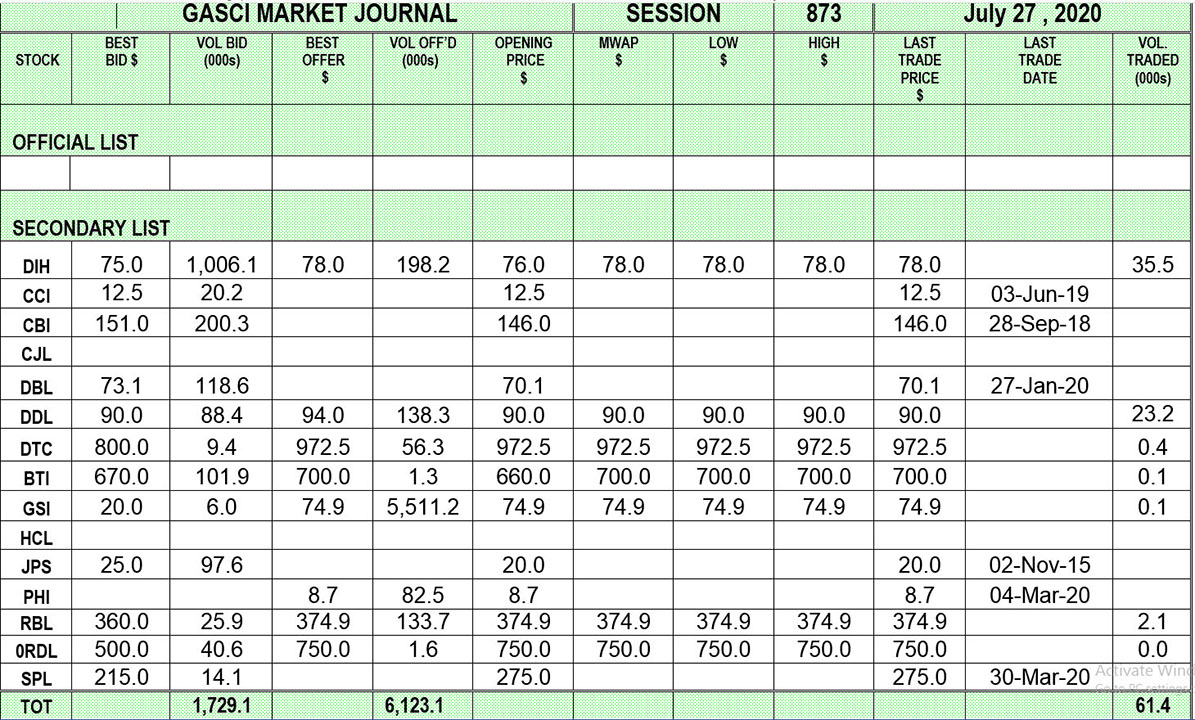

GASCI (www.gasci.com/telephone Nº 223-6175/6) reports that session 873’s trading results showed consideration of $6,079,395 from 61,435 shares traded in 15 transactions as compared to session 872’s trading results which showed consideration of $8,626,930 from 89,920 shares traded in 14 transactions. The stocks active this week were DIH, DDL, DTC, BTI, GSI, RBL and RDL.

Banks DIH Limited’s (DIH) six trades totalling 35,545 shares represented 57.85% of the total shares traded. DIH’s shares were traded at a Mean Weighted Average Price (MWAP) of $78.0, which showed an increase of $2.0 from its previous close of $76.0. DIH’s trades contributed 45.61% ($2,772,510) of the total consideration. All of DIH’s trades were at $78.0.

Demerara Distillers Limited’s (DDL) three trades totalling 23,226 shares represented 37.81% of the total shares traded. DDL’s shares were traded at a Mean Weighted Average Price (MWAP) of $90.0, which showed no change from its previous close. DDL’s trades contributed 34.38% ($2,090,340) of the total consideration. All of DDL’s trades were at $90.0.

Demerara Tobacco Company Limited’s (DTC) two trades totalling 354 shares represented 0.58% of the total shares traded. DTC’s shares were traded at a Mean Weighted Average Price (MWAP) of $972.5, which showed no change from its previous close. DTC’s trades contributed 5.66% ($344,265) of the total consideration. Both of DTC’s trades were at $972.5.

