Today’s column concludes my discussion of fiscal stabilization clauses (FSCs) in Production Sharing Agreements (PSAs). My main purpose is drawing attention to some key results/ observations/lessons, which the referenced Oxford Institute of Energy Economics’ (OIES’) survey of such clauses reveal. In the next paragraph, I wrap-up last week’s analysis of the political economy of FSCs.

The literature reviewed on FSCs last week reveals three primary features: First, there are variations in the wordings of FSCs, but their main intent remains in no doubt. Such variations reflect cultural, historical, legal and other features of the host country.

These variations apart, there has been an historical evolution in constructing these clauses, which is examined in the next Section. Second, continuous resort to these clauses invariably reflects fractures in the legal and other relations between the Host country and the Contractor, which is invariably self-defeating. Third, while over time FSCs have evolved, such evolution has been widely unpredictable.

Variations and Categories

The literature also identifies three principal categories of FSCs. First, there is the category termed Freezing Clauses. This can be either full or partial freezing. Second, there is the category of Economic Equilibrium Clauses which is also full or partial. Third, there is the category of Hybrid Clauses. As the name suggests, this category combines the other two, and are also full or partial.

Full freezing clauses seek to “protect against the financial implications of all changes in the Host country’s laws and regulations (fiscal and non-fiscal).” Limited freezing clauses, however, restrict the applicable laws/regulations and the compensation provided for changes. Economic Equilibrium Clauses do not focus on freezing the host country’s laws and regulations. They instead focus on maintaining the “economic equilibrium of the contract.” This therefore, provides the Contractor with compensation for legal/regulatory changes. Such compensation is provided in a variety of ways. And, like Freezing Clauses this category is also applied either full or partial. Full covers all changes and the latter some of these, with exemptions. Hybrid Clauses are also both full and partial and combine elements of the other two types. Further, Economic Equilibrium Clauses are considered “modern” and as such represent an improvement on traditional FSCs!

