If Guyana is to avoid the oil resource curse, policymakers need to structure the Public Investment Programme to embrace transparency and evidence-based investment decisions.

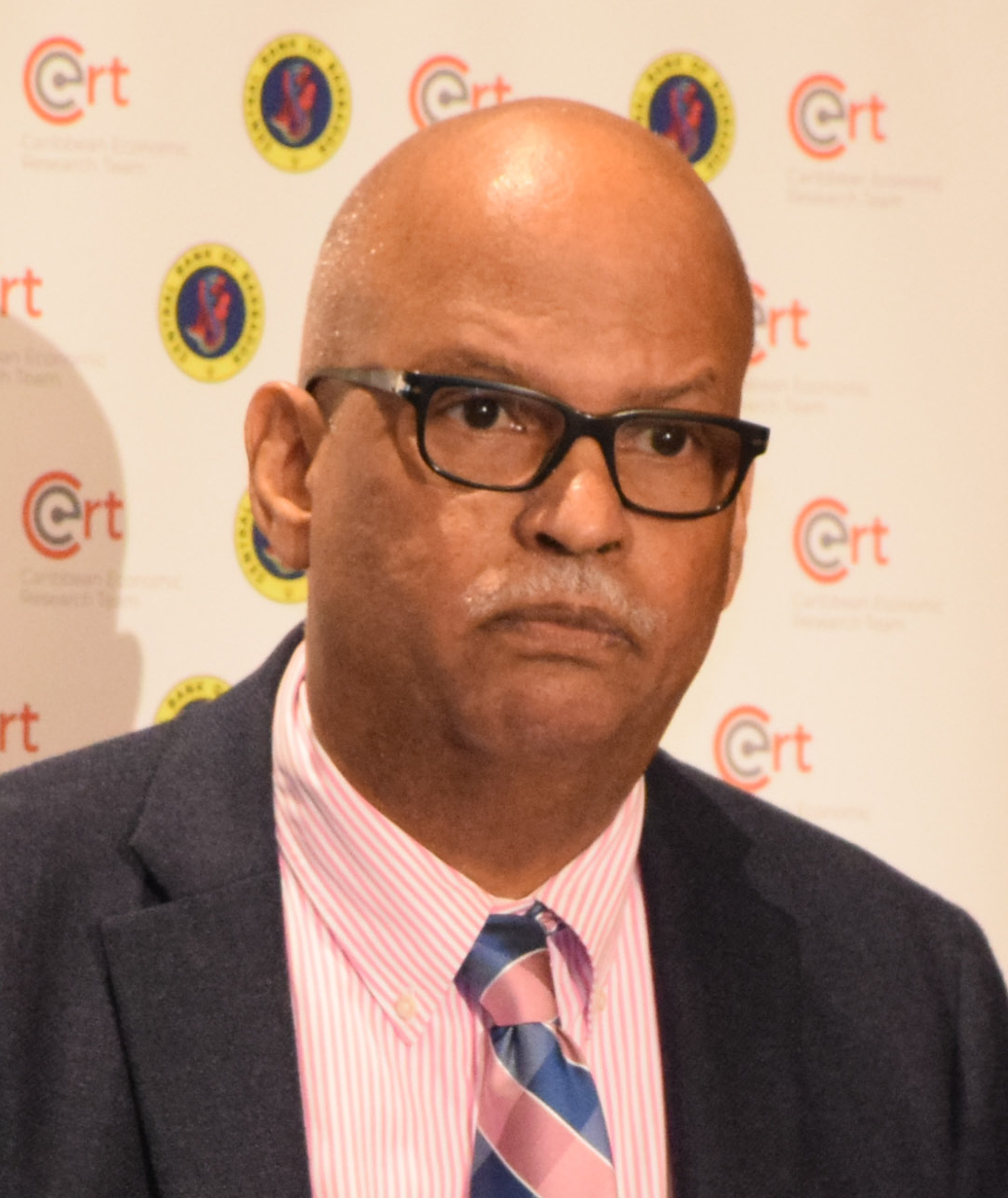

This is according to the IMF Mission Chief to Guyana, Arnold McIntyre who related in an interview with Trinidadian economist Marla Dukharan that Guyanese authorities are significantly concerned that recent oil discoveries could lead to the oil resource curse.

“In the initial years of oil wealth it is important not to ramp up too fast and get caught up in white elephants and bad spending. Give yourself time while you are addressing people’s needs to build the capacity you need,” McIntyre said.

He explained that what is needed is rigorous cost benefit analysis that provides a good analytical framework for choosing between different investments and prioritizing those investments and ensuring that you stay within the targets of the medium term fiscal framework for public investment.

According to the economist, following an analysis of its Public Investment Management government has committed to providing by 2020 a transparent rules based fiscal framework that clearly spells out targets for capital spending as well as a published policy framework for private-public partnership.

McIntyre, who led the IMF team which conducted a recent Article IV Consultation here, explain-ed during the hour-long interview that the team has worked with government to develop a fiscal target that preserves positive features of the Natural Resource Fund which is the savings and at the same time allows Guyana to reach critical development goals.

He explained that currently Guyana’s Human capital index is 0.49 which is below the regional average of 0.5. According to McIntyre while the average Guyanese has 12.1 years of schooling by 18 years when that number is adjusted for quality of learning it is only equivalent to 6.7 years.

Noting that similar metrics can be produced in the health and social sectors and that there is also a large infrastructure gap, he stressed that it is important to ramp up both capital and current spending to address these critical development needs but at the same time prevent inflation.

“The Minister was keen to ensure spending did not result in Oil Curse also known as the Dutch disease where spending is ramped up at such a rapid pace that it produces high levels of inflation which undermines real exchange rate and competitiveness and causes significant macro-economic distortions,” he shared.

The solution as detailed by the economist is to monitor fiscal deficit as a percentage of non-oil GDP.

He explained that Guyana’s current deficit is 5% of GDP and using resources available at the fund the team was able to determine that fiscal deficit was constrained so that the overall fiscal balance could be constrained to zero that is if transfers from the Natural Resources Fund every year would be equal to non-oil fiscal deficit the non-oil fiscal deficit would increase in a measured way from 5% to 8% of GDP by 2024.

Additionally by that time, 2024, oil revenue is projected to be 40% of GDP which should result in improved economy all around.

He further noted that following a request by Central Bank Governor Gobind Ganga, the Fund will be providing the technical assistance necessary to craft a monetary policy that facilitates economic growth and adjustment to oil price shocks while maintaining price.