In last week’s column, I had indicated that there were two proposals, which I wished to offer on the tenth topic on my list of “top-10 development challenges.” That topic is “Integrating PSA Revenues into the National Budget.” These proposals are: First, a call for a major framework policy indicative plan early on in the process. This is intended to prepare the nation for the coming petroleum sector. The plan is to be designed to benefit from experiences in other countries. The second proposal is that Guyana unreservedly commit to the adoption of global best practices on this matter. Today’s column focuses on the first proposal and next week’s will focus on the second.

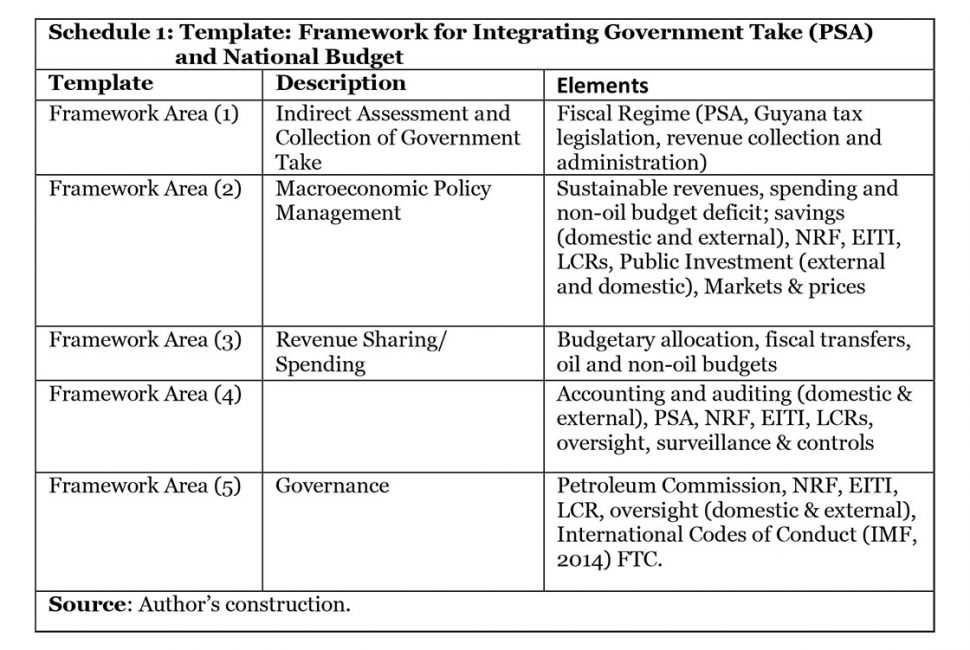

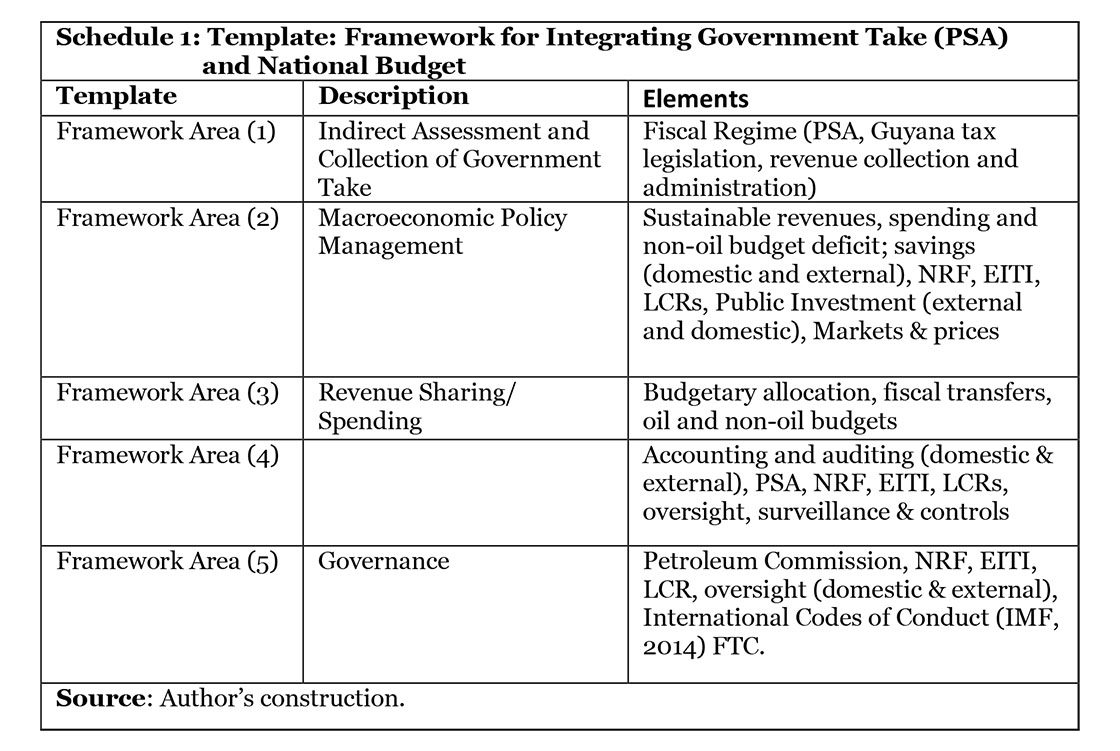

I had also indicated last week that there is already a comparable study I would recommend. This was prepared for the Republic of Uganda, in 2012. And, based on this and other related studies, I have designed a Template. This is shown in Schedule 1.

The Template highlights five basic areas of work required for the preparation of the National Indicative Policy Framework Plan. Its first area is a detailed assessment of Guyana’s fiscal regime, with emphasis on the collection and administration of revenues, and its legal and regulatory framework. The second area covers the macroeconomic management framework. This treats with the standard topics: sustainable revenues; oil and non-oil budgets, national savings, exchange rate management, public investment planning; and institutions like the Extractive Industries Transparency Initiative (EITI), the natural resources Fund (NRF) and local content requirements (LCRs).

The third area focuses on revenue sharing and spending allocations for oil and non-oil budgets. Transfers from Central to other levels of Government are also considered. The fourth area is a framework for accounting and auditing petroleum revenues and their control, surveillance and oversight. This area directly relates to the operations of the PSA, the Auditor General, the NRF, and the LCRs regime. Finally, there are governance issues. Allocation of responsibilities are indicated, particularly for the Ministries of Finance and Natural Resources; the Department of Petroleum; the Bank of Guyana; and related organizations like the EITI, the NRF, and the Petroleum Commission.

The starting point of the proposal to undertake an indicative framework policy plan for the coming petroleum sector is rooted in my observation that, when such a study has been undertaken, governments seem to be far better prepared for this task. Indeed, discussions with persons in Guyana suggest that such a proposal for Guyana makes sense. If global experiences are anything to go by, Guyana could be in for exceedingly testing times in the years ahead if this proposal is not adopted. The question remains however: whether it is too late into the process for such a plan to yield real value?

