The Agreement provides for Guyana to receive a royalty of two percent which is significantly below what other oil-producing countries are receiving, as highlighted in our article of 5 March 2018. In that article, we had included a table extracted from the Law Library of Congress showing the royalty rates of 22 countries. (See http://www.loc.gov/law/help/crude-oil-royalty-rates/). In countries where ad-valorem rates are applicable, the rates vary from 8 percent to 20 percent. For example, in Trinidad and Tobago the royalty rates are between 10 percent and 12 percent while for the United States, the rate is 16.6 percent. Colombia’s royalty rates are between 8 percent and 25 percent while for Brazil and Peru, the rates are 10 percent and 5 to 20 percent respectively.

Additionally, Guyana will receive 50 percent of the share of profits after deducting up to a maximum of 75 percent of recoverable costs from monthly revenues. Any excess recoverable costs are to be carried over to the following month. Because of the difficulty in verifying such costs and perhaps our apparent lack of capacity and technical expertise to do so, we had suggested that in any renegotiated agreement, the profit-sharing model should be replaced with a revenue-sharing one, as is being done in the case of India. In the petroleum industry, recovery costs are by far more difficult to verify, compared with revenue. The over-generous fiscal concessions granted and exemptions from various forms of taxation should also be reviewed. The U.S. Ambassador to Guyana has stated that the United States acknowledges that it is within Guyana’s sovereign right to renegotiate the Agreement if it so wishes.

A recently released report suggested that there is a 99.9999% chance that human activity is causing global warming through burning of fossil fuels that release carbon dioxide, methane and other gases into the earth’s atmosphere. (See https://www.usatoday.com/story/news/nation/2019/04/21/earth-day-2019-climate-change-humans-global-warming-weather-rising-water/3507125002/; https://news.yahoo.com/earth-day-2019-high-temperatures-131301815.html). The report highlighted the following:

The last five years ere the warmest in recorded history;

The average global temperature in the last ten months was 1.8 degrees Celsius above what prevailed in the 1800s;

Certain parts in Australia experienced record summer heat of 121 degrees Fahrenheit (approximately 50 degrees Celsius) last January;

Carbon dioxide levels last month were 411.97 parts per million – a 46 percent increase since the 1800s;

Sea levels have risen by one inch in the last 50 years due to melting glaciers alone;

The earth’s glaciers are losing 390 billion tons of ice and snow per year; and

Three trillion tons of ice have melted in Antarctica in the last 25 years.

Now for today’s article. On 12 April 2019, the Minister of Finance issued his 2018 End-of-Year Report. Prior to 2016, there was no separate reporting of the performance and state of the economy since such reporting was reflected in the Minister of Finance’s budget speech to the National Assembly. With the presentation of the Estimates of Revenues and Expenditures and their approval by the Assembly before the close of the fiscal year, instead of late March/April into the fiscal year, it has become necessary for an End-of-Year Report to be issued to provide an update of the information contained in the Minister’s budget speech. The 2018 Report was prepared based on information available as of the end of February 2019.

