The National Assembly on Thursday approved tax exemptions for oil companies operating on the Kanuku and Kaieteur blocks

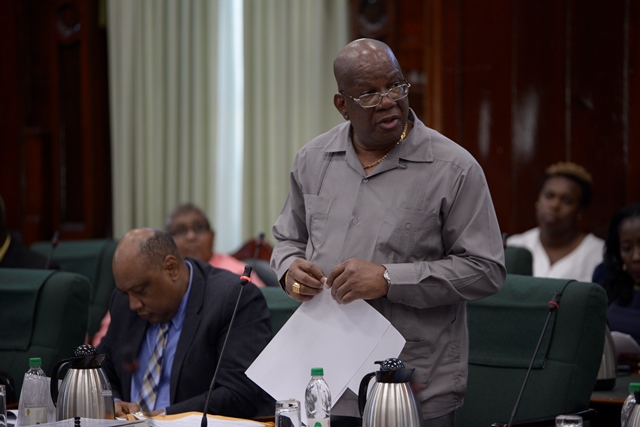

In presenting the two orders, Minister of Finance Winston Jordan said that they are replicas of the order passed the previous week in relation to the Orinduik Block.

The Kanuku block is held by Repsol Exploracion Guyana S.A. (formerly known as Repsol Exploracion S.A.) which is the operator and has 37.5 per cent interest while Tullow Guyana B.V. has a 37.5 per cent stake and Total E&P Guyana BV holds 25 per cent.

Jordan said the partners are working towards the drilling of the Carapa-1 exploration well which is scheduled for the third quarter of 2019.

The Carapa prospect is a 200 million barrel Cretaceous target located in 70 metres of water and will be drilled using a jack-up rig.

A second order grants the same exemptions to the operators of the Kaieteur Block, namely Esso Exploration and Production Guyana Limited (ExxonMobil), Cataleya Energy Limited (formerly Ratio Energy Limited), Ratio Guyana Limited and Hess Guyana (Block B) Exploration Limited.

Signed by Jordan on May 2nd, 2019, the orders specify that the written laws mentioned in Section 51(2) of the Petroleum (Exploration and Production) Act or any part thereof shall not apply to or in relation to the Licensees of each block as specified in the Production Sharing Agreements (PSAs) signed between them and the Guyana Government.

Section 51(2) lists the Income Tax Act, the Income Tax (In Aid of Industry) Act, the Corporation Tax Act and the Property Tax Act as legislation which, by order of the Minister (subject to an affirmative vote of the National Assembly), shall not apply to a licensee in possession of a PSA with government.

Meanwhile, the PSAs specify that the company shall pay no tax, no value-added tax, duty, fee, charge or other impost on income derived from petroleum operations or in respect of any property held, transactions undertaken or activities performed for any purpose authorised under the PSA.

However, there are exceptions including import duties on some items listed in the PSA, Local Government rates and taxes and licence fees paid to government.