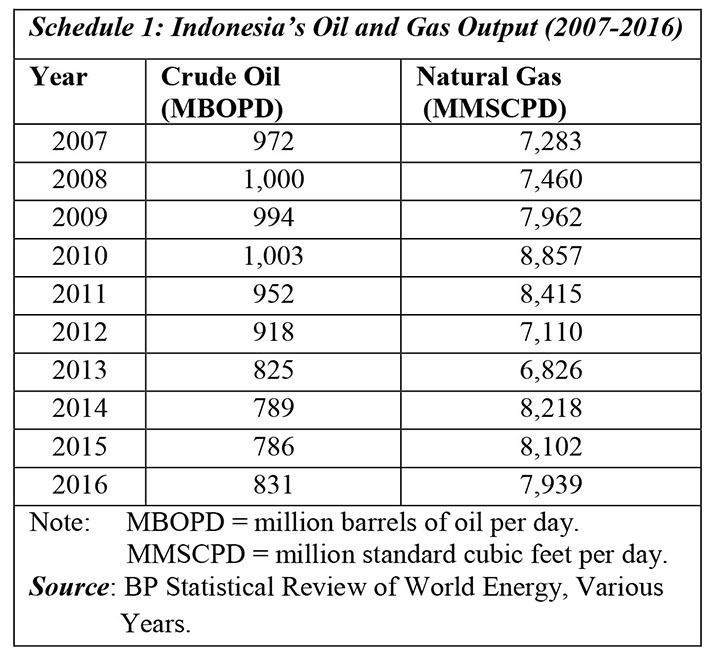

As indicated there also, one analyst had even labelled the Indonesian variant a “part of the Government’s desperate and unpopular attempts” aimed at reversing the decline of that country’s petroleum sector. The data reveal that, over the past decade, Indonesia’s oil sector had declined significantly. So much so that the country has shifted from being a “leading Member” of the Oil Producing Exporting Countries (OPEC), to one where it is no longer a Member of OPEC ̶ since it became a net importer of crude oil.

The data in Schedule 1 further reveal that, during the period of the most recent decade for which data are available (2007-2016), the country’s crude oil production had fallen by about 15 per cent (from 972 to 831 MBOPD). It may be noted also that, the gap between the year of the country’s highest (2010) and lowest (2015) oil output over the decade, was about one-fifth. On the other hand, the natural gas sector, while fluctuating over the decade, has seen its output remain within the fairly stable range of 7283 to 7939 MMSCPD.

Indonesia’s gross split regime

Since its introduction in mid-January 2017, careful review of Indonesia’s gross split regime indicates that, the preponderance of comments on it show a decidedly lukewarm response from the country’s hydrocarbons investors. No doubt this has occurred because their view is that the gross split variant is less favourable to them than the cost recovery PSC regime which it has replaced. This would seem to be the case in particular for those upstream projects that are located in marginal, mature, and relatively riskier production fields/areas. Such projects are located in what the industry labels as: “frontier projects areas”.

As a result of this outcome, within months of its introduction (that is, by August 2017), the government published amendments to the terms of the gross-split mechanism. The present situation, therefore, makes it necessary for me to highlight some key features of the gross split model, in order to advance readers’ understanding of it.

To start with, the explicit aims informing the gross split variant can be summarized as: 1) seeking to incentivize investors to undertake more exploration and production, specifically through rewarding them for cost efficiency rather than encouraging them to gold plate their costs, and 2) simultaneously, allowing the state (government) to maintain appropriate control over the country’s hydrocarbons wealth, thereby facilitating its vision/efforts at upstream value added activities based on proven petroleum resources.

From this standpoint a few salient items in model PSAs/PSCs have been retained in the Indonesian variant; these include: 1) state ownership of natural resources and the contractor’s installations; 2) the contractor (Foreign Operating Company, FOC) retains operational control of exploration and production; and 3) all required capital is to be provided by the contractor (FOC) for discovery and development of resources. There is the further provision that the contractor carries all risks of financial losses from the project.

In the end, the decisive difference between the Indonesian variant and the model PSA/PSC is that the agreed gross production split is made without any regard to providing the contractor (FOC) with cost recovery provisions. As Price Waterhouse Coopers, (PWC), in a special edition of its Indonesia, Energy, Utilities Mining News Flash (February 2017) has pointed out, the country’s Gross Split PSC is expected to stipulate as many as 17 individual items, and, as a result, the general formulation has been summarized as indicated in Schedule 2.

Schedule 2: Principal: Agent Take

(Agent) Contractor Take = Base Split + ⁄- Variable Components +/-

Progressive Component

(Principal) Government Take = Government share + bonuses + Contractor’s

income tax

Source: PWC, 2017.

The 17 items referred to by the PWC include features such as: the government take, financing obligations, and dispute settlement. The Indonesian base split ratio has been projected as follows: For oil: 57 per cent, government; and 43 per cent to contractor; and for gas: 52 per cent, government; and 48 per cent, contractor.

The variable components in the Schedule include adjustments to the shares. In turn these reflect adjustments such as the status of the working areas; the location and difficulty facing a field; the size of the reservoir that is being drilled; and the supporting infrastructure. Similarly, the progressive components include adjustments that reflect factors such as the price of crude oil; and the cumulative production of the contractor. To ensure success these considerations require complex economic and financial modelling and projections by the Indonesian government.

As would be expected, the actual production split in Indonesia has varied from the pro forma one cited above, and at times, this variation has been significant. Additionally, in practice, the gross production split mechanism is based on the plan of development submitted by the contractor, rather than the original PSA/PSC.

In closing, it should be noted that several auxiliary features of PSAs/PSCs do remain. Thus, for example, domestic market obligations, as well as local content requirements. Such examples clearly affect variables like local employment, purchases of services, technology transfer, reclamation of abandoned exploration sites, and so on. This adds to the complexity of the required economic/financial modelling needed to be successful.

Conclusion

We can see therefore, that under the variant, the vulnerability of cost recovery in model PSAs/PSCs has been transferred to the accuracy of the economic/financial modelling of the economy. For Guyana-type economies, this is, indeed, no less severe than monitoring cost recovery. Such variants therefore are not magic bullets. Indeed, there is none for any contract.

Next week I begin discussion based on the released Guyana PSA contract and the local ‘debates’ surrounding Guyana’s coming time of oil and gas production.