Introduction

Today’s column wraps-up my discussion of Guidepost 4, in Part 2 of Guyana’s Petroleum Road Map. This Guidepost evaluates opportunities for increased downstream value added to Guyana’s crude petroleum finds. The premise of the analysis is that such value added would promote diversification of Guyana’s crude into other petroleum-based products, thereby adding sources of foreign exchange, public revenues, GDP growth, and employment creation.

Over the two previous columns, I had advanced two Decision Rules, which are intended to guide State action in this area. The first Rule proffered the view that, if a privately owned, managed, and controlled refinery is established, the State should support this endeavor, subject to the proviso/ caveat that the operation of the refinery is wholly predicated on commercial criteria. No explicit or implicit protection, especially under the guise of “local content,” should be afforded the private venture, through State facilitation in any form or manner.

Similarly, the state of play following the Haas feasibility study prepared on behalf of the Authorities, demonstrates lack of support, in any significant way, for State involvement in the ownership and/or management of a local refinery, seeking to add value to Guyana’s crude oil production.

What Next?

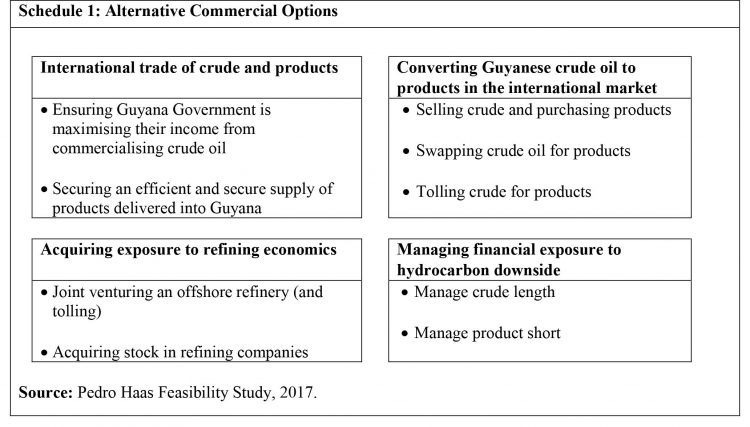

However, these two Decision Rules do not end the discussion. In Guyana’s context, they raise the question of what next? Two options readily spring to mind. The first of these is to pursue the several “alternative commercial options” proposed in the Haas study. For convenience, these proposals are listed in Schedule 1 below. Broadly, I support these.

The second option has had little public discussion over the years, until very recently. It concerns Guyana’s natural gas potential. This refers to both the fossil fuel (hydrocarbons) gas associated with (found in close proximity to) as well as not associated with the rock formations that bear the oil finds. Presently, natural gas is not usually flared, but it is instead typically utilised to generate value for the crude oil producers, after being processed to remove impurities and to meet desired specifications for its usage. Such processing yields multiple by-products. Of more specific importance, however, one usually finds that where it is commercially/economically feasible, pipelines are constructed to transport the natural gas to an end user for energy supplies. Indeed, worldwide, natural gas is presently a major source of electricity generation (and co-generation); the latter often in combination with renewable energy sources. Of particular relevance to Guyana, there is also petroleum-based cogeneration!

There are two major considerations that encourage Guyana’s use of natural gas. First, it is widely considered to be an “affordable” fuel. Second, although it is by no means a “green” energy source, it is known to be the “cleanest” of the fossil fuels, by a wide margin. Typically, it is less “dirty”, as it emits carbon dioxide at levels about one-third lower per unit of energy released than other fossil fuels.

Guyana’s Natural Gas

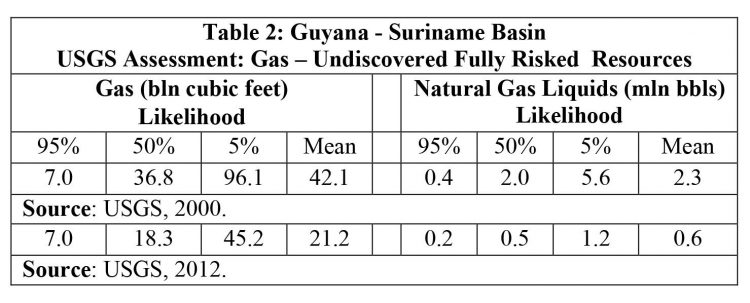

The United States Geological Services (USGS) has provided two estimates of the Guyana-Suriname Basin’s potential for natural gas; one in 2000 and the other in 2012. These are shown in Schedule 2.

Two years ago (November 5, 2017) I had supported Government’s decision to engage Energy Narrative (a network of Caribbean energy experts and strategic market analysts), to undertake “a desk study to determine the options open to Guyana’s natural gas finds”, (DPI, April 27, 2017). This study sought to determine for “official purposes”, the following: 1) the probable size of Guyana’s “associated and non-associated” natural gas supply and demand; 2) the various market and other economic options open for its usage; 3) likely costs; 4) the technical/commercial feasibility of bringing national gas on-stream; 5) the technical/commercial feasibility of various modes of transporting natural gas from offshore; 6) the economics of Guyana natural gas storage; 7) natural gas usage for generation and/or co-generation of electricity (technically and commercially); and 8) other related matters (like accidents, environmental impacts, and health impacts) as well as national security concerns.

I have heard nothing until two days ago on this endeavor. The Department of Energy is reporting that initially, natural gas will be “on shore by 2023, but the gas would not be available in significant quantities until 2035”. I recommend Guyana’s pursuit of its natural gas option as an appropriate replacement for state investment in oil refining. Natural gas usage is relatively clean and affordable. It is relatively abundant for domestic energy in Guyana, with prospects for exporting regionally and even further afield. Further, it is more compatible with Guyana’s pursuit of the aspirational goal of a “green state”, particularly when compared to building a risky and, more importantly dirty oil refinery!

One of the most cogent reasons why the strategic market assessment by Energy Narrative is so crucial, lies in the seeming “non-serious” present-day estimation of the natural gas associated/not associated with Guyana’s petroleum finds. This is all the more disconcerting as I have come across press reports that suggest Exxon Mobil and its partners will be following the industry practice of pumping the natural gas back into the oil reservoirs, in order to raise their pressure to facilitate extraction of crude oil. Clearly the economics of this process, from a Guyana perspective, can, and perhaps will, differ, from that of Exxon and partners, the operators of the oil rigs/wells.

Conclusion

Next week, I turn to evaluate the final topic, Guidepost 5 in Part 2 of Guyana’s Petroleum Road Map.