Today’s column starts consideration of the final topic (number 10) on my list of the top 10 development challenges, which I anticipate that spending Government’s Take from its coming petroleum sector, scheduled to be on-stream in early 2020, will have to confront in the coming years. That topic is Integrating the Production Sharing Agreement (PSA) Revenues and the National Budget. As a complement to this task, I propose to address also, the role of fiscal stabilisation in the PSA. For this purpose, fiscal stabilisation simply refers to the deliberate insertion of a clause into the PSA, designed to deal with future changes in Guyana’s fiscal laws that may occur during the life of the petroleum project. This clause is, by intention, aimed at mitigating any risk the Contractor (Exxon and partners) faces, if fiscal law changes to the Contractor’s “detriment.” Such changes are likely to reduce the value of the Contractor’s investment.

My inclusion of fiscal stabilisation at this late stage is entirely for convenience. Up to the present, I have not found a convenient opening to introduce this topic. And, its consideration is definitely required, given the original focus of the series, as well as the course local debates have taken on Guyana’s coming petroleum sector.

Given the scope of what I have to say, I propose to address this tenth challenge in several columns lasting up to mid-January 2019. Thereafter, as earlier promised, I shall address the final topic in the overall series of columns on Guyana’s coming oil and gas industries, which to recall, started more than two years ago (September 4, 2016). The final topic will offer a Road Map for Guyana’s transformative development, based on its coming petroleum sector. The Road Map will provide a detailed explication of the so-called Buxton Proposal, which I put forward at the Buxton Emancipation Day Symposium on August 5th, 2018.

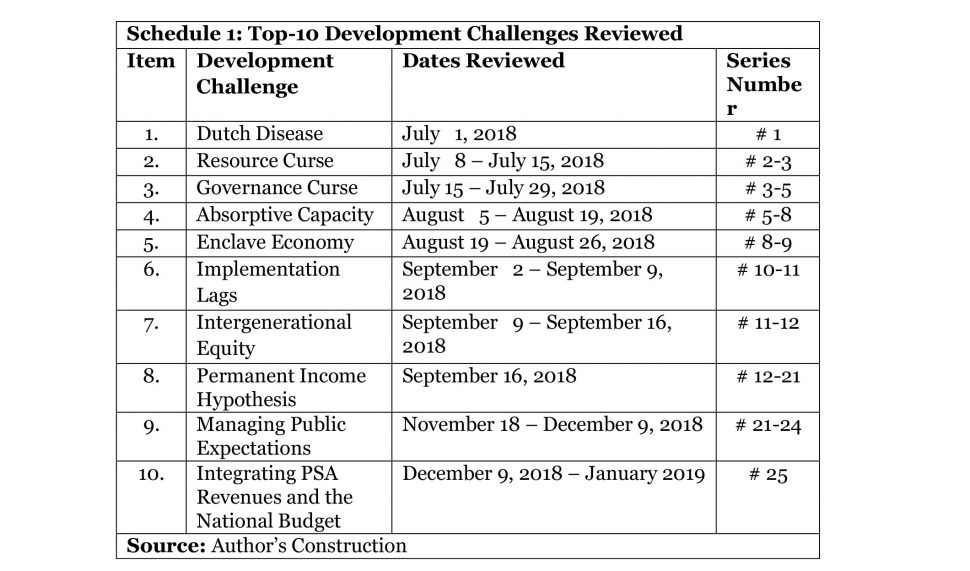

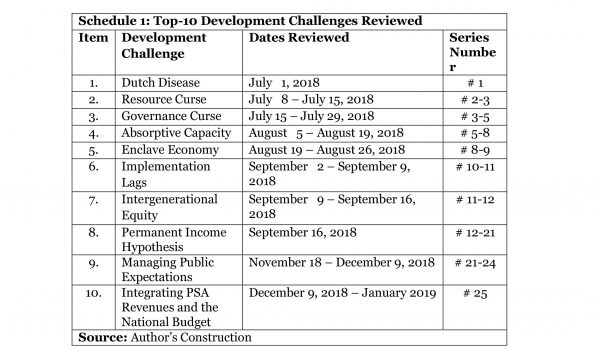

In the very first column (July 1st, 2018) that listed the top-10 development challenges, I had indicated the list was presented in no order of ranking. I admit however, the ranking which I used is somewhat traditional. Treatment of this topic typically begins with a consideration of resource, pre-source and governance curses, and concludes by focusing on the Contract, fiscal rules, and collecting/ spending priorities for Government Take. I had also indicated in that first column that the top-10 list I provided was not exhaustive. Further, I admit here that the list is narrowly development-based. Thus, I failed to cover other key challenges that I now recognise: geo-strategic, regional (CARICOM) and environmental.

Unprecedented Opportunity

The question has been posed to me: why are there so many development challenges? Three considerations lie behind the list. First, Guyana’s coming petroleum sector presents an unprecedented opportunity to fast-track or accelerate the transformation of Guyana. This offers the real prospect of fulfilling the Vision of both the Green State Development Strategy (2018) and the United Nations’ Sustainable Development Goals (2015).

Second, this fast-track potential has encouraged my preparation of the Road Map mentioned above. My reading of the potential embedded in what I term as an “unprecedented opportunity” is largely, but not entirely, a function of four variables: 1) the projected eventual size of reserves/finds; 2) their quality (as determined by current industry standards); 3) their accessibility; and 4) medium to long-term market projections.

Third, and linked directly to the above consideration, the offshore location of Guyana’s reserve finds puts huge pressure on costs of recovery. Serendipitously, the Contractor (Exxon and partners) is exceptionally well-placed to command the technical resources for petroleum operations in deepwater and ultra- deepwater reservoirs. The quality of the oil (light, sweet crude) also presents partial compensation for the extra costs incurred from such reserves location.

Opportunity and Global Risk

To be truthful, the unprecedented opportunity before Guyana, today, is situated in global experiences, which continue to exhibit highly significant risks. These are: 1) risks of mismanagement of revenue flows; 2) risks of revenue volatility and significant swings in crude oil prices; and 3) risks of corruption. Indeed, these three risks have largely guided my choice of the top-10 development challenges. For readers convenience I recall in Schedule 1 the top-10 challenges and details on their publication.

Going Forward

There are two major proposals, which I make on the topic: integrating Guyana’s PSA revenues into the National Budget. The first is based on my study of the experiences of several developing countries in the process of preparing for their coming petroleum sectors, I have found that an important priority is conducting a formal framework policy study of this task. When undertaken, such a task identifies, early in the process, the pertinent Authorities (organisations and individuals) that should be mobilised and tasked with the execution of the main features of the national process to be set in train. In practice, these studies have been mainly undertaken by consultants (individuals and firms) under technical assistance agreements with international organisations and development partners. In some cases, though, the studies have been conducted through the auspices of a relevant Government ministry.

One such study, which I have found particularly useful is that conducted under the auspices of the Republic of Uganda, Ministry of Finance, Planning and Economic Development, entitled, “Oil and Gas Revenue Management Policy” (February, 2012).

Conclusion

I shall present a Template for such a study in the next column and expand on this first proposal.

The second proposal will be introduced in the following week. That proposal is for the Government of Guyana to adopt, formally, a code of global best-practices dealing with fiscal management and transparency.