On February 2 of this year, I concluded my year-long series of columns, which had commenced on January 27, 2019, on the topic: Guyana’s Petroleum Road Map. I indicated in that column my intention was to shift the focus of future columns to “broader development themes and challenges facing Guyana, beyond oil and gas.” As readers may recall, this had been the original aim of my Sunday columns, which started well over a decade ago. I had also, indicated in the column that my intention was between that date (February 2, 2020) and the National and Regional Elections scheduled for March 2, I would devote my columns to “reflections on aspects of the public debate … relating to the reporting of Guyana’s petroleum discoveries”.

Further, I had indicated in the same February column that when I engage Guyana’s oil and gas sector in the future, I shall focus more on empirical outcomes, avoiding dwelling on speculative (theoretical) concerns. With that in mind, today’s column (the first since National and Regional Elections), assesses Guyana’s first Report on Petroleum Production and Revenues (RPPR) produced by the Ministry of Finance.

The First RPPR

Guyana’s first RPPR was released last month. It reports on Guyana’s oil and gas production and revenues to the end of December 2019. This follows Guyana’s First Oil on December 20, 2019. As publicized by the Ministry of Finance, the Report is “in keeping with the rules set out in the Natural Resources Fund (NRF) Act, 2019. The First RPPR relates to the period, December 2019”. The information carried in the first RPPR is based on data provided to the Government by ExxonMobil, the contractor (Operator). The Ministry claims that it makes “all reasonable efforts” to verify the accuracy of the data in the Report but indicates it is not the original source of the information.

Today’s and next week’s column assesses the first RPPR and offers a few recommendations.

The Natural Resources Fund

The publication of the First RPPR is directly linked to Guyana’s Natural Resources Fund (NRF). This was created in January 2019. Its purpose is primarily two-fold; namely: 1) to safeguard against the resource curse, and 2) to benefit the present and future generations of Guyanese. For these purposes the Government has committed itself to: “managing the NRF according to international best practices”, specifically as laid out in the Santiago Principles (previously discussed extensively in this series of Sunday columns).

These international best practices require, by law, several reports to be submitted by the NRF to the relevant Authorities. Consequently, the RPPR aims to bridge the gap between such reports and an official report/update on the broader topic of Guyana’s petroleum production and revenues. In what follows below, I shall summarize the contents of the PRRP and then proceed to indicate how it can be usefully improved. Because of space constraints, I shall address the latter concern in next week’s column.

As the first RPPR indicates, several reports on the NRF are required to be published, including, but not limited to:

1.Reports from the Public Accountability and Oversight Committee, Macroeconomic

2. Committee and Investment Committee;

3. Reports on withdrawals from the NRF, to be included in the annual budget proposal and, if needed, in a Supplementary Appropriation Bill; Annual reports of the NRF, including audited financial statements;

4. Quarterly reports and financial statements of the NRF; and

5. Monthly reports of the NRF.”

The above reports monitor deposits and withdrawals from the NRF. However, they do not adequately address the information needs as regards to the determination of the calculation of Government Revenues. Such information would improve transparency, given the sheer projected magnitude of the potential revenue flows.

The RPPR Results

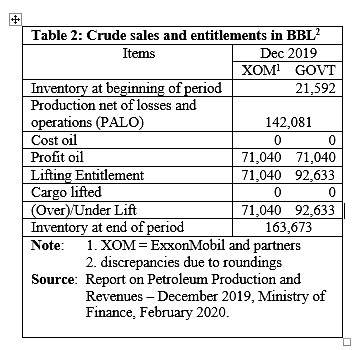

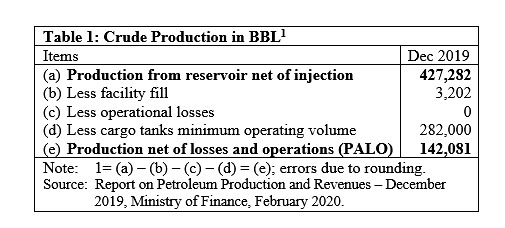

The RPPR presents its major dataset in two main Tables. These are reproduced in this Section. Table 1 provides data on crude production in December 2019, and Table 2 supplies data on crude entitlements (and sales). Both are indicated in barrels (BBL). Table 1 data are indicated below.

Table 2 shows the crude oil sales and entitlements for December 2019, the first period of the Liza 1 destiny operations. No petroleum was “lifted” from the Liza Destiny, because the available volume of 163,673 BBL was less than the standard cargo size of 1 million BBL as agreed by the Government of Guyana (GoG) and ExxonMobil, and partners.

Of the available 163,673 BBL, the GoG’s share was half the PALO in December 2019 plus the “onboard inventory”, which amounts to 92,633 BBL.

Conclusion

Next week I’ll conclude the discussion of the RPPR and make a few recommendations to aid the helpfulness of future RPPRs.