Introduction

Last week’s column wrapped-up my evaluation of Guyana’s first Report on Petroleum Production and Revenues (RPPR). However, three months after First Oil (December 20, 2019), Guyana’s infant oil and gas sector is being severely assaulted by global and internal convulsions. These have invoked the metaphor that titles this column: “A baptism of fire and brimstone for Guyana’s infant oil and gas sector.” Thus far, reporting on these phenomena in various print and social media has swung from thinly disguised “glee and delight” at the impending misfortunes confronting the infant sector, to “doom and gloom” based on concern that what is unfolding seems typical of the narrative of far too many failed “Petro states”!

In today’s column I commence an evaluation of these prognostications. Facing Guyana’s infant oil and gas sector is, by any measure, a severe ‘global crisis.” To date, this crisis exhibits four major dimensions. These are headlined as: 1) a financial crisis; 2) an economic crisis; 3) a crude oil crisis; and 4) a broader political economy crisis, encompassing: economic growth and distribution; investment and returns (profits); and, unsustainable global development. Clearly this analysis cannot be adequately covered in this column; indeed, it will take several. Consequently, today’s column’s focus is on briefly indicating a few of the key manifestations of the crisis referred to above. Afterwards, in columns to follow I shall focus on their analysis and evaluation.

Headline Factors

For purposes of the discussion of this topic, I identify five headline factors as being responsible for driving the “global crisis”. First, there is the ending of the global investors “bull market”. This ending marks the demise of the more than decade-long economic boom that has lasted since the Great Recession of 2007/2008. Second, there is the ongoing global public health epidemic which has transitioned in a matter of weeks into a global pandemic. This has, in turn, all but triggered the onset of a global recession. Third, there has been the literal collapse of the” OPEC+ other countries”, joint global crude oil marketing stance. And, in particular, there has been the eruption of an “oil price war” between the Kingdom of Saudi Arabia and the Russian Federation. As we already know oil price shocks have always tended, on balance, to divide global economies into “winners and losers”. In the present global circumstances, this division or contrast in countries’ fortunes is being exaggerated by low rates of interest and inflation, worldwide. Such low rates hamper the ability of the Authorities, mainly monetary, to contain adverse consequences. Historically, also, sharp swings in oil prices have always reverberated on the world’s stock markets. Fourth, there is the consequential impact of all the above on global “swing-oil producers”, particularly the US oil shale sector.

Fifth and finally, there are the ongoing long-term structural challenges that will face high-carbon sources of energy in the future. Global concerns about climate change plus a growing geopolitical “option” for renewable sources of energy are shaping the future energy mix. Indeed, such pressures have been severe enough, to have led to the prediction that this year, 2020, could well end up by being only the fourth year that global demand for oil will contract since the mid-1980s!

Financial Crisis

For the remainder of today’s column, I highlight some of the key features of the first of the four headline factors. That is the unfolding financial crisis. I wish to emphasize “unfolding”, because I do not believe that this crisis has run its course, or indeed has reached its projected peak. Furthermore, as indicated above the financial crisis interacts with the others cited. This means the crude oil, health (corona virus), greening of energy supplies and economic/development crisis dimensions are all integrated in the unfolding general crisis facing the global economy and Guyana.

Beginning a month ago (20 February 2020) there have been several major stock market crashes, worldwide. This is exhibited in the behaviour of the US-based Dow Jones Industrial Average, the NASDAQ-100 and the S&P 500 Index. Indeed, one of the most calamitous trading weeks since the Great Recession of 2007-2008, saw trading on all three of these markets fall into “correction territory”. That is a short-term price decrease of around 5 per cent. Readers may recall this is a significant decline but not enough to signal a “bear market”, which as noted before signals a 20 per cent and more decline over at least a two-month period.

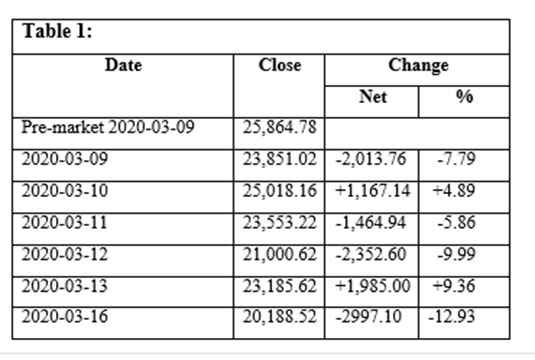

In the recent weeks, stock markets have been very volatile, with very pronounced swings. Thus for the 7-day trading period March 9 to March 16, 2020 (the day before this column was prepared) swings of minus 12.93 percent (March 16) and plus 9.36 percent (March 13, 2020) were recorded. The full details are shown in Table 1 below. The pre-market index at the opening of the period (March 9) was 25,864.78. This value was 5,676.26 higher than at the close (March 16) 20,188.52.

In the period referenced above there were two Black Mondays and a Black Thursday, the colloquial term applied to signal a stock market crash of 12 or more per cent. The first Black Monday preceding the Great Depression of 1929 and similar days were recorded in 1987, 2015 and 2020.

Conclusion

Next week I address some of the dramatic developments in the sphere of public policy responses to this component of the global crisis.