The catalogue of desirable features energy economists promote for effective PSAs are that 1) ownership of the petroleum wealth should remain within the domain of the country in which it is discovered; 2) the State/Principal should maintain managerial control of this wealth, but 3) the Contractor/Agent (in Guyana’s case Exxon and its Partners) should maintain operational control of contract-assigned petroleum activities. 4) For the purposes of 3) above, the Contractor/Agent must submit annual work programmes and budgets for approval by the State/Principal; and 5) the Contractor/Agent should be responsible for providing finance, technology and skills, required for petroleum operations.

Further: 6) the Contractor/Agent should bear responsibility for all financial risks; 7) the facilities acquired by the Contractor/Agent for purposes of executing petroleum production should become the property of the State/Principal, except those belonging to its service companies and leased equipment; 8) the recovery of cost should be allowed to the Contractor/Agent, up to a specified percentage of production (75 per cent in Guyana’s PSA); and 9) the remainder (profit oil and profit gas) should be split between the State/Principal and the Contractor/Agent (in Guyana the split is 50:50). The carrying forward of costs should also be allowed. Finally, the legal foundation of PSA contracts should reside in production sharing and not profit sharing.

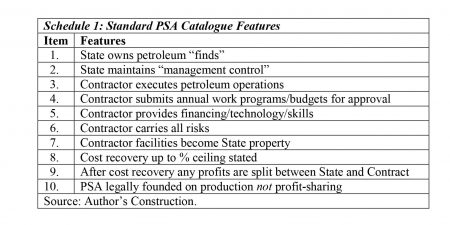

Schedule 1 illustrates these features:

Carrying forward

Under the PSA, recoverable cost recovered is a critical determinant of profit oil. Therefore, a few observations on this would aid understanding of Guyana’s 2016 PSA. Thus, Article 11 (Cost Recovery and Production Sharing) and Annex C (Accounting Procedure) treat with the procedure and regulation of cost. Article 11 states: “subject to the terms and conditions of the Agreement the Contractor shall bear and pay all Contract Costs incurred in … petroleum operations”. Further, the Contractor “shall recover [all] Contract Costs … pursuant to the provisions of Annex C”.

Guyana’s 2016 PSA also provides for recoverable costs to be carried forward. It states: “to the extent that in any Month, Recoverable Contract Costs exceed the aggregate value of Cost Oil/Gas … the unrecoverable amount shall be carried forward and … shall be recoverable in the immediately succeeding Month”. Furthermore, if recoverable cost is not recovered in the immediately succeeding Month, it continues to be carried forward in later succeeding months.

Cost Items

Annex C, Section 2, of Guyana’s PSA classifies, defines, and allocates costs, expenses and expenditures. These include: 1) unrecovered costs to be carried forward; 2) exploration costs (incurred in the search for petroleum “finds”); 3) development costs (well drilling, field facilities, engineering design and so on); 4) operating costs (incurred in operations other than costs separately identified here); 5) service costs (direct and indirect, incurred in support of all petroleum operations); and 6) general and administrative costs and overheads.

Additionally, Annex C, Section 3 lists thirteen categories of costs that do not require “further Ministerial approval”. These include: surface rights; labour and associated labour costs; transportation; service charges; material; rentals, duties and other assessments; insurance and losses; legal expenses; training costs; general and administration; pre-contract costs; interest and financing costs; and, abandonment costs.

Observations

Several comments are warranted at this stage. First, the higher the ceiling is set on recovered cost under the PSA, the better it is for the Contractor. Second, “low or high cost oil/gas” speaks directly to the effective terms of a given fiscal package. Third, for evaluating negotiations between the Principal (State) and Contractor (Exxon and partners), recoverable cost is a barometer of effective policy ‘trade-off’. Fourth, Guyana’s 2016 PSA allows Cost Recovery Statements to be “given in separate statements for each Field” but then these are “added together [to arrive at] the Contractor’s total allocation of Cost Oil”. (See Annex C, Section 8.2). This regulation is highly contentious, as it speaks to the ‘ring-fencing’ of costs, which will be considered next week.

Stand alone

Turning to commentary on the debate over Guyana’s 2016 PSA at this juncture, one notable feature is that several commentators avoid the consequences, which flow from the fact that each petroleum contract is stand-alone/unique. Despite, typologies of oil contracts, each contract is negotiated for the specific configuration of circumstances, affecting both Parties, (State and Contractor) along with the prevailing regional/global context. As a consequence, contract evaluation should occur in relation to the objectives driving the contract Parties and the state of the petroleum market. Absence such, there is no coherent appraisal framework. And consequently much of Guyana’s debate has been sterile, bickering and unconstructive.

Consequently, for purposes of appraising the fiscal terms of the 2016 Guyana contract, I adopt the precepts of the Natural Resource Charter. That Charter indicates the principal objective for the State should be to ensure: 1) Guyana earns the best possible benefit, subject to 2) its ability to attract adequate investment flows into the sector. In other words, benefit should be evaluated over the “short-medium-long term”; that is, revenue timing: now or later (ibid, page 4). At this juncture readers should recall that very early into this series (last quarter of 2016) I had devoted much effort at identifying the complex distinguishing features of the petroleum sector.

These include for Guyana: 1) long and costly gestation periods of exploration and development (as its experience shows); 2) severe geological challenges (exhibited in deep offshore finds); 3) the technical/technological challenges (posed by 2), 4); the related challenges of acquiring the requisite skills; 5) global market and price volatility and uncertainties; 6) massive environmental challenges; and 7) severe geo-political considerations (the border controversy with Venezuela).

Such complex features allow for no other outcome but that Guyana’s petroleum contract has to be specific and unique for the Parties concerned.

Next week I shall continue from this comment.