At the heart of the 2020 general crisis and its financial driver is a serious public health crisis. However, serious as the public health crisis is, it is by no means the sole significant source of the financial and economic meltdown that is presently unfolding worldwide. More appropriately, it conflates with other financial and economic developments whose origins are separate and independent of the arrival of the global public health crisis or pandemic. Today’s column begins with an evaluation of this proposition. I urge on readers the need to pay careful attention to my argument, since from all indications there is a widespread assumption that today’s global economic fall-out, stock market gyrations, recession fears, and, dramatic rise in global unemployment are the exclusive product of the pandemic

I caution also that this column does not pretend to offer a comprehensive analysis of the global economic impact of the pandemic. Its aim is simply to illustrate from one study the potential magnitude of this on energy demand.

UN 2019 Predictions

Preceding the outbreak of the Covid-19 epidemic, which rapidly transitioned into a pandemic in 2020, was a signal United Nations Committee on Trade and Development (UNCTAD) Report published in 2019. In that 2019 Report, UNCTAD specifically reported on “the possibility of a global recession in 2020”. The Report went as far as to identify 2020 as “a clear and present danger”.

This economic outlook was based on several analytics, including: 1) that 2019 was revealing itself as the year of the weakest expansion in a decade; 2) indeed, this slowdown was showing several signs of turning into a full blown GDP contraction in the following year (2020); 3) some of the indicators of this likely outcome, included wide currency fluctuations, lower long-term interest rates, and, global policy conflicts such as: Brexit, trade wars (mainly China vs US), the up-coming US elections; 4) signs of “spluttering growth” in the developed economies, combined with signs of “slowdown” in developing areas. In the face of these, the Report posited that: the macroeconomic policy stances of global governments were “lopsided and insufficient to give a sustained boost to aggregate demand.” It was also noted, global GDP growth and global trade were slowing down in 2019; the latter due mainly to the US-China trade war.

For purposes of the analysis to follow in my later discussion of this topic, the UNCTAD Report identified four inter-dependent issues as poses great risk to the global economy in 2020. These are: first, the reducing share of labour in global income; second, the erosion of public spending; third, the weakening of investment; and fourth, the challenge that was being posed to all forms of high-carbon sources of energy, especially petroleum.

