Today, we conclude our coverage of the GYEITI report by highlighting other key areas. Readers will appreciate the difficulty in capturing in two articles all the findings and recommendations contained in the report. We therefore hope that by presenting a summary of the recommendations, they will be able to glean what are the other major findings.

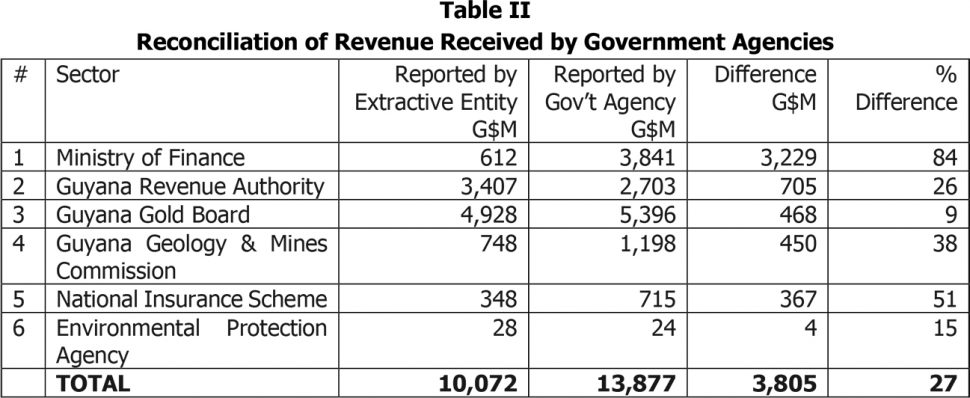

Data of production

Except for stone, there was a decrease in production in 2017, compared with 2016, as shown at Table I.

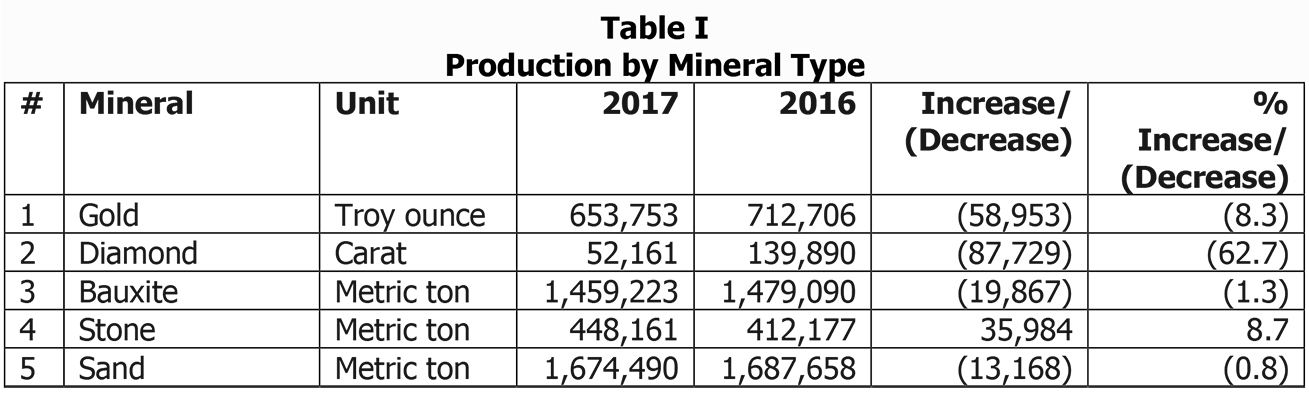

Reconciliation of Cash Flows

After adjustments and reconciliation, a net difference of G$3.805 billion representing 27 percent of Government reconciled revenues remained unreconciled, as shown at Table II.

As can be noted, four of the six government agencies reported higher revenues received from the extractive entities; while the Guyana Revenue Authority (GRA) and the Environmental Protection Agency (EPA) reported lower revenues.

List of Recommendations

Arising out of the study, BDO LLP has identified several shortcomings and weaknesses when compared with the requirements of the EITI Standard. As a result, it has made the following recommendations:

1. Establishment of an open database: Government agencies should set up an open EITI database by (i) implementing and upgrading a cadastral system with adequate details about shareholders and beneficial owners of the companies; (ii) enhancing the current management information involved in the GYEITI process; (iii) providing capacity-building and raising awareness of government officials on transparency and open data disclosure; and (iv) implementing a manual of procedures to provide the necessary guidance to ensure timeliness, quality of data and cost effectiveness of the systems.

2. Enhanced project level reporting: Government agencies should ensure that disaggregated payment flows, exports and production by projects can be made available to allow for the reporting of relevant data by: (i) improving the information systems to include the relevant modules for reporting exports data, revenue collections, and production data at project level; and (ii) updating the tax declaration processes and forms to be submitted by extractive entities to the Guyana Geology and Mines Commission (GGMC), Guyana Gold Board and GRA.

3. Automation of export data: GGMC and Guyana Gold Board should implement automated controls to ensure the comprehensiveness of the export data reported by mining companies, and develop analysis tools to ensure consistency of export data with the production data. This may include (i) putting in place a computerised system allowing for the update and oversight of such data; (ii) collecting data from mining companies on a common and accessible IT platform for the relevant government agencies; and (iii) performing monthly control of export data collected from various government agencies to prevent discrepancies in disclosed data.

