Column 71 published last week included a summary table of the Statements of Financial Position (the Balance Sheet) of the three oil companies which will lead Guyana to First Oil projected to take place during the first quarter of 2020. Noting that the financial statements audited by the same firm reflect significant differences in their content and presentation, Column 71 pointed to the value of expenditure incurred by the companies – more than G$500 billion – as at December 31, 2018, more than one full year before First Oil. As is now well known, the Petroleum Agreement provides for the recovery of costs before sharing Profit Oil equally between the oil companies and Guyana, subject only to a 75% of revenue limitation. In US Dollar terms, at December 31 the expenditure was approximately US$2.5 billion.

This expenditure falls into the category of pre-production costs which also includes pre-contract costs, including the amount of US$460 million stated in the Petroleum Agreement as having been expended to December 31, 2015. For completeness it is worth noting that this Column disputes this amount as being overstated by a not insubstantial amount when measured against the financial statements of the three companies. Of course, recoverable contract costs also include annual operating costs once production begins, usually measured by reference to a barrel of oil. The oil companies have not given any indication of what that cost is likely to be and one wonders at the basis of projections used by the Ministry of Finance and the Guyana Revenue Authority.

In all the Oil and Gas Columns so far, I have used a per barrel cost of production figure of US$35, inclusive of capital costs. However, in a recent presentation at Moray House, Dr. Tulsi Singh, a Texan-Guyanese who has been involved in the sector for decades, has used a figure of US$35 plus US$7 for capital expenditure. One would have expected that by now, some light would be shed on this important number and inevitably, one wonders whether the Energy Department itself has any idea of the likely number and how it has been derived.

Balance Sheet

The Summary table published last week did not disclose the Balance Sheet items by companies, an omission which I will now touch on briefly for two of the more significant items – Inventory and Property, Plant and Equipment. The December 31, 2018 total inventory of $14 billion is made up entirely of inventory held by Esso ($10.9 billion) and Hess ($3.1 billion). It is more than passing strange that CNOOC reports no inventory at that date and raises the question of a real time supply chain one hundred and twenty miles offshore, either directly or through its co-contractors which would more than likely be Esso. CNOOC has in fact not reported any Inventory over the past three years and Hess has only done so in 2018.

As expected Property, Plant and Equipment (PPE) is by far the most significant item in each of the three Balance Sheets. The financials of Hess and CNOOC have two classes of PPE – Exploration and Evaluation Assets and Development Assets – while Esso has three classes – Buildings and Vehicles, Wells, and Plant and Equipment (Work in Progress). Combined PPE at year end 2018 mounted in total to G$490 billion in 2018, up from G$247 billion in 2017 with the highest growth being Esso (108.9%), CNOOC (93.9%) and Hess (89%).

Income Statement

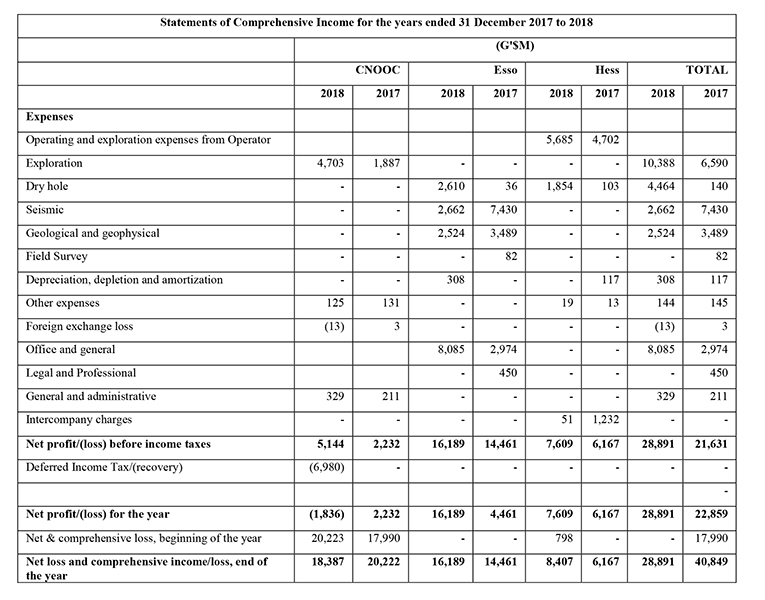

I now turn to the summarised Statement of Profit and Loss and Other Comprehensive Income extracted from the separate financial statements of the three companies.

There are three lines to which special attention needs to be paid and these are highlighted: Net Profit/loss before income taxes, Net profit/(loss) for the year and the Net Loss and Comprehensive Income, end of the year. I noted last week that both content of and disclosure in the financial statements are inconsistent but there is another matter that raises a different question altogether which appears in Hess’ books. In this latter case, Hess reports a charge of G$5,685 Million for Operating and exploration expenses from Esso but there is no similar item in CNOOC’s financial statements. This raises a few questions:

i) Does this mean then that Esso’s operating relationship with Hess is different from that with CNOOC?

ii) Is CNOOC doing its own exploration while Hess merely bears part of Esso’s exploration cost?

iii) Has the Minister or the person delegated by him to carry out his functions aware of and given express or implied approval of this arrangement?

iv) If Hess’ financial statements reflect costs assigned by Esso, why is there no corresponding transaction in Esso’s books showing it has recovered that sum and reduced its own expenditure?

And no surprise that Esso’s accounting and disclosure are different from that of CNOOC as the Table shows with Esso reporting items like Dry Hole, Seismic and Geological and Geophysical while CNOOC has a single block figure for Exploration.

Standing out in Esso’s Income Statement however, is an $8,085 million charge for Office and General Expenses which compares with $339 Million by CNOOC. Hess’ statement does not have such a line item but its administrative expenses could possibly be found in line Item Other Expenses ($19 Million), or in Intercompany charges ($51 Million). Esso’s 2018 financials also show Legal and Professional expenses incurred in 2017 of $450 million but none in 2018.

Esso’s $8,085 million charge for Office and General Expenses in 2018 and $450 million in Legal and Professional expenses in 2017 are not insignificant sums and these will probably all have to be borne by the Guyana taxpayer, one way or another.

Conclusion

Not too long ago everyone seems to have been auditing the financial statements of the oil companies for purposes of the Petroleum Agreement but months later, nothing is being heard. Oversight is not an episodic matter but one of sustained vigilance.

There is nothing that the Granger Administration has done in relation to the Stabroek Block that suggests anything but the greatest deceit and incompetence that continues to this day. It seems fair to say that the oil companies having been handed a lifetime gift in the form of the 2016 post-discovery contract is being fortified by a dangerously weak oversight. Let us pray.

Next week’s column will consider Petroleum Czar’s plans to uplift Guyana’s share of oil every ten days.