Introduction

Having previously dealt with 1) aspects of the organizational and legal framework of Guyana’s intended Natural Resources Fund (NRF) (October 7, 2018) and 2) the fiscal rules governing its operations, today’s column turns to its overall assessment and evaluation. But, because of the amount of material, I shall conclude this assessment next week. There are several issues remaining to be raised, and for brevity, I concentrate on the most crucial.

SWFs: State Capital and Global Capitalism

My first observation arises from my earlier assertion that, collectively, sovereign wealth funds (SWFs), as proposed for Guyana with the NRF, comprise state actors/owners operating in a largely private global capitalist economy. This circumstance is aggravated by their reported size (recall: collectively SWFs control US$8.1 trillion in assets, of which petroleum-based SWFs control US$4.4 trillion, or 54 percent). Such enormous state capital generates tension in the universe of private investors, accumulating capital and investing this in private financial markets, where private risk-return incentives prevail!

I had indicated further that one of the most important consequences of petroleum-based (or indeed other natural resources) SWFs in economies like ours is that these become, in effect, conduits for redistributing surpluses generated by their countries’ export earnings to finance non-domestic based income-generating activities! As the Guyana Green Paper unambiguously asserts: “investment in overseas markets is necessary (my emphasis) to minimize risk of local instability.”

However, although this is a primary consequence of the NRF, so far it has been its least discussed and assessed feature.

Santiago Principles

In response to the obvious state capital-private investor contradiction, SWFs have over the years sought to legitimize themselves by developing a set of Generally Accepted Principles and Practices (GAPPs) for their operations. These GAPPs seek to remove any semblance of a SWF seeking to operate outside of private, profit-centred incentives. To this end, the collective body of SWFs has created what are known as the 24 Santiago Principles. The Green Paper indicates the Government of Guyana (GoG) intends to subscribe to each and every one of the 24 GAPPs. These 24 Santiago Principles have been voluntarily agreed to in a compact shared with most of the roughly 50 countries that have SWFs. This arose a decade ago (2008) as a consequence of concerns arising in the early years of the Great Recession and its associated financial crisis (2007-2008). Because of their state-ownership, SWFs had generated strong concerns about their economic and political motivations; incentives framework; manipulation of private markets; opacity; and, typically, their broad avoidance of the “disciplines” of private markets “risk-return incentives”. The IMF has played a leading role in bringing together the key stakeholders: SWFs, the global private financial community, and Developed Countries’ Governments.

The Green Paper lists the 24 principles and sub-principles in some detail. Space does not allow for repetition here. However, it is generally accepted that these principles form three major groupings. One is the set of principles governing the legal framework, policy purpose, funding, and withdrawal arrangements of SWFs (primarily GAPP 1, 2, 4). Second, there are principles governing the institutional framework and governance arrangements. The main thrust of these GAPPs is to separate the owner (Governments/politicians) from management of the NRF (primarily GAPP 6, 7, 8, 9). The final part is focused on investment and risk-management. The disclosure of investment policies, especially objectives, themes, horizons, benchmarks, and strategic asset allocation aims, is mandatory. Investment goals of the SWF that are considered to be “non-economic or non-financial” should be revealed (primarily GAPP 18, 19, 21).

Investment Management

The preceding comment concerning the investment framework leads into the second significant issue posed by the Green Paper. As can be interpreted from the above description, the Santiago Principles put enormous pressure on SWFs to declare their investment mandate, management, and strategy framework. This is clearly the reason why Guyana’s Green Paper is so forthcoming with details. This is not about local transparency. It is all about international pressure. The Green Paper makes clear the primary roles of Parliament (passage of the NRF Act, processing Annual Budget) and the Ministry of Finance (appointment of Investment Committee, Investment Adviser and Analyst). The Central Bank (Bank of Guyana) is named as the Operational Manager of the Fund.

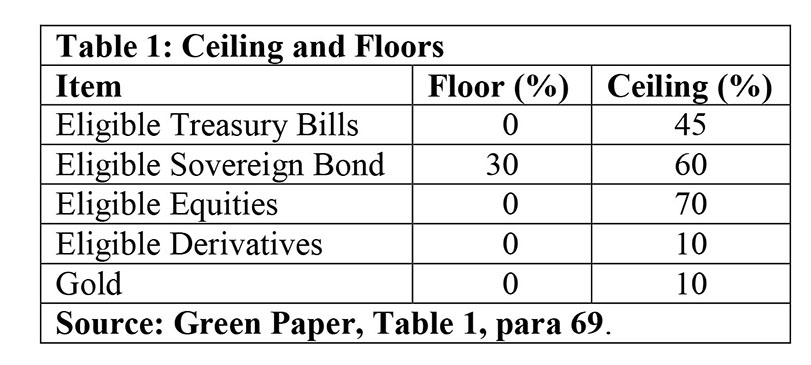

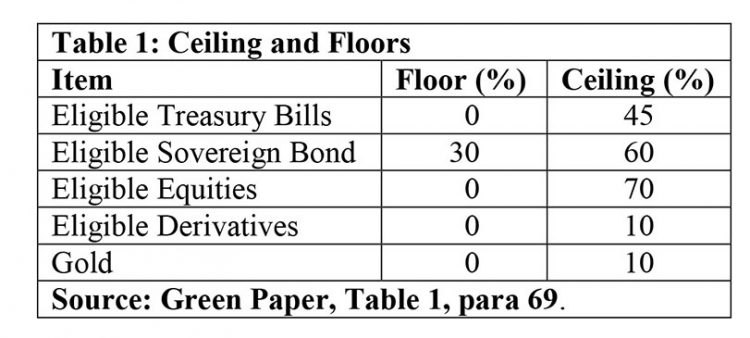

However, in keeping with the aim of creating “distance/space” between the political class, as owners, and the NRF management, it is clearly stated: “Private Managers would manage the overall investment portfolio.” The Green Paper goes on to make it clear that the Investment Mandate fixes the allocation of Fund investments. And, with this in mind the Green Paper identifies the “eligible asset classes” to be held by the NRF and their floor and ceiling limits.

The Green Paper identifies the designed asset classes as: eligible bank deposits; eligible treasury bills; eligible equities; eligible sovereign bonds; eligible derivatives; and, gold. The ceilings and floors of these eligible classes are reproduced below (Table 1).

As noted last week, the NRF is targeted to earn a three percent return. This is not specified either as a gross or net figure. Furthermore, it is not indicated whether this is a nominal or real return or, for that matter, which market prices will be used to adjust nominal to real values. Readers would appreciate the potentially significant variation in the monetary outcome for the numeric values of these targets. I had noted last week that, on its face, a three percent return seems modest.

Internet searches reveal that the SWF Institute’s website admits to difficulties in finding reliable comparative data aggregates. They do suggest, however, that by 2015, there had been over the previous 20 years an annualized return of 6.5 percent for SWFs. And, for the previous 30 years their annualized return has been 7.5 percent. Average portfolio allocations also reveal: 1) Developed country equities (32-42 percent); 2) Government bonds (10-20 percent) 3) Real estate (5-10 percent) and 4) Cash (10 percent).

Conclusion

The two observations treated above are the most important I wish to make in my overall evaluation of the proposed NRF. Lesser important but still vital features of the Green Paper, about which I remain concerned, will be discussed next week.