Last week’s column highlighted my conviction that, even though there are model petroleum contracts, there are no perfect ones. Consequently, there are no magic bullets to be inserted into any contract, to make it flawless. The Indonesian variant of the PSA, which was examined last week, has been hyped in sections of the local media as a ‘magic bullet’. Regrettably, this is still yet to be a proven time-tested mechanism for financial/economic forecasting and modelling of petroleum economies; one that is capable of replacing even the admittedly weak auditing/monitoring of cost recovery, which exists in developing oil rich states. Guyana-type economies are severely hampered by their weak economic and financial databases, along with being starved of skilled energy economics analysts. Such modelling cannot therefore be a safe limb on which to hang the country’s economic future.

Today’s column starts consideration of the final topic in the ongoing petroleum series. That topic treats with 1) the fiscal terms of Guyana’s 2016, PSA, and 2) the media debates, which have ensued, particularly over the period since the publication of my very first column in this series (September 2016) to now. My intention as I go forward is to intersperse both segments of the discussion in each column, stressing one or the other, as the logic of the discussion unfolds.

Although this treatment of the remaining issues in the series was indicated several weeks ago, the start has been delayed because of the hold-up in the public release of the PSA. Additionally, dispute over the recent publication of the ‘secret signature bonus’, (signed back in September 2016), has drowned out overall much of the discussion. As I had written last year at the disclosure of the leak (December 17, 2017), the revelation of the signature bonus “has been stunning, dismaying and deeply distressing to members of the public”. This still remains true.

The debates

Having advertised my intention to cover the debates several weeks ago, some readers have since advised this would be a waste of time and effort. They have expressed scant regard for the public exchanges, suggesting alternative pejorative labels for these debates. Such labels range from, on the one hand, ‘cuss-down’, ad hominem pillorying, and the thinly disguised hustling of their wares to both sides of the controversy: Government and Exxon; to, on the other, egotistical self-promotion, provoking hysteria in contrived echo chambers and sheer ignorance.

Despite the undoubted presence of such traits, I firmly believe a non-pejorative description is needed and indeed justified. There are important lessons to be learnt for ensuring that future debates on national development topics, bring learning and awareness for the population at large.

With this introductory observation on the media debates, I turn next to introduce the setting for my analysis of the fiscal terms of Guyana’s 2016, PSA.

The setting

The setting I shall utilize to consider the Guyana 2016 PSA, is the one most commonly applied in energy economics, for appraising the fiscal terms of petroleum contracts. As previously indicated, theoretically, this area of analysis is located in the associated fields of behavioural economics (trade-offs and risk-reward theorems) and institutional economics (principal-agent relations). From these perspectives, the principal objectives of the Guyanese authorities should be to 1) obtain the most wealth from its oil and gas resources; and 2) to do so through promoting maximum exploration of Guyana’s petroleum resources and their subsequent development. During this process, maintaining the country’s desired levels of national control of upstream value added petroleum activity becomes the third objective. These are, therefore, to the formulation, the objectives of the authorities (Principal).

On the other hand, the objectives of the agent (Exxon and its partners) are assumed to require: 1) building equity, through petroleum finds; 2) producing from these finds at the lowest possible cost; and 3) keeping the compatibility of 1 and 2, with the highest likely profit margin.

In theory, if the global petroleum sector were truly competitive, one would expect the oil and gas markets to ensure routinely that: 1) countries with unfavourable petroleum resource geology, 2) relatively higher operational costs, and 3) relatively poor crude quality would have to offer the most favourable fiscal terms in order to encourage investors. And with the reverse configuration countries would offer the least favourable fiscal terms. Unfortunately, as I have shown repeatedly in this series, the petroleum market is not (competitive) efficient. Such an outcome cannot therefore be left to global market rules, as would happen in other businesses.

The above observations logically lead to recognition that, market solutions are not available. Worse, the above circumstance generates a fundamental dilemma: highly competitive global bidding for rights to explore and develop petroleum resources, cannot be expected to achieve the market objective of matching assessments of petroleum fields/resources to fiscal terms on offer by host governments.

Indeed, to the contrary, the hydrocarbons market is celebrated today for its many imperfections, unknowns and uncertainties. And, these ensure a key defining feature of competitive (efficient) markets ̶ availability of information ̶ is absent from the global hydrocarbons market. As a result, one can safely conclude that, until there is enough information to fuel stiff competition, market outcomes will not determine what can be borne by the Principal and Agent in oil contracts, and, therefore, the most likely profit.

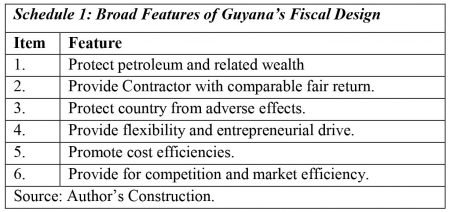

Based on the above description, the key tasks facing the Guyana authorities (Principal) can be summarized as follows: First, to protect the state’s petroleum and other contingent wealth, both in its natural and improved states; second, to offer the Contractor (ExxonMobil and Partners) a fair return on their investments, when compared to similar environments and resource configuration; third, to protect the country against manipulation, speculation, and the systematic taking of abnormal profits; fourth, to foster entrepreneurial flexibility for the Contractor (Agent) and promote organisational and institutional flexibility; fifth, to encourage and reward cost efficiencies, as allowed by law. And finally, above all, to ensure the Principal is able at all times to promote competition and market efficiency, as the prime drivers of economic outcomes.

Conclusion

The points advanced in the above Section are captured in Schedule 1.