Introduction

This week I turn to consider the second and third of the three relations, identified last week, as informing the petroleum metrics/revenues of the Guyana Petroleum Road Map, and, relatedly, the Buxton Proposal. This column also concludes my presentation of Guyana’s Petroleum Road Map. I must remind readers that these metrics have already appeared, at various stages, in my presentation of the Petroleum Road Map.

As indicated last week, the second of the three relations zeroes in on the estimation of overall profit (surplus). This profit (surplus) is expressed as the difference between the average price per barrel of oil equivalent (boe) and the average cost of producing same. Brent crude oil price behaviour is used as a proxy for Guyana crude. For purposes of the Road Map, I had projected a price of US$70 per boe at “full ramp-up”. To recall, full ramp-up is the stage when Guyana’s daily rate of production (DROP) equals 1.5 to 2.5 million boe (mboe) per day.

(Profit) = (Price less Cost) per boe

The second relation looks at the determination of how projected overall profit (surplus) is arrived at. Here, the larger is the positive difference obtained between the price per boe and its cost of production, the greater is the expected rate of profit. For purposes of the Road Map, I have used a range of cost ratios. This range is from 0.31 to 0.46 of the projected price, which is US$70 per boe. This yields a dollar value of unit cost of US$21.70 and US$32.2 per boe.

As it turns out, this cost-price ratio compares high, with Rystad Energy’s cost-price ratio of 0.33 for its model of Guyana crude oil and gas production analytics. The difference is significant, nearly 50% higher. I acknowledge my high value of cost, but I accept this, as a useful restraint, given that I am so “strongly bullish”, when projecting Guyana’s reserves potential.

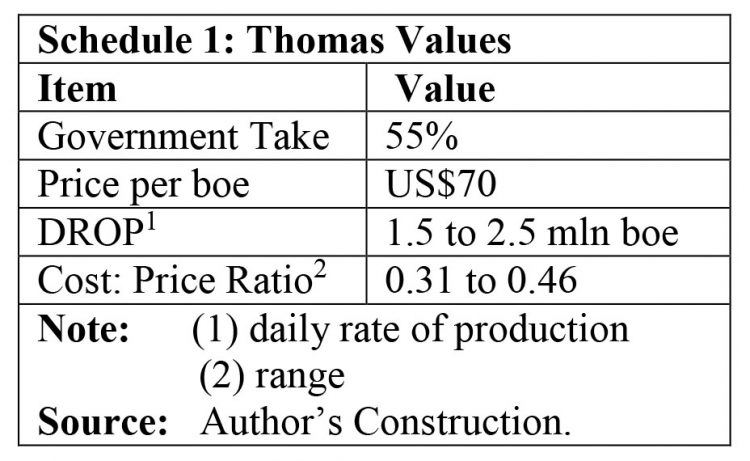

Thomas Petroleum Metrics Values

Schedule 1 summarizes the key values that I have identified so far, in regard to the relations dealt with that govern the petroleum metrics; namely, Government Take (55%); crude price per boe (US$70); Guyana’s DROP (ranging from 1.5 to 2.5 mboe per day); and, finally, my projected cost price ratio (ranging from 0.31 to 0.46).