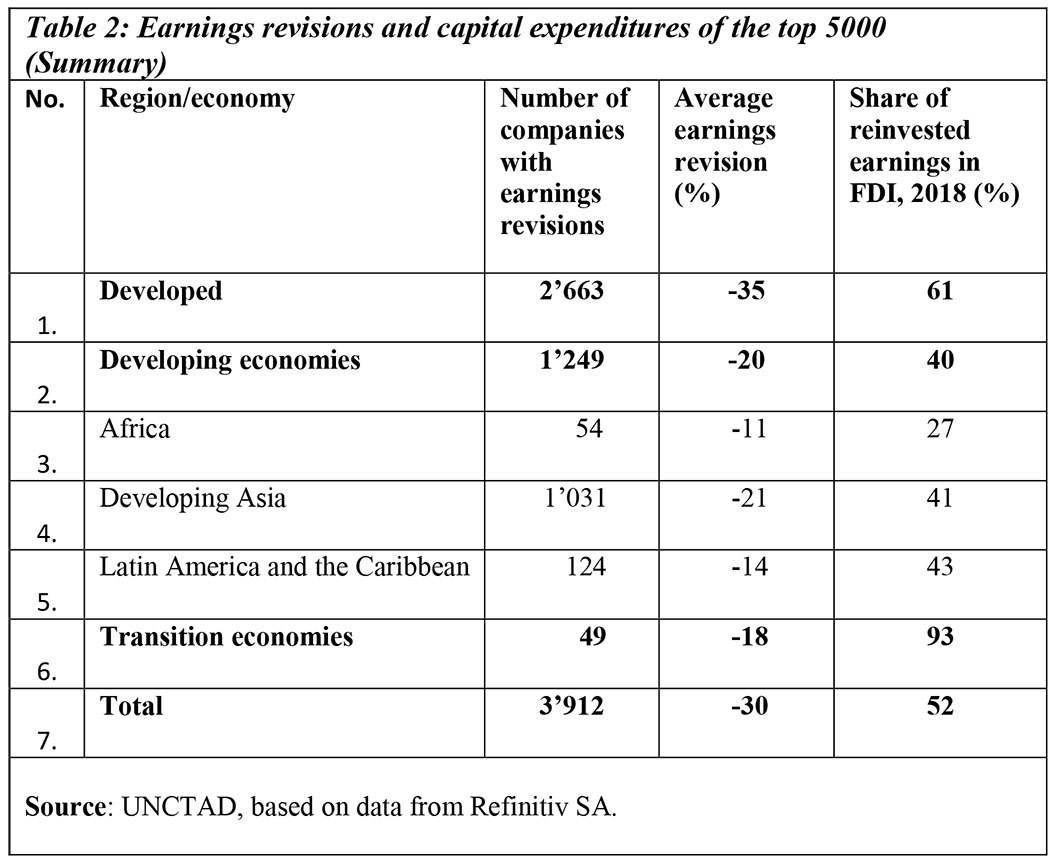

Sticking with UNCTAD, its Investment Trends Monitor publication for March 2020 reported on the “Impact of the Coronavirus Outbreak on Global, Foreign Direct Investment (FDI) twice during the month of March, about 2 weeks apart! Its latest Report for March 2020 has projected “a dramatic drop in global FDI”. The projected drop is in the range of minus 30 to 40 per cent for the period 2020-2021.

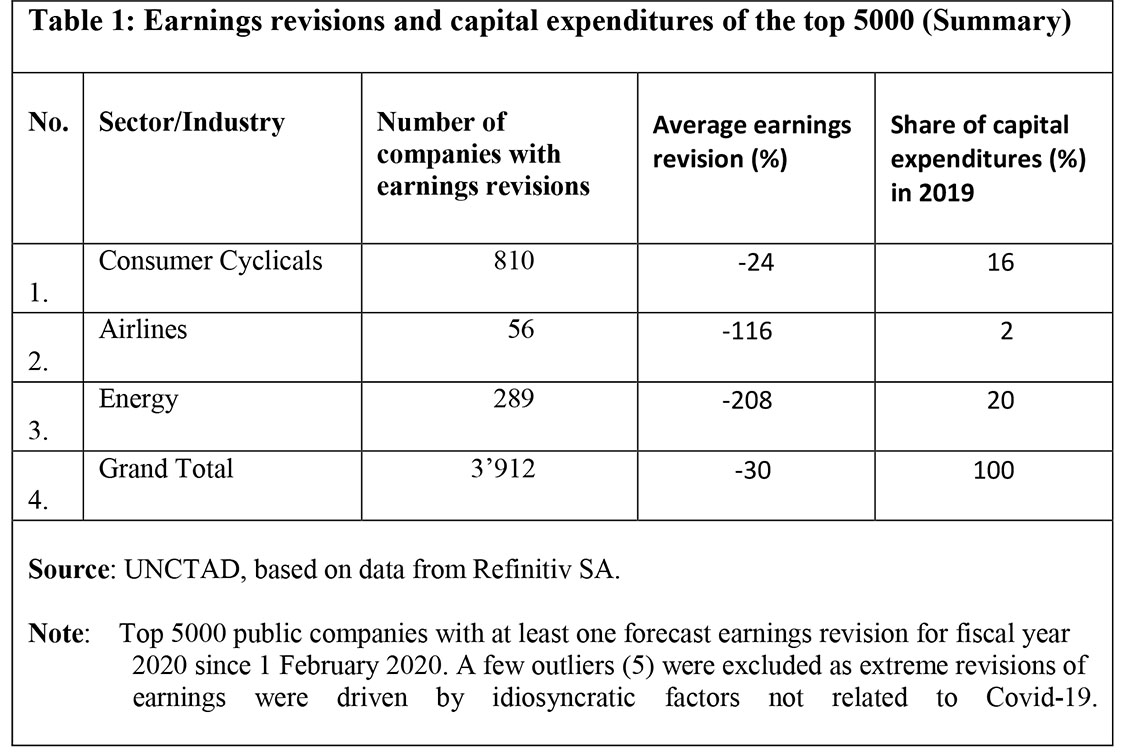

Table 1 shows earnings revisions and capital share for the energy sector and the top (consumer cyclicals) and bottom (airlines) sectors in terms of number of multinational enterprises, as well as the Grand Total for all these enterprises. The energy sector is the hardest hit (- 208 per cent)

Policy Response Limits

Limitations to current efforts of global policy responses are becoming increasingly evident. Thus the third fiscal stimulus of US$2 trillion in the USA and similarly scaled public resource commitments in Europe and Asia have met with calls for yet more fiscal stimuli! Indeed, there is growing recognition that markets do not offer perfect foresight; and, several analysts are calling for temporary closure of stock markets.

Conclusion

Last week I had concluded that the impact of the general crisis on Guyana’s infant oil and gas sector would depend on the depth and duration of the impending global recession. Given the role of the public health crisis in propelling this outcome, I would add that the outcome impact for Guyana will be worsened and also depend on the propensity of economic agents, worldwide, to spend, once the crisis begins to ease. However, the complication of the public health crisis is that we have little empirical evidence to draw on, in this regard.