In last week’s column I started an evaluation of the likely future impacts of the 2020 global general crisis, as I have portrayed this in recent columns, on Guyana’s infant oil and gas sector. In that column the focus was on projected impacts over a near-term to medium-term time frame; that is, from now to, roughly speaking, the mid-2020s. Today’s column changes the time frame to evaluate the likely future impacts from the medium to long-term (secular). That is, from the mid-2020s to the early 2050s.

Last week I concluded that the target set by ExxonMobil and its partners, back in July 2018, is still achievable, despite the severe impact to date, of the 2020 general crisis. By this I meant that, I expect Guyana’s crude oil production will ramp-up to 750,000 barrels of oil equivalent (BoE), per day by 2025. As readers were informed, in light of the 2020 developments, the ExxonMobil and partners grouping have hedged this 2025 forecast. It has added a further year to the target date, which is now 2026. I had also predicted that natural gas production will flow commercially in 2021.

These predictions are premised on the view that the parent companies of the Exxon grouping for the Stabroek Block will, during the crisis, “divest its low-productivity assets in oil” and focus on the more productive and profitable plays – like their offshore Guyana discoveries. In this regard, Rystad Energy has identified ExxonMobil, the super major, as a leading force, in this shift in the composition of petroleum assets.

To conclude this brief recap, I make two observations. First, the Exxon grouping has not been severely affected by the COVID-19 pandemic thus far. The Company advises, though, if it is seriously affected, “future activities can be delayed”. Second, I reserve comment on the near-term (2020) effects of the general crisis for my overall conclusion on this topic, which comes later. This allows for more time to elapse in the year.

Approach

In considering the likely future impacts over the long-term, two foundational considerations rise to the fore. One of these is the projected status of petroleum liquids and natural gas as sources of primary energy over the long-term (secular). The other is the projected long term quantity of Guyana’s recoverable oil and gas reserves. This latter will largely determine the output level reached when Guyana achieves full ramp-up of production and the likely duration of its supply of recoverable resources. In what follows I draw reader’s attention to the information I possess, on these two separate, but related topics.

Long-term Energy Mix

There are several long-term projections of the global energy mix available. These range from estimates provided by individual academic researchers, through estimates offered by energy firms and energy consultancy and related business intelligence firms to national and international institutionally sponsored sources. For this column, I have chosen to rely on the United States, Energy Information Administration (EIA), Reference Case projection cited in the EIA’s International Energy Outlook, 2019. This models the Reference Case to estimate the world’s energy situation in 2050.

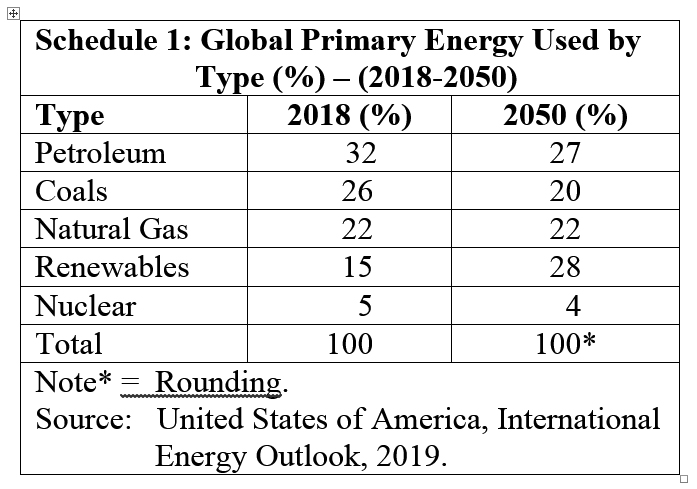

The modelling centres on the standard five modes of primary energy supply; namely, (in descending order of importance) in 2050: renewables, petroleum, natural gas, coal and nuclear. Their projected respective global shares in 2050 are 28 percent, 27 percent, 22 percent 20 percent and 4 percent. Over the period, the most striking occurrences exhibited in the projections are that 1) petroleum liquids lost the pre -eminence it held in 2018 (32 percent); and in fact declined as a share of global primary energy supplies 2) the share of renewables rose from 15 to 28 percent 3) the share of natural gas remained constant over the period, at 22 percent 4) coal’s share fell the most, from 26 to 20 percent, and, finally, 5) nuclear power’s share declined from 5 to 4 percent, while remaining overall still only a marginal source.

In summary, the fastest growing energy source projected by EIA over the period, 2018-50 is renewables at 3 percent per annum. Natural gas is projected to grow by 1.1 percent and liquid petroleum by 0.8 percent per annum over the period. These data are summarised in Schedule 1.

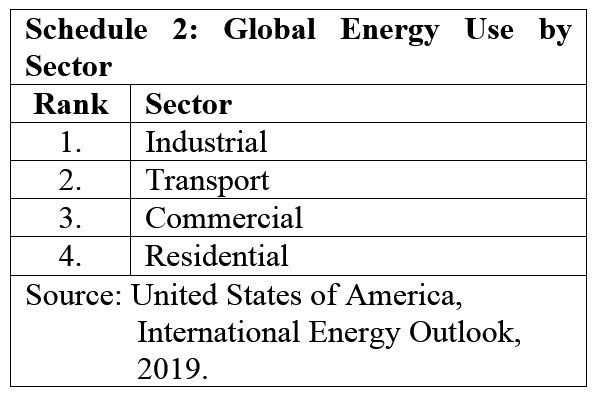

The EIA model identifies the leading primary energy consuming sectors as industrial, transportation, commercial, and residential. Here, industry includes manufacturing, refining, construction, and agriculture. This sector accounts for more than half of projected energy use in 2050. Schedule 2 summarises these data.

Looking into the future there clearly will be an inflection point for global crude oil production on/or before 2050. This is captured at the point when liquid petroleum loses its pre-eminence as a primary energy supplier. An important caveat, however, must be introduced. Despite liquid petroleum’s reduced share by 2050, between now and then global demand for this item is indeed projected to increase by a whopping 30 percent! This means that today, the existential threat to Guyana’s infant oil and gas sector still remains a secular prospect. This is a key outcome for my appraisal of the probable impact of the 2020 general crisis on that sector.

Conclusion

I continue this discussion next week.