GDP Growth

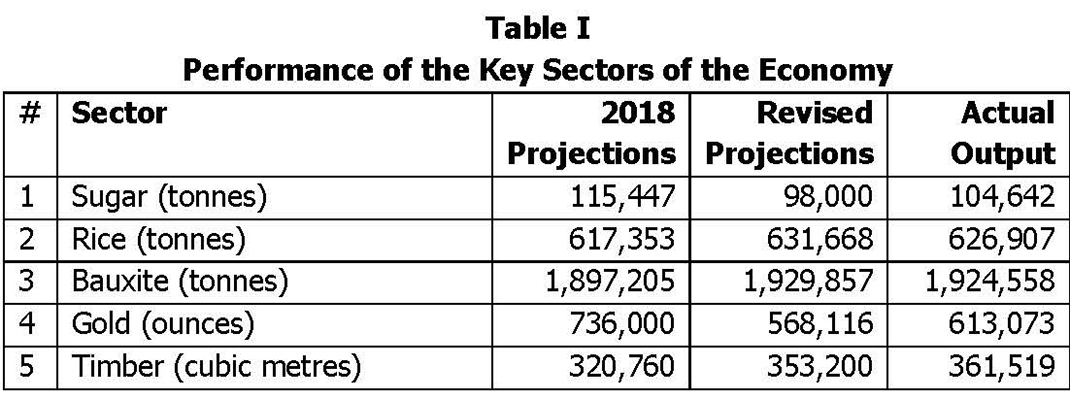

The recorded growth in the Gross Domestic Product (GDP) for 2018 was 4.1 percent, compared with 3.8 percent reflected in the 2018 Estimates and revised downwards to 3.4 percent in November 2018. In our article of 4 June 2018, we had raised the question as to whether the forecast GDP growth of 3.8 percent was not an over-estimation, considering that the actual GDP growth for 2017 was 2.1 percent. This would have meant an increase of 95.2 percent. As it turned out, it did not appear to be an over-estimation, as the report indicated that there were ‘further improvements in production across all major sectors than previously predicted’.

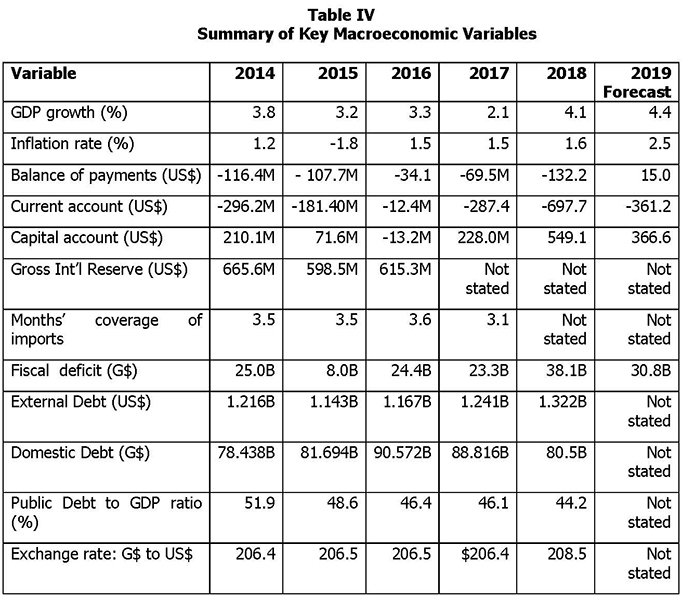

Table I shows the performance of the key sectors of the economy.

According to the 2018 Annual Report Bank of Guyana dated 29 March 2019, production was higher in respect of bauxite, livestock, forestry and other crops as well as increases in construction, manufacturing and service activities. There were also favourable commodity prices, greater investment expenditure and moderate domestic demand. However, the output of sugar, rice, gold and fishing declined due mainly to poor weather and road conditions.

Table II shows the actual GDP growth rates over the last five years as well as the forecast for 2019:

Balance of Payments

The Current Account recorded a deficit of US$697.7 million in 2018, compared with US$287.4 million in 2017, an increase of US$410.3 million. This indicates that export earnings were significantly less than the value of imported goods and services. Unless appropriate action is taken to boost export earnings, the country’s reserves are likely to be adversely affected; and the Guyana dollar will be under pressure to maintain its value. GDP growth is also likely to be adversely affected. Although the situation is likely to improve with oil revenues expected to flow in 2020, we again emphasise the need for other areas of the economy to be strengthened and diversified and become export-oriented so as to avoid over-dependence on oil revenues. The report indicated that the increase of 142 percent in the Current Account deficit was mainly due to increased activity in the oil and gas sector.

The Capital Account recorded a surplus of US$549.1 million, compared with a surplus of US$228.0 million in 2017, an improvement by 141 percent due mainly to larger-than-expected inflows from foreign direct investments, mainly in relation to the oil and gas sector. Notwithstanding this, the overall result was that the Balance of Payments Account reflected an increased deficit of US$62.7 million from US$69.5 million at the end of 2017 to US$132.2 million in 2018, a more than doubling of the deficit. The deficit was financed by US$17.9 million in debt relief, US$58.7 million in debt forgiveness, and drawdowns of US$55.6 million in gross international reserves from the Bank of Guyana.

Inflation Rate

The inflation rate was 1.6 percent which was slightly higher than was recorded in 2018.

Interest Rate

Interest rate on small savings was 1.04 percent while the commercial banks weighted average lending rate was 10.03 percent. The 182 days Treasury Bills attracted an interest rate of 0.96 percent; 364 days Bills, 1.23 percent; and 91 days Bills, 1.54 percent.

Exchange Rate

The exchange rate remained stable during the year at US$1 = G$208.5 while the market mid-rate was US$1 = G$213.3.

