Last week’s column, sought to reinforce the critical importance of two features of the fiscal regime embedded in Guyana’s 2016 Production Sharing Agreement (PSA). One is the synergistic relation of the fiscal package’s individual components (deductions/taxes/allowances/credits/other terms & conditions). The second, is that the fiscal package embodies both written (tangible) and unwritten (intangible) components. The latter include items such as trust and goodwill amongst Parties to the Agreement. These two dimensions of the fiscal package also apply to the PSA as a whole.

There is a third complementary feature however, which is not readily recognized. That is, the PSA represents what economists term an “incomplete contract”. (Of note, this is an area of rapid theoretical development in economics and significantly was the subject area for the winners of the 2016 Nobel Prize in Economics.) Put simply, incomplete contract theorists argue oil contracts are incapable of specifying what is to be done for every possible contingent development during their legal lives. Indeed, “at the time of contracting, future contingencies may not even be describable”. Therefore, if Parties to a contract are rational and have independent interests to serve, they would never truly “commit themselves never to engage in mutually beneficial renegotiation later on in their relationship.” Such notions relate to my earlier introduction of the concepts of “known- unknown risks” and “unknown-unknown risks”. Incomplete contract theory suggests that, despite public declarations to the contrary by Parties to the Guyana 2016 PSA indicating “no re-negotiation”, this cannot be ruled out as a future rational option.

Prelude

The observations made above were prelude to my advancing the proposition that, in its broadest and most fundamental sense, the 2016 PSA neutralizes significantly the greatest existentialist threat facing Guyana’s petroleum sector ̶ the Venezuelan territorial claim. As indicated in the previous column, the two global economic powerhouses, the USA and China, have significant national economic interests invested in Guyana’s petroleum sector. Therefore, despite the disproportionate size of economic, military and international influence of Venezuela compared to Guyana, it would not be easy for Venezuela in this situation to seek to exploit these advantages by provoking energy conflicts, or worse. In this sense therefore, the present ownership and operating structure of the PSA gives Guyana considerable geo-strategic protection.

Given this operational structure, and even after considering the alleged and/or actual ‘warts and all’, of the PSA, it nevertheless, remains a win for Guyana. In an absolute sense, post-2020 (the projected date for the start of petroleum production and export) Guyana’s national income, exports, imports, domestic consumption, foreign investment inflows, value added, degree of production and export diversification, as well as economic well-being for the most part would not decline absolutely (making it worse off) but instead, will increase by significant margins. How these increases will impact on income, wealth and consumption distribution cannot yet be reliably ascertained, as the projected revenue data from oil rises with each new find. It has already risen more than four-fold in the space of three years, from 100,000-120,000 barrels of crude oil per day in the third quarter of 2015, to more than 500,000 barrels a day in the first quarter of 2018.

Fiscal regimes

Remarkably, every single component of Guyana’s 2016 PSA has produced one or more claims in the media declaring it is either too low, or far less in comparison to that, which exists in other jurisdictions. This is an absurdity, as the global range in taxes and other fiscal tools are described in textbooks as “limitless”. This therefore, means each country’s fiscal regime should be judged as unique to the conditions facing the country and its proven oil and gas reserves. Because of this reality, several instructional manuals/texts and other such material seek to aid students/readers grasp of the unique character of every contract by challenging them to select the best option for the State from among a few provided by the author/lecturer.

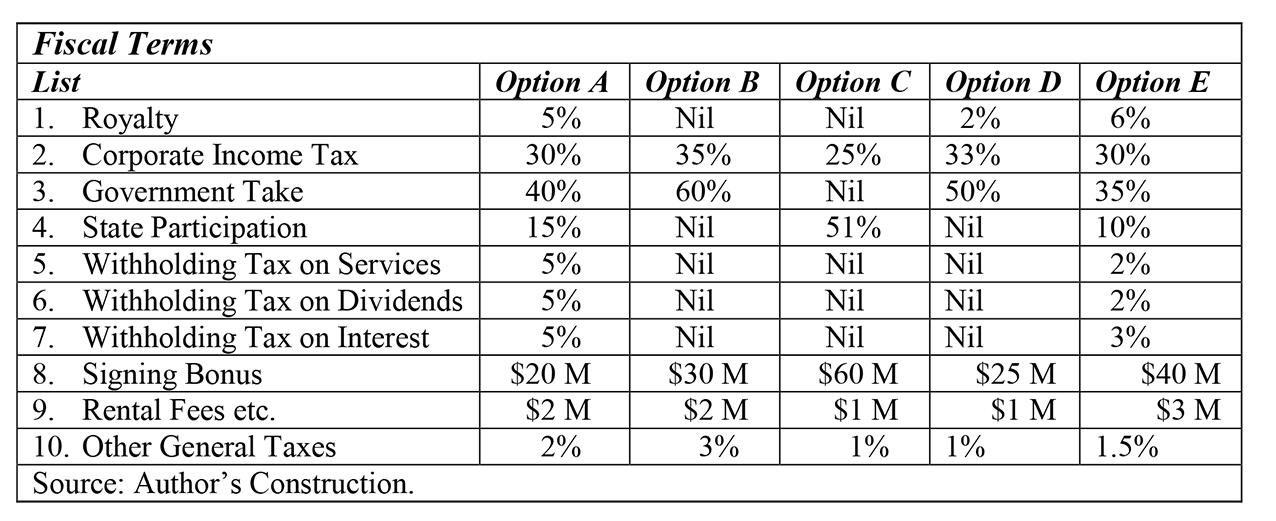

Following this practice, I have constructed Schedule 1 below, which provides five

Certain features stand out in the Schedule, namely: 1) two options have all 10 taxes listed (Option A and E; two options have only five taxes B and C; and, only one has six taxes (Option D); 2) the highest fiscal component is a government take of 60 per cent, found in Option B; 3) the lowest tax, one per cent, is found in Option C; and D, 4) there is State participation in three of the Options (A, C and E); 5) this State participation ranges from majority, 51 per cent in Option C to 10 per cent in Option E and no State partnership in the two remaining Options B and D.

There is no way by which any examination of the five fiscal packages as given above, can determine 1) actual revenue yield; 2) the fiscal effect on disincentivizing tax avoidance/evasion behaviour; 3) reinvestment flows into the oil and gas sector; or 4) price and cost behaviour over the medium to long-term.

Government take

Traditionally, industry analysts have resorted to charting the comparative course of government take by country. This has been acknowledged as being misleading. As Open Oil points out, “the difference in Government take” can be explained quite simply: petroleum discoveries in a country like Ireland (with a low percentage government take of 40 per cent) are very small and investors are few, while Iran, Libya and Iraq (with a high percentage government take of 90+ per cent) have been “blessed with some of the best petroleum endowments in the world”, Oil Contracts page 110.

Conclusion

Next week, I continue from this observation on government take.