4. Inventorising licences/permits and maintaining a register: An inventory of all active licences/permits should be undertaken in order to capture all relevant details from each licence/permit, and a register prepared. Once this is done, GGMC should ensure that the cadastre is kept up-to-date and that all data on licences/permits are systematically recorded. The register should include TIN of current licence holders or any other identification number rather than using the names of companies or individuals. The development of the online cadastral portal should also be expedited in order to make publicly available the mining cadastre.

5. Publication of mining agreements and maintaining an archive: The Multi Stakeholder Group (MSG) should set out a work plan for the publication of all mineral agreements in the mining sector. The work plan may include the following: (i) defining how the electronic publication of mineral agreements can be undertaken; (ii) the steps required for all mineral agreements to be published electronically and how to make these accessible to the public; (iii) a realistic timeline as to when such data could be available; and (iv) performing a review of the institutional or practical barriers that may prevent such electronic publication.

GYEITI Secretariat should also maintain an archive of copies of all active mineral agreements.

6. Awarding of mineral agreements based on tendering and providing a clear definition of and distinction between large-scale licences and medium-scale permits: In order to address under-exploitation of mining licences covering large plots by investors who may not have the required technical and financial capacities, there should be a tendering process for awarding mineral agreements.

GGMC should consider amending the awarding procedures to include clear definition of and distinction between large-scale licences and medium-scale permits. In order to comply with the legal requirements set out in the Mining Act, account should be taken of the combined acreage of the permits when awards are made to the same applicant and when the plots are continuous. A review and update of the list of current active mining permits should also be undertaken to comply with the definition of the large-scale mining licence, given that several of them cover neighbouring plots for the same extractive entity and exceed 1,200 acre when combined.

7. Need to improve comprehensiveness of production data: GGMC and the Guyana Gold Board should set out procedures to ensure the comprehensiveness of the production data reported by extractive entities and implement a computerised system to monitor and update the data on a monthly basis. This would improve both their ability to reconcile royalties and other non-tax payments with production data and to investigate any discrepancies. These entities should also provide the MSG with a comparison of the production volumes declared by extractive entities with the measurements made by them throughout the year.

8. Acceleration of reform of the petroleum legislation: To promote a favourable legal environment for investment and to boost the confidence of private operators, the MSG should follow up with the Department of Energy to accelerate the reform of the petroleum legislation and how to address any technical barriers delaying the process.

9. Need to improve GGMC’s organisational structure: A thorough review of the current organizational structure of GGMC should be undertaken to identify governance structures best suited for greater accountability and transparency in all extractive industries including the petroleum sector. (BBO LLC understands that an organizational review is currently underway and that a recommendation to award the contract was made.)

10. Emphasising the importance of data quality and assurance: Instructions for future reporting should emphasize the importance of complying with the requirement for proper signature and certification of templates by auditors. Efforts should also be made to ensure that reporting entities are adequately notified of the requirement.

11. Raising awareness of importance of industry participation: The MSG should liaise with their constituency groups to raise awareness of the importance of participation amongst reporting entities and to ensure an adequate timeline is set for submitting reporting templates.

GYEITI may focus on enhancing the communication lines of the EITI process through a strong awareness campaign such as conferences and outreach activities. It must also set out an adequate time-frame for the reporting process, including selection of reporting entities, updating and submitting the reporting templates, and instructions for completion of all reconciliation work.

A review of the Mining Regulations should be introduced with regard to EITI reporting such as: (i) reporting obligations for extractive entities while specifying the level of disaggregation of the data to be submitted; and (ii) sanctions against extractive entities for non-compliance and false declarations. In addition, application and renewal forms for mining licenses and permits should explicitly include a declaration of consent to disclosure of information required for compliance with EITI reporting. Such information should be made available in a disaggregated, project by project, format.

12. Need to devote time and exercising due care in preparing reporting templates: For future reconciliation exercises, extractive entities and government agencies should devote ample time towards the preparation of their respective reporting templates in accordance with the instructions set out by the Independent Administrator. All reporting entities should be made aware of the importance of the EITI data they are providing, and due care and attention should be paid during the preparation of these templates.

13. Use of unique identification numbers for payers: The statements of revenues of government agencies should include a unique identification number, such as TIN rather than using names or different reference numbers for identifying payers. This would lead to an efficient tracking of receipts and ensure harmonization of databases of different tax authorities. Government agencies collecting revenues from the extractive industries, in particular GGMC and the Guyana Gold Board, should revise their reporting system in order to include TIN when recording receipts.

14. Need to amend the GRA Act: Section 23 (1) of the Revenue Authority Act (1996) and Section 4 of the Income Tax Act (1929) should be amended to allow for the information required for EITI reporting to be disclosed to the Independent Administrator.

GYEITI must set out an adequate time-frame for the reporting process, including selection of reporting entities and submitting the signed waivers by the extractive entities in order for GRA to have reasonable period of time to consider them.

Conclusion

The 2017 GYEITI report is the first of its kind, and one does not expect full compliance with all the requirements of the EITI Standard. The report points to the areas of shortcomings/deficiencies and contains valuable recommendations for remedying them. One hopes that every effort would be made to implement these recommendations in the shortest possible period of time so that there is full compliance with the EITI Standard in our 2018 report. That report is due at the end of next year.