It is worth noting here that I have already in this series of columns, reviewed important components of such a plan. Thus, I have dealt with the EITI; the NRF; LCRs; as well as, upstream investments (formation of a National Oil Company and/or establishing a national refinery).

Vision and Drivers

The Template embodies a set of Goals and a Vision, and there are three main drivers informing the process. The first is the creation of an appropriate framework from which to ensure: “a sustainable approach to the management of expected Government Take.” It needs to be stressed that whatever its eventual size, the resource finds are going to be ultimately finite. Revenue yield from them are therefore also finite. Further to this, crude oil prices have been, historically, uniquely volatile. This makes the transmission effects to the national economy highly irregular.

The second driver is the budgetary requirement to integrate PSA revenues into existing national revenue streams and expenditure systems. Because of features like uniquely high revenue volatility (referenced above) such revenue flows have to be modulated in order to reduce their wide and destructive swings in Government, and indeed national expenditures!

The third driver is that the proposal seeks to incorporate global best practice, which has already been acknowledged in both the EITI and the NRF process. As I intend to indicate more fully next week, my second proposal is specifically a recommendation for the Guyana Authorities to adopt, unreservedly, the International Monetary Fund’s, IMF Fiscal Transparency Code, 2014!

Conclusion

In sum therefore, the main aim of the Template is to provide for Guyana a systematic method for ensuring the installation of appropriate mechanisms to ensure the country’s anticipated petroleum revenues are integrated and managed within the existing and planned public finance laws and regulations. These mechanisms seek to ensure that petroleum revenues are absorbed; and, if required they are modulated to ensure the desired impact on the national economy. Given this, the mechanisms must be necessarily situated in a policy framework informed by: 1) long-term projections of petroleum revenues; and 2) spending programmes directed by the Green State Development Strategy, GSDS, and on global and regional commitments under the United Nations Sustainable Development Goals.

Such a framework is technically grounded in: 1) the size, quality and accessibility of the resource finds; 2) the costs of production; 3) the projected prices for Guyana’s crude oil; 4) the projected daily rate of production (barrels per day); and 5) the projected depletion rate applied. These indicators determine the efficacy of the fiscal rule that anchors the spending of Guyana’s Government Take.

Next week I shall treat with the second proposal.