Empirical Evaluation of FSCs

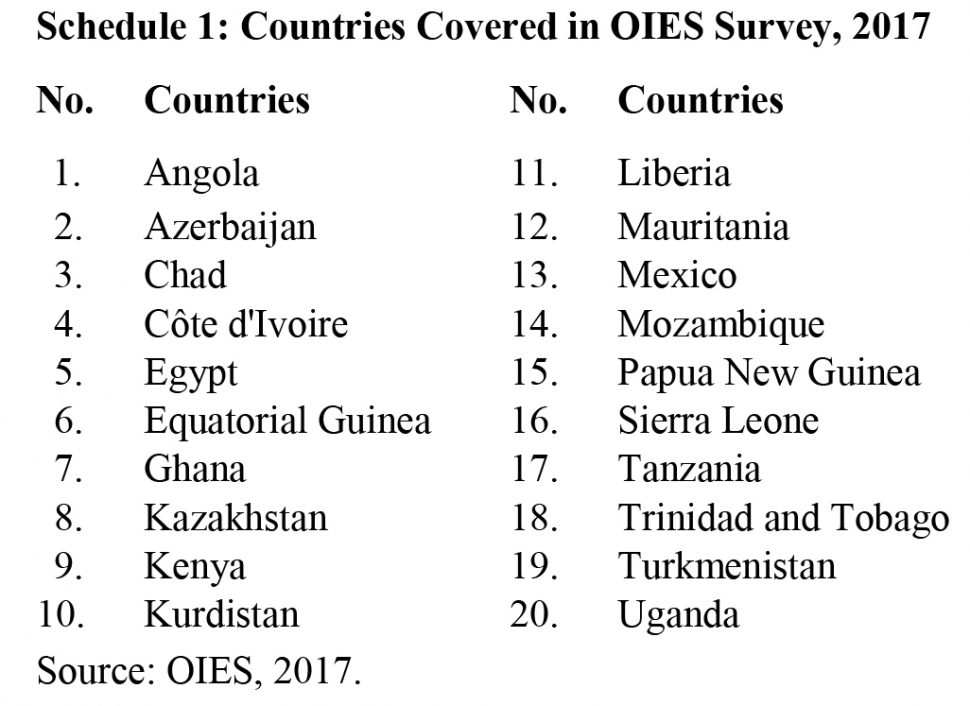

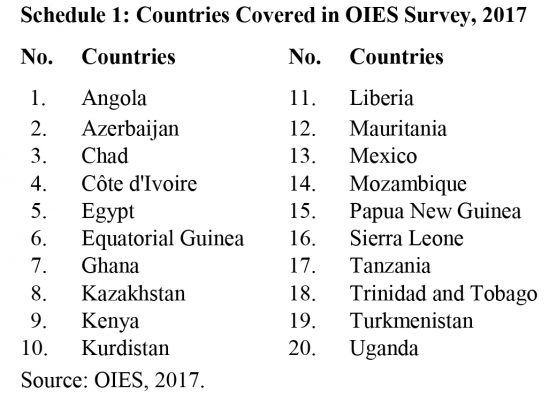

In this Section, I offer some of the key observations and results of the OIES survey of experiences in 20 developing countries that have FSCs in their petroleum agreements. These countries are listed in Schedule 1. Of note, several African and Eurasian countries are covered, along with two from the Americas, namely, Mexico and our Caricom neighbour, Trinidad and Tobago.

The survey contains scores of observations and results. Readers are encouraged to consult these on their own as space does not permit me the opportunity to entertain more than a few. I do this in the next Section, and rely mainly on quotes, in order to avoid disputes based on interpretation.

Results/Observations

Most of the quotes cited in this Section speak for themselves:

First, the Survey notes: “Despite the popularity of [FSCs] their practical value to oil and gas companies is questionable.” This is indeed a sobering observation, given the hysterical denouncement of Guyana’s FSC in sections of the media, a year ago.

Second, it notes, too: “To be valid and legal, FSCs must not (my emphasis) be in conflict with constitutional and legislative requirement”. This leaves little doubt about the wide legal acceptance of the first observation concerning the restricted practical effect of FSCs.

Third, further reinforcing the above consideration, the Survey notes: “stability provisos that conflict with national law do not receive the protection of international law.” There is therefore, no real controversy, only manufactured ones, on the acceptance of this self-evident truth.

Fourth, the Survey indicates clearly that nationalization/Guyanization can proceed legally “under the aegis of permanent sovereignty over natural resources.”

Fifth, it also states: “taking a government to Court or Arbitration (over FSCs) can mean that the company in question has little future in the country.”

At this stage it is worth pointing out that the Survey cites the IMF/World Bank view that FSCs “can be administratively cumbersome, limit tax policy flexibility and impair the legislature’s fiscal authority.” Despite this, however, the Survey observes these institutions go on to state that FSCs may be necessary in high risk environments, and to improve government take (by reducing the Contractor’s risk premium).

Lessons

Reality is not as simple or naïve as it has been portrayed by those advancing a dystopian view of Guyana’s coming petroleum sector. In this regard, the OIES Survey offers three general lessons. The first lesson is that historically the category of “freezing clauses” can be considered as “classical stabilization mechanisms/models”. And, taken as a whole, this category “has not been successful.” The second lesson is that the “more modern” economic equilibrium (or outcome based) clauses are more symmetrical, through providing both benefits to government, and risk mitigation, to the Contractor. The traditional freezing clauses however, are “biased in favour of oil companies.”

And, the third lesson is that the “more modern” category of FSCs offer policy makers the prospect of approaching petroleum fiscal regulations as an integral element of the “overall tax system and its impact on revenue and growth, without worrying about the specific impact on the petroleum sector, and without penalizing investors in the sector”.

For countries like Guyana, the OIES survey suggests they should continue to err on the conservative and cautious side by including such clauses in their Agreements. This requirement is driven by two considerations, namely: 1) the state of global competition; and 2) the fact that such countries lack the capital and skills to develop the petroleum sector on their own.

Conclusion

The hysteria a year ago over Guyana’s PSA stability clause was misinformed as regards the dangers it portends. Practice has revealed otherwise. It is, however, “par for the course” for the perverse dystopian view, which claims that everything is wrong in Guyana’s preparations for its coming petroleum sector.

Next week, I start to delineate my final topic: “A Road Map for getting and spending Guyana’s Government Take.”