Today’s column considers the challenge of navigating external pressures on Guyana to pursue a spending path for its expected Government’s Take, which conforms with what economists term the “permanent income hypothesis (PIH) budget rules”. Because of the recent August 8, 2018 Green Paper on Guyana’s Sovereign Wealth Fund, (SWF) and its proposed budget rules, I need to integrate the discussion of this topic into my earlier protracted presentation on SWFs, over the period January 1, 2017 to February 5, 2017.

Continuing, I propose therefore, in the following order, to first, expand today on the budget rules introduced in last week’s column; second, beginning next week, integrate my earlier commentary on SWFs with analysis of the Green Paper; third, provide a summary analysis of the PIH budget rule; and finally, draw overall conclusions for this topic.

Economic studies reveal that, spending Government Take faces very complex policy challenges. Indeed, some of these challenges go beyond my selected “top-ten”. The PIH issues are directly connected to the choice of Guyana’s spending path for petroleum revenues, in light of the overarching goal of promoting a Green State and sustainable development. In this regard, the PIH imposes notably severe and “long-lasting” numerical constraints on fiscal policy, supposedly directed at 1) driving sound macroeconomic management 2) providing resistance to Government overspending, and 3) maintaining national debt sustainability.

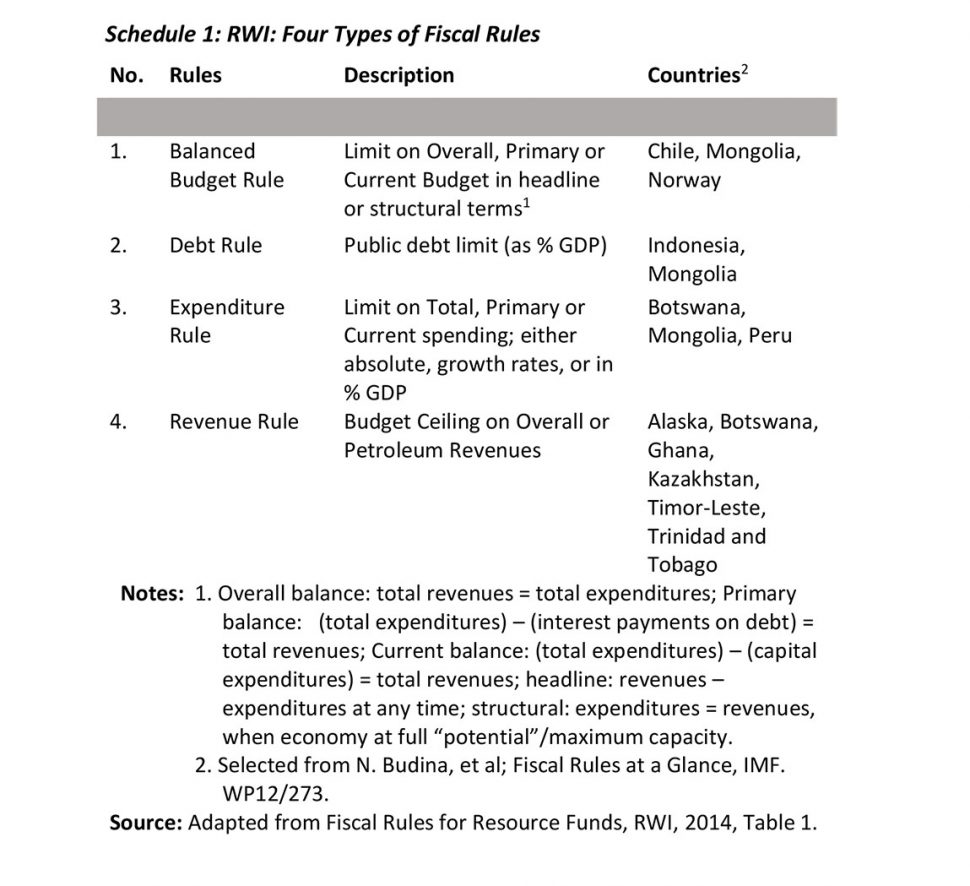

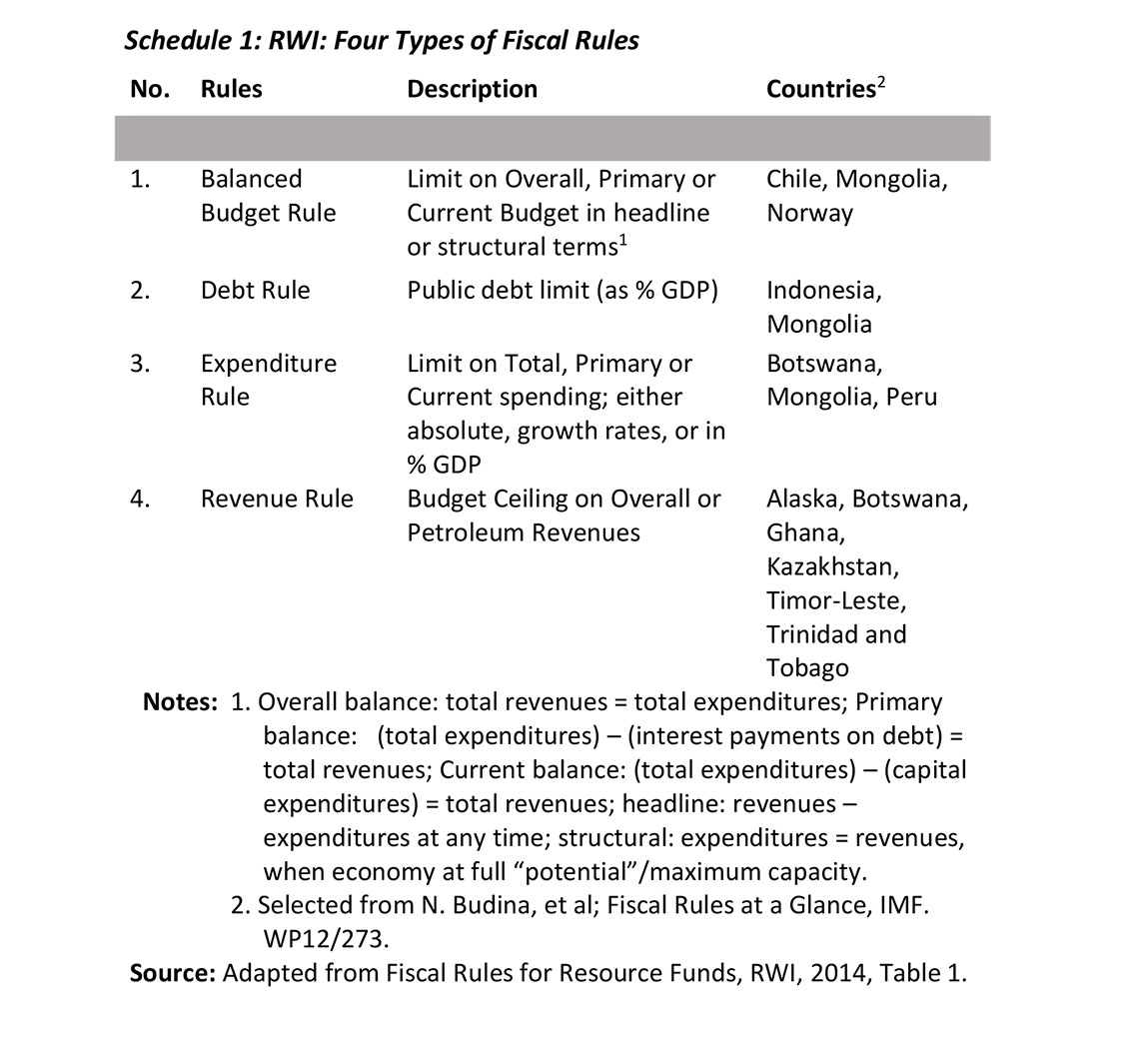

Types of Fiscal Rules

Schedule I reveals the four fiscal rules commonly recognized in the literature. This information is sourced from the Revenue Watch Institute, (RWI) 2014 and the IMF, 2012. As previously noted, apart from these four fiscal rules, there is the no fiscal rule option, of “all oil revenues being spent in any given year!”

