Introduction

Today’s column wraps-up discussion on the “reasonings” or developmental rationale for the Buxton Proposal of “oil-for-cash” transfers to Guyanese households. It deals with four topics briefly; it: 1) provides the fifth and final developmental rationale, in support of cash transfers 2) indicates the limits to cash transfers as a poverty alleviation tool 3) offers a brief reading list of evaluation studies by leading development agencies, experts, and think tanks, cited in my presentation, and 4) re-states, for convenience, the main features of the Buxton Proposal.

Fifth Reasoning

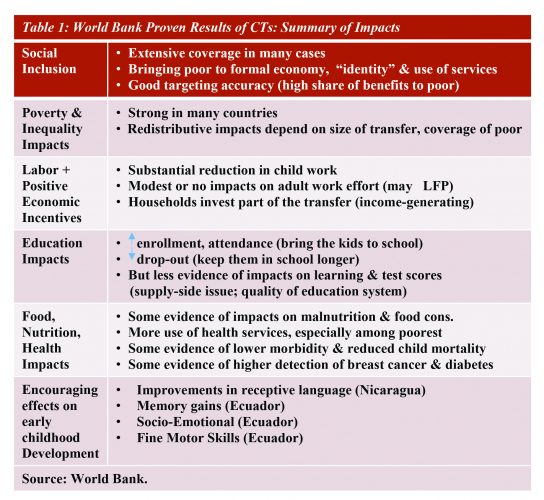

Conveniently, the World Bank displays, in a single Table, under six headings, much of the empirical basis from which it finds cash transfers useful: social inclusion; poverty & inequality impacts; labour and positive economic incentives; education impacts; food, nutrition & health impacts; and, encouraging effects on early childhood development. This Table is reproduced below, revealing the strong positive impacts on the scourge of income poverty.

Limits

However, ultimately the impacts of cash transfer schemes are limited to the value of public resources they can command. Out of an abundance of caution, and in an effort to manage expectations, I have proposed a limit or cap of 10 percent of Government Take, devoted to financing the Buxton Proposal.

Apart from this budgetary cap, there are two other observable limits to the Proposal. One is the capability of the State to operate a scheme of such complexity. Indeed, such concerns strengthen my call for a feasibility/pilot study to shepherd the Buxton Proposal into existence! The second limit is the political environment, in which advocacy for the proposal is being introduced. My hope is that, the race/ethnic neutrality of giving the transfers to all households, enhances its attractiveness. Of note, also, a progressive tax structure could add equity to a Proposal, which gives the same income to every household, thereby ignoring their different income-earning.

References

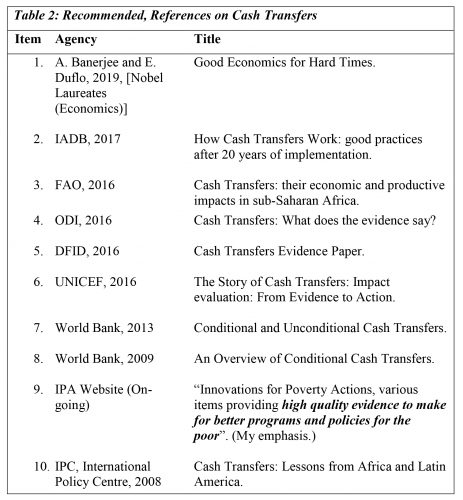

Thirdly, Table 2 displays a sample of ten items that I strongly recommend readers to browse, in order to improve their understanding of the merits/demerits of cash transfer schemes.

The Buxton Proposal

In this Section I conclude with a summary description of the eight (8) distinguishing features of the Buxton Proposal.

The Proposal is a call for direct, regular (annual), predictable time-bound payments to all Guyanese households. Time-bound is determined by the daily rate of crude oil production, DROP, (in barrels of oil equivalent, boe).

Cash transfers from oil wealth to citizens are implicitly and explicitly conditional. These are designed a) to support households’ accumulation of human, financial and productive assets and b) to protect households from low and fluctuating incomes/consumption. Lack of such “support” and “low/fluctuating incomes/consumption” are indeed, the major drivers of income poverty in Guyana.

At its peak, the Buxton Proposal cash transfer’s target, is set at an annual payment of US$5,000 (1.05 mln G$) to each household. This Proposal kicks in fully, at the peak target level. This target level is defined as: when, and only when, the daily rate of production (boe), DROP is at full ramp-up. Full ramp-up according to the Petroleum Metrics of the Road Map, requires a DROP ranging between 1.5 to 2.5 mboed.

Cash transfers however, can commence whenever the Government determines. These are pro-rated to the full ramp-up DROP, target level. For example, a DROP of 500,000 boed would yield 0.33 of the target level of US$5,000 (1.05 mln GS) with a DROP of 1.5 mboed. Similarly, a DROP of 750,000 boed yields 0.50 of the target level, and, a DROP of 300,000 boed, yields 0.2 of the target level, and so on.

With approximately 210,000 households, the estimated annual cost at full ramp-up is US$1.05 bln.

To ensure Budgetary affordability, the total annual budget for the Buxton Proposal is subject to the binding constraint or cap of a maximum of 10 percent of Government Take.

Since cash transfers are financed from export income (foreign exchange (oil)) adverse macroeconomic effects are constrained.

Finally, the recommended feasibility/pilot study shall advise on the basic operational matters; such as the trigger level to initiate the scheme, frequency of payments (one or several annually), types of allowable transfers, legal identification of household recipient, and so on.

Conclusion

To conclude discussions on the Road Map, I re-cap the petroleum metrics informing it in order to demonstrate the affordability of the Buxton Proposal.