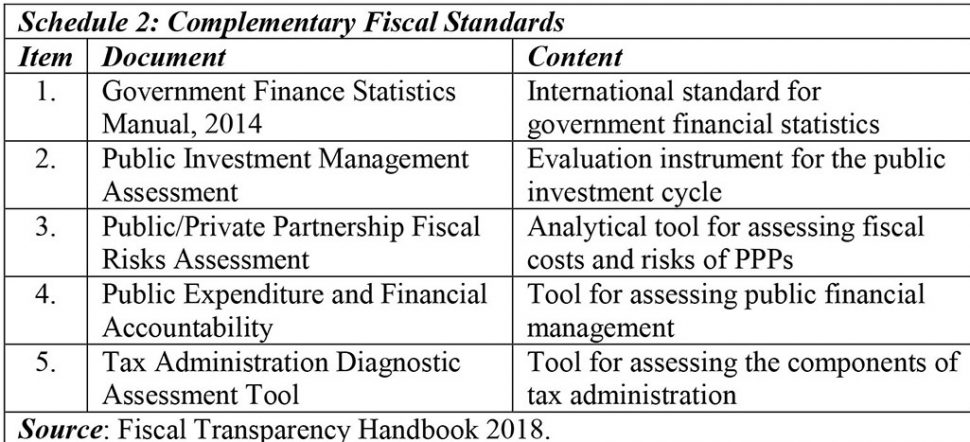

Today’s column develops further the discussion of the IMF’s Fiscal Transparency Code. I had proposed Guyana’s unqualified adoption of this Code, as the most effective means for forging a seamless integration of spending the expected Government Take from the petroleum sector and the national fiscal and budgetary systems. The column elaborates on the Code and its contents in, hopefully, an easily digestible manner, given its technical and operational bias.

A useful starting point for this discussion is the query: how does the IMF interpret fiscal transparency. For starters, its’ Handbook on the subject states: “Fiscal transparency refers to the information available to the public about the government’s fiscal policy making process”. The Handbook goes on to elaborate on this in some detail. It famously interprets the quote as referring to: “the clarity, reliability, frequency, timeliness and relevance of public fiscal reporting and the openness of such information”.