(Trinidad Guardian) In the last three days, several suspicious transactions by dubious professionals have been unearthed in the banking sector as thousands of customers continue to rush financial institutions to exchange their existing $100 bill for the new $100 polymer notes.

One suspicious activity involved a barber who walked into a bank with $1million in paper-based $100 bills to be swapped for the new $100 notes which the public began accessing at banks on Tuesday.

The old $100 notes will become invalid on December 31.

The changeover from paper to polymer is the basis of Government’s latest anti-crime plan to flush out criminal elements, cut off funding of gangs and take the profit out of crime.

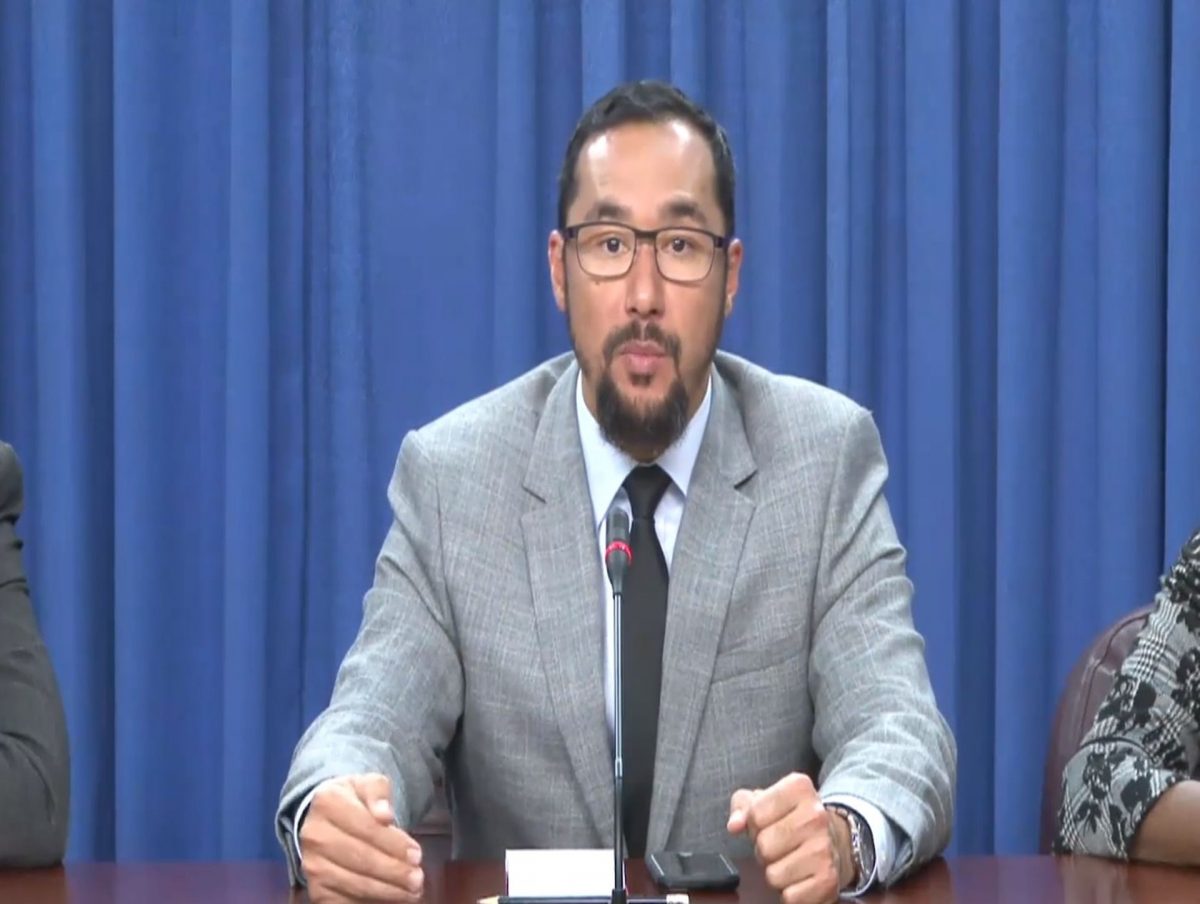

The revelation came from National Security Minister Stuart Young and Finance Minister Colm Imbert at yesterday’s post Cabinet media briefing at Diplomatic Centre, St Ann’s.

Imbert was first to talk about the suspicious activities, stating that he received reports yesterday that some customers had been visiting banks with “large quantities of cash.”

Imbert said some of these individuals are finding it difficult to fill out a source of funds declaration form “to indicate where they got the money from.”

If someone walked into a bank with a $1 million in cash and claimed it was their savings over the years, Imbert said: “It can prove to be a challenge.”

In cases like that, Imbert said that customer would be advised to go to the Central Bank to have the money exchanged or to get some consideration for the notes.

“We are dealing with the issues as they arise. As issues come up we are addressing it,” Imbert said.

He said commercial banks and Central Bank have been working with the Government.

Young admitted that in the last three days banks have picked up in the system some unusual transactions.

“Some of the examples would shock any law-abiding citizen of persons turning up with significant amounts of cash and when being asked about the source of funds some of the explanations are very difficult from a point of view. We have had quite a few instances of persons turning up and claiming to be of professions…you would be very surprised to be carrying around $1 million in cash and thereabout. Some with more than $1 million in cash.”

Pressed by reporters to give examples of people claiming to have “professions” and had showed up at banks with large sums of cash in exchange for the $100 polymer note, Young said he could not divulge much as the state’s security services and heads of security at his ministry have been working on intelligence and gathering certain information.

“We had some ridiculous examples of persons going to legitimate businesses placing orders in cash and then cancelling the orders when it is time to collect and say, well, give me a cheque instead. Persons are turning up at the banks trying to cash hundreds of thousands…. millions of dollars in some instances….telling us it is a very dubious profession as to where the money came from,” he said.

Young cited an individual who identified himself as “a barber with over $1 million in cash. That is a very expensive set of haircuts. Again, I am not casting any aspersions.”

He said they also received reports that some individuals had purchased large quantities of gold and foreign-used cars with the old $100 bill to get it off their hands before the money becomes invalid by year’s end.

In the study of what they expected, Young said it is within the ambit of the T&T Police Service and Customs and Excise when faced with individuals with large sums of money “who cannot provide a proper explanation as to how they acquired the money” or “have suspicion on the proceed of crime” that they carry out an interrogation process, and if not satisfied with their answer, a seizure takes place and then it goes to court.

“That is being employed across the country.”

Young could not say how many transactions were flagged since banks began exchanging the old for the new notes.

He also revealed there were instances of banks picking up counterfeit $100 bills.

Young reminded the population that money laundering was a criminal offence and anyone who facilitated money laundering can also be charged.

The Government, he said, did not create any new law to the amendment the Central Bank Act to have the demonetisation process done, pointing out that the Explain Your Wealth Bill was passed months ago to take the profit out of crime which they have been clamping down on.