electricity generation, gross capital formation and others. Moreover, the index places environmental sustainability as an important aspect of infrastructure. Market sophistication is seen as essential for innovation and it is the fourth innovation input pillar. This includes credit market development, market capitalisation, investor protection, domestic market scale, tariff and trade matters, and others.

Business sophistication is the fifth input factor for innovation. It includes such conditions as the consulting collaboration between businesses and university, firms offering formal training, female employment with advanced degrees, patents, research collaboration between business and university, and other variables. Speaking about business-university collaboration, I was at the recently concluded conference held by UG’s School of Entrepreneurship and Business Innovation. One thing that was obvious to me is the econometric help the university could provide to commercial banks and organizations like IPED. Folks like my good friend Mr Sukrishnalall Pasha can easily come up with probability models for more objective risk assessment of potential borrowers.

The innovation output pillars include two broad measures: (i) knowledge and technology outputs and (ii) creative outputs. These can include variables such as high-tech exports, ICT services export, new business formation, peer-reviewed publications, patents received, growth rate of per capita GDP, high-tech manufacturers, computer software spending and others. The GII is therefore a simple average of the input and output innovation indicators.

I selected the GII score for a group of small countries. They all face the same global shocks like Guyana. In 2014, 143 countries were ranked on the various input and output factors of innovation. Switzerland was ranked highest on the index with a GII score of 64.78 out of a total of 100. The United States placed with a rank of 6 and score of 60.09.

Guyana was ranked as 80 with a score of 32.48 out of 100. The efficiency ratio, which measures the conversion of innovation inputs into outputs, was 0.74. The efficiency ratio of Guyana is surprisingly high. However, the failures associated by high-risk technology innovation is likely to be higher and therefore those countries could have a lower efficiency ratio. In other words, the spillover effect from sophisticated manufacturing and other applications are very different, thereby likely affecting the very long-term trend of the growth rate in different ways.

Singapore is ranked as 7 overall, but has a lower efficiency score of 0.61, possibly indicating the pursuit of more high value and risky technologies. Barbados’ rank of 41 represents the highest among Caribbean economies, which as a group have lagged other regions in innovation. Resource dependent Trinidad and Tobago and Botswana both ranked below Guyana in terms of the score and efficiency ratio. According to the GII, Singapore and Israel are two of the most innovative small open economies. Israel is known for integrating its diaspora in business, financial, scientific and other matters. There might be something to learn here.

Comments: tkhemraj@ncf.edu