In last week’s column, I had introduced the concept of the break-even price. I then applied it to Guyana from the perspective of those private businesses that are contracted to produce its oil and gas on behalf of its legal owners, the Government of Guyana (GoG). As was earlier indicated, presently two major consortia of foreign interests are principally responsible contractually for on-going exploration, as well as the development, production and marketing of its oil and gas! These two consortia are led separately by Exxon Mobil and Tullow Oil.

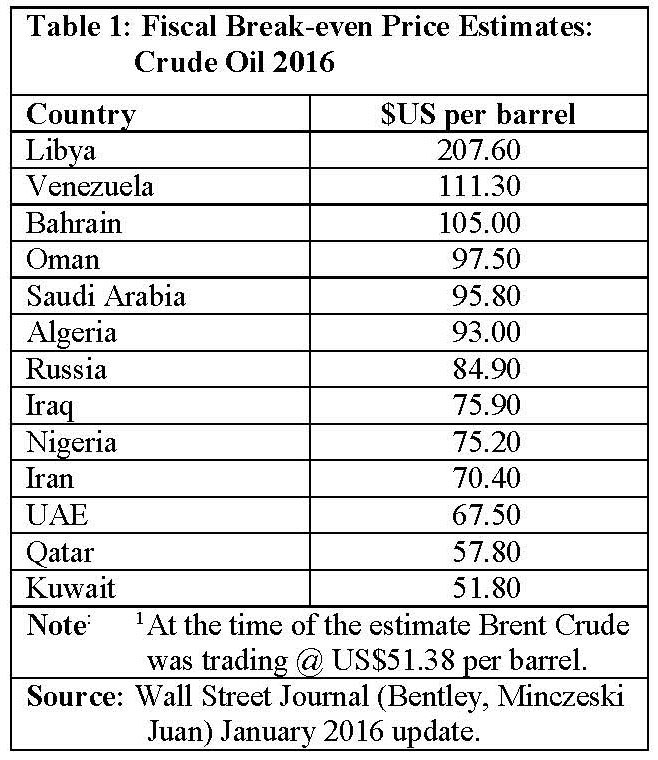

The focus of today’s column however, shifts quite a bit to what the literature terms as Guyana’s “fiscal break-even price” for its petroleum exports. In its simplest essence, this fiscal break-even price reflects the perspective of the GoG as it is the legal owner of the petroleum resources that are being exploited. This perspective holds, regardless of whether Guyana’s oil and gas resources are being developed as it is now, by consortia of external business, or through a specially created government-owned National Oil Corporation (NOC).

This is indeed the logic which lies behind last week’s concluding observation that the introduction of fiscal as a descriptor of the break-even price makes the concept a “social” or “national” price. As I shall reveal as I continue, this is no longer a price determined in the market place for private businesses. From such a perspective it therefore becomes a normative price. In other words, it reflects what the GoG thinks it ought to be, as explained in the next Section.