Last Sunday’s column concluded my discussion of Guidepost 6. It also provided the indicative unit total cost range for a barrel of oil equivalent (boe) which I shall apply to the estimation of Guyana’s likely petroleum revenues, after cost, for the remainder of the Road Map, going forward. Having fixed this metric, today’s column seeks to wrap-up the discussion on all of Part 1, which focusses on “getting petroleum revenues” in Guyana’s Petroleum Road Map. This discussion will centre on a brief recap of the major conclusions arrived at in the dimension of getting revenues. Recall that Guidepost 6 is the last in this dimension.

For readers’ convenience, it’s useful to re-state at this juncture, the broad intent that lies behind the construction of a Road Map. It is not to produce either a detailed programme or a ‘to do list” of actions. Instead, it is to give strategic focus to a “line of march” with strategic goals in mind. The long series of columns on Guyana’s coming petroleum industry has identified at least four inescapable strategic developmental challenges facing First Oil. Two of these the Road Map attacks head on. These challenges are:1) getting petroleum earnings from sales and revenues for the state 2) spending the revenues effectively 3) ensuring the capability, legality and legitimacy of the Contractors producing petroleum on behalf of the State qua Owner of the resources and 4) operationalising petroleum production and sales, including their governing, regulating, oversight, monitoring and periodic review.

The Road Map in its entirety deals with developmental challenges 1 and 2 above, respectively, in Parts 1 and 2. I have little of value to add to my earlier columns on these topics over the long period since 2016. In any event, I believe the two other challenges listed above (3 and 4) have been the subject of both intensive and extensive public scrutiny and polemic in Guyana.

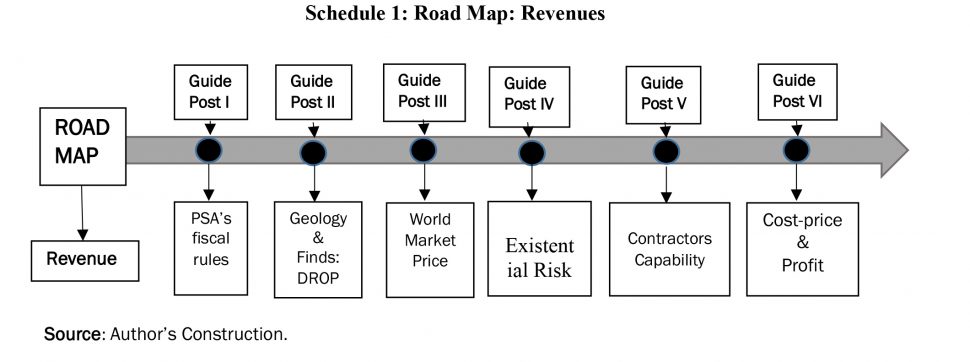

The Schedule

For the purposes of 1) above, I reproduce the Schedule that I had previously presented (February 3, 2019) in order to illustrate the “getting of revenues” dimension of the Petroleum Road Map.

Getting Revenues Guideposts

The Schedule reveals succinctly that the Government of Guyana’s (GoG) expected petroleum revenues are principally a function of six major variables, labelled Guideposts. The first of these variables is the set of fiscal rules enshrined in the Production Sharing Agreement (PSA) between the GoG and the Contractor. Based on existing rules I have estimated conservatively that, Government Take is the approximate mid-point range of 55 percent, which has been derived from publicly available estimates of this Take for Guyana. Since my early publication of that figure the University of Trinidad and Tobago (U of T&T) model, considered previously has arrived at three Government Take ratios based on the Liza field development. These are 52.06, 51.92 and 51.64 for prices of US dollars 45, 50, and 65 per barrel of oil respectively. The mean of these three Government Takes is 51.87. This therefore allows the mid-point range estimate cited above to remain.

The second Guidepost relies on my previous estimates of Guyana’s petroleum finds, and the country’s expected daily rate of production (DROP). That indicated projection of Guyana’s reserve potential, at its peak, is 13-15 billion boe. My inferred DROP for Guyana at this peak, is therefore 1.5 to 2.5 million boe. Peak production is likely to be attained in the mid-2030s.

For Guidepost 3, my estimated indicative crude oil price at the highest confidence level while remaining at low to medium risk is in the price range of US$60 to US$74 for the late 2020s, going forward. Located next to that price in my projection, is the indicative price range of US$75 to US$89, while at medium likelihood and low to medium risk. I had concluded that earlier column with the statement that “I feel confident in using US$70 per boe for Guyana’s crude as the nominal benchmark indicative price for determining values of Guyana’s projected crude oil revenues.” I remain equally confident.

Classing as an existential threat those that constitute the following 1) a permanent or continual risk to the ample materialisation of Guyana’s petroleum sector as it is currently envisaged, and/or 2) a substantially delayed transition to ramped-up oil production, and thereby in the process significantly stranding Guyana’s petroleum assets, I had identified three such live threats. These are: 1) the geo-strategic political risk posed by Venezuela’s aggression; 2) the ever present threat of an environmental catastrophe; and 3) intensification of national political strife and conflict, which has recently provoked a call by a former Head of State invoking “sanctions against Guyana” on the cusp of its First Oil! Such threats I treat as forming Guidepost 4 in Part 1 of the Road Map.

Guidepost 5 assessed the capabilities of the two leading consortia or Contractor Groups at this stage of Guyana’s approaching First Oil. These are: 1) ExxonMobil and partners (Hess Corporation and CNOOC Nexen Petroleum) and 2) the Eco Atlantic, Tullow Oil and Total. The former Contractor concentrates on the Stabroek block, where 13 major finds have already been announced, with estimated reserves declared at about 6 billion boe plus. The latter Contractor has, in a recent Competent Persons report, announced a “low case” estimate of 2.01 billion boe and a “high case” estimate of 7.2 billion boe, along with a “best case” estimate of 3.98 billion boe, all in the Orinduik Block.

Significantly, each of the two leading consortium groups has one of the top-10 oil majors as a partner.

The sixth and final Guidepost in the “getting petroleum revenues” dimension of the Petroleum Road Map considers the unit total cost – price relation, which is central to the determination of profit. Last week I identified that unit cost range as: US$21.75 to US$31.50; a spread of US$9.75

Conclusion

Next week I begin my presentation on “spending petroleum revenues” for Part 2 of Guyana’s Road Map