Foreign Exchange Reserves

There was no mention of the amount of the gross international reserves. However, according to the Bank of Guyana, the reserve cover was 2.3 months, which is a significant decrease, compared with approximately 3.1 months of import cover at the end of 2017.

Central Government Revenues and Expenditures

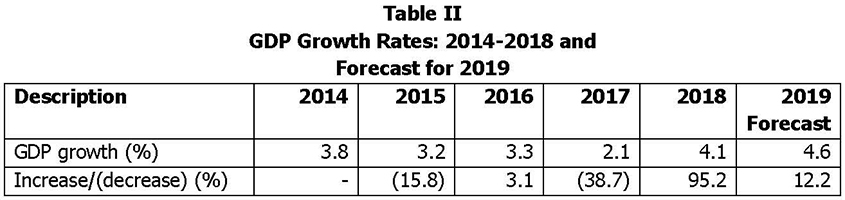

Total revenue collections for 2018 were $216.7 billion while expenditures incurred amounted to $254.8 billion, giving a fiscal deficit of $38.1 billion. Table III shows the Central Government revenues and expenditures for the last five years:

The annual fiscal deficits are financed from withdrawals from the Consolidated Fund. This account was overdrawn by $155.8 billion at the end of 2017. The End-of-Year report did not state the extent of the overdraft at the end of 2018. However, when account is taken of the fiscal deficit 2018, inclusive of grants of $10.8 billion, the overdraft is estimated at $183.1 billion as the end of 2018. With a projected deficit of $30.8 billion for 2019, the overdraft on the Consolidated Fund at the end of 2019 is expected to increase further to $213.8 billion.

Public Debt

The total public debt at the end of 2018 was US$1,708.4 million, compared with US$1,670.7 million at the end of 2017, an increase of US$37.7 million. This gives a debt-to-GDP ratio of 44.2 percent, compared with 46.1 percent at the end of 2017.

The external debt was US$1,322.1 million, compared with US$1,240.6 million at the end of 2017, an increase of US$81.5 million. The external debt accounted for 77.4 percent of the total debt stock.

Summary of economic performance: 2014-2018

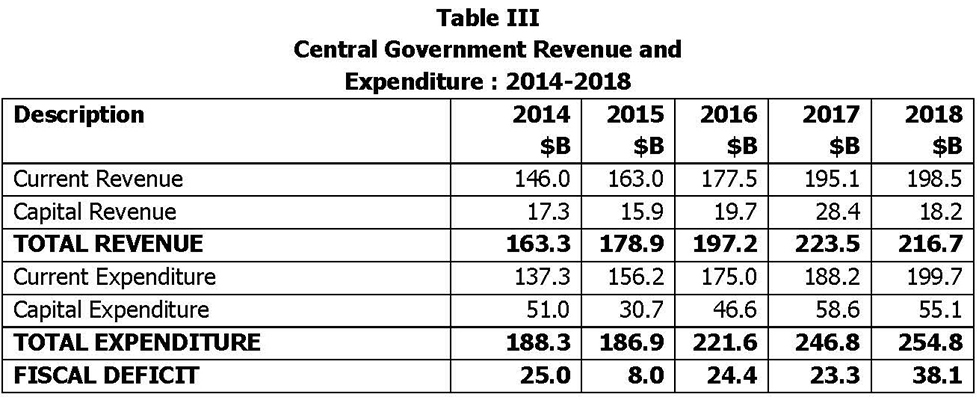

Table IV presents a summary of the key macroeconomic variables over the last five years along with projections for 2019:

While the macroeconomic fundamentals reflect a stable economy, the economy needs to be sufficiently diversified and become more export-oriented to avoid overdependence on revenues from oil reserves which will be completely depleted around 2038, based on the estimated rate of extraction. Other areas that require special attention include:

(a) Reducing and possibly eliminating annual fiscal deficit through more effective budgeting coupled with greater expenditure monitoring and control. This essentially involves moving away from deficit budgeting towards a system of balanced budgeting;

(b) Reviewing all government programmes and activities and eliminating those that do not produce the desired outputs, outcomes and impact, as well as eliminating waste, extravagance and indeed corrupt behaviour. In other words, we must intensify our efforts not to incur expenditure beyond our means; and

(c) Strengthening foreign exchange reserves to ensure a minimum of three months of import cover is maintained.