Rule 1 is the balanced budget rule. This rule sets limits on either the overall, primary, or current budget, or any combinations thereof. The overall balance refers to the circumstances where total revenues are equal total expenditures in the National Budget: (total revenues = total expenditures).

The primary balance is obtained by deducting from total expenditures, those that are spent to satisfy interest payments due on the National Debt: [(total expenditures) – (interest payments on national debt) = (total revenues)]

Arriving at the current balance, capital spending is excluded from total spending to determine current spending. This magnitude is then related to total revenue. [(total expenditures) – (capital spending) = (total revenues)]

Headline terms means these limits apply at any point in time. Structural terms, however, are related to the economy at its “potential”, or performing at full capacity.

Rule 1

Three countries are listed in the Schedule where the limit on budget balance rules apply (Chile, Mongolia and Norway). Examples of these rules are: 1) structural surplus limited to 1% of GDP 2) structural deficit, not exceeding 2% of GDP 3) structural deficit of the non-petroleum sector (for Central Government) cannot exceed 4% (expected long-term real return from SWF investments) (see RWI 2014, Table 4).

Rules 2 & 3

Rule 2 sets public debt limits in percent of GDP. The country examples given are Indonesia and Mongolia. Such rules apply to Government debt (central, regional, local) as stated percentages of nominal GDP. Rule 3 refers to agreed limits on total, primary or current expenditure, as described above (Rule 1). This Rule is given in either absolute terms, growth rates or as a percent of nominal GDP. Country examples are Botswana, Mongolia and Peru. Such rules apply as 1) national expenditure to GDP ratio with a percentage limit 2) ceilings on the real growth of current expenditure in the National Budget 3) limits on the rate of growth of Budget expenditures in the non-petroleum sector.

Rule 4

Rule 4 is the Revenue Rule. It sets limits/ceilings on overall revenues or Government Take from the petroleum sector. Country examples include Ghana, Botswana, Kazakhstan, Timor-Leste, Trinidad and Tobago, and Alaska. Such rules are given as 1) percent of oil revenues allowed to enter the National Budget 2) sharing of petroleum revenues between national SWFs and the National Budget 3) revenue limits going to the SWF, limited as percentage of estimated petroleum wealth and/or earnings (Government Take).

Comments

A few comments on the four Rules follow: first, it is clear from the examples cited that countries do not necessarily adopt a single type of rule. Thus, in the examples exhibited in the Schedule, Mongolia and Botswana appear more than once!

Second, fiscal rules vary in their technical complexity. Debt/GDP ratios are the most widely used in economic commentary. This is preferred to detailed revenue or expenditure rules. Because of this, one finds public buy-in/monitoring is easier to assure.

Third, although uniformly termed rules, their adoption by governments varies in their obligatory nature. Some rules represent political pacts, MoUs, or guidelines, to which successive governments commit. Others are enshrined in legislation and/or concretized in determinative bodies/institutions/Committees.

Fourth, it is typical for fiscal rules to be linked to Government’s establishment of a SWF, as proposed for Guyana.

Worldwide, the IMF’s Fiscal Affairs Database (FAD) shows that most countries that had fiscal rules in place (2013) relied on debt rules (Rule 2). This was followed in descending order by countries with balanced budget rules (Rule 1) expenditure rules (Rule 3) and Revenue rules (Rule 4). Combined, those with expenditure and revenue rules numbered less than half of those with debt rules!

Conclusion

Next week, I’ll address my earlier SWF discussions before proceeding in the following week to discuss the Guyana Green Paper on its proposed SWF.