Guyana Bank for Trade and Industry Limited’s (BTI) single trade of 100 shares at $700.0 represented 0.16% of the total shares traded. BTI’s shares were traded at a Mean Weighted Average Price (MWAP) of $700.0, which showed an increase of $40.0 from its previous close of $660.0. BTI’s trade contributed 1.15% ($70,000) of the total consideration.

Guyana Stockfeeds Incorporated’s (GSI) single trade of 100 shares at $74.9 represented 0.16% of the total shares traded. GSI’s shares were traded at a Mean Weighted Average Price (MWAP) of $74.9, which showed no change from its previous close. GSI’s trade contributed 0.12% ($7,490) of the total consideration.

Republic Bank (Guyana) Limited’s (RBL) single trade of 2,100 shares represented 3.42% of the total shares traded. RBL’s shares were traded at a Mean Weighted Average Price (MWAP) of $374.9, which showed no change from its previous close. RBL’s trade contributed 12.95% ($787,290) of the total consideration.

Rupununi Development Company Limited’s (RDL) single trade of 10 shares at $750.0 represented 0.02% of the total shares traded. RDL’s shares were traded at a Mean Weighted Average Price (MWAP) of $750.0, which showed no change from its previous close. RDL’s trade contributed 0.13% ($7,500) of the total consideration.

Best bid: The highest price that a buyer is willing to pay for a security.

Best offer: The lowest price at which a seller is offering to sell securities.

TERM OF THE WEEK

Financial Services Compensation Scheme: Scheme designed to provide an element of protection in the event of default by an investment business. The maximum claim depends on the nature of the business.

Source: Dictionary of Financial and Securities Terms.

Contact Information:

Tel: 223 – 6175/6

Email: info@gasci.com

Website: www.gasci.com

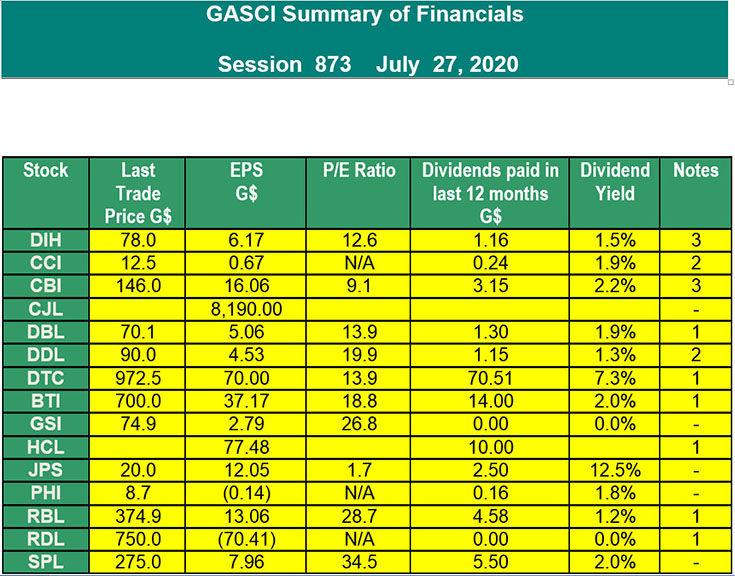

Notes

1 – Interim Results

2 – Prospective Dividends

3 – Shows year-end EPS but Interim Dividend

4 – Shows Interim EPS but year-end Dividend

EPS: earnings per share for 12 months period to the date the latest financials have been prepared. These include:

2016 – Final results for CJL and PHI.

2018 – Final Results for GSI, and JPS.

2019 – Interim Results for HCL and RDL.

2019 – Final Results for CCI, BTI, DDL, DTC, and SPL.

2020 – Interim Results for CBI, DBL, DIH and RBL.

As such, some of these EPS calculations are based on un-audited figures.

P/E Ratio: Price/Earnings Ratio = Last Trade Price/EPS

Dividend yield = Dividends paid in the last 12 months/last trade price.