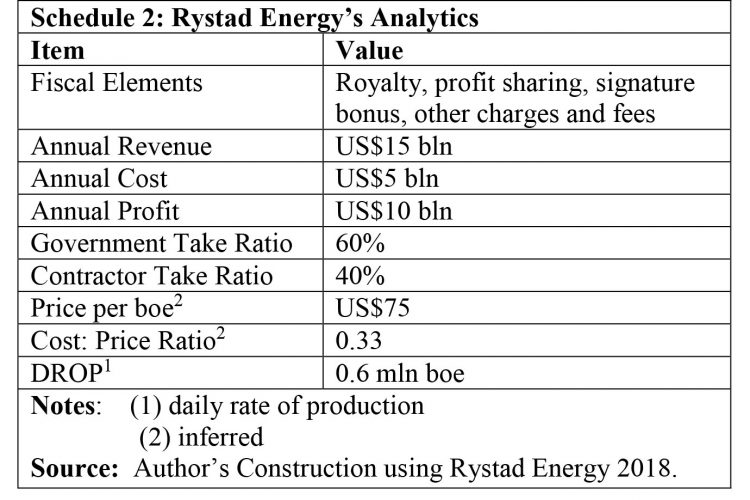

Rystad Energy Analytics

At this stage, I introduce once again, the Road Map’s presentation of Rystad Energy’s modelling of Guyana’s petroleum metrics as it relates to the third critical relation — estimation of Government Take. The key data in Rystad Energy’s model are captured in Schedule 2.

This information shows: 1) the fiscal elements assessed by Rystad Energy (royalty, profit sharing, signature bonus and a miscellany of other charges/fees/rentals and so on, covered in the PSA template that was used); 2) Government Take, which averages 60% of net cash flow 3) a DROP of 0.6 mboe per day. This low DROP is used in Rystad Energy’s model, despite ExxonMobil and its partners projecting a DROP of 0.75 mboe per day by 2025 (before full ramp-up), and additionally, excluding any output from other holders of petroleum blocks 4) a cost/price ratio of 0.33 derived from Rystad’s proprietary model. This cost-price ratio is about 10% below the mean of the two cost ratios, which I apply.

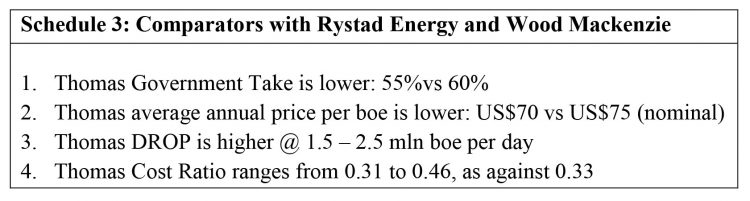

Juxtaposition of Model Values

For ease of comparison, I display in Schedule 3, the variances in the variables as applied by Rystad Energy and myself, based on Rystad Energy’s model. The difference in Government Take reveals that mine is lower (55% versus 60%). My projected average annual price of Guyana crude oil is also lower (US$70 per boe versus US$75 per boe). My DROP is however, higher at 1.5 to 2.5 mboe per day versus 0.6 mboe per day for Rystad Energy. My cost/price ratio too is higher. This ranges from 0.31 to 0.46 of price versus 0.33 of the price by Rystad Energy.

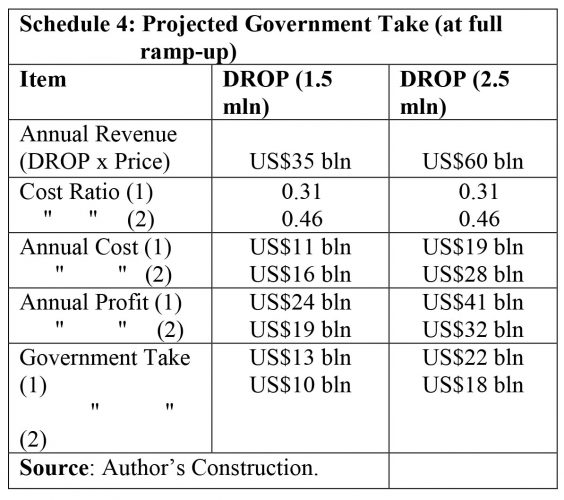

Thomas Model, at Full Ramp-up

Finally, Schedule 4 summarizes the values I obtained for Guyana oil and gas, at full ramp-up. These reveal that, with a cap of 10% of Government Take to be spent on the Buxton Proposal at full ramp-up, it is theoretically affordable for Guyana. The task that must now be completed, is a feasibility/pilot study to determine a workable scheme.

Conclusion

This completes, for now, my Sunday columns in the series themed: Guyana Petroleum Road Map. It also wraps-up discussion of the final topic in the series, namely, the Buxton Proposal.