In last week’s article, we referred to the urgent need to convene Parliament in order to set the legislative agenda for the rest of the year, including the presentation and approval of the budget for 2020. In effect, it will be a five-month budget, considering that seven months have already elapsed. However, for completeness and to ensure parliamentary approval is given for the budget for the entire year, the revenues collected and expenditures incurred in the first seven months are included, but shown separately. This had happened in 2015 when the budget was approved in August of that year, following a change in Administration.

Now that the two political parties have named their candidates for membership of the National Assembly, it is expected that the Assembly will convene early next month, if not earlier. Regarding the 2020 budget, due account will have to be taken of not only the balance on the Consolidated Fund but also anticipated revenue collections for the rest of the year. Since 1992 and perhaps earlier, the Consolidated Fund bank account has been heavily overdrawn, and after each passing year when expenditure exceeded revenue, the overdraft kept increasing.

Constitutional and legislative provisions

Article 217 of the Constitution requires all revenues or other moneys raised or received by Guyana to be paid into and form one Consolidated Fund. This is elaborated on by Section 38 of the Fiscal Management and Accountability (FMA) Act which requires all such moneys to be credited fully and promptly to the Fund. By Article 218, no moneys can be withdrawn from the Consolidated Fund except to meet expenditure chargeable to the Fund by the Constitution or an Act of Parliament, or as authorized by an Appropriation Act. The Appropriation Act is the culmination of the annual budget process. After the Assembly approves the Estimates, an Appropriation Bill is passed authorizing the withdrawal of funds from the Consolidated Fund to meet expenditure on public services. When the Bill is assented to by the President, it becomes an Appropriation Act.

In short, all public revenues are required to be paid into the Consolidated Fund, and no withdrawals can be made except with the approval of Parliament. Additionally, in accordance with Section 26 of the FMA Act, all appropriations lapse at the end of the fiscal year. As such, any unspent balances cannot be rolled over into the following year.

Consolidated Fund bank account severely overdrawn

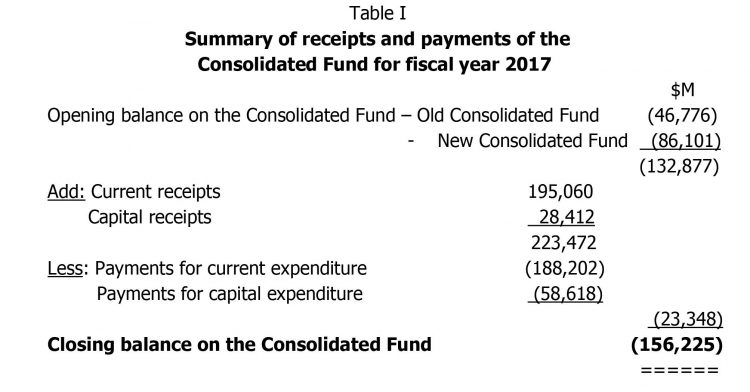

The Consolidated Fund bank account is held at the Bank of Guyana. According to the 2017 audited public accounts, the account was overdrawn by $156.225 billion as of 31 December 2017, as summarised at Table I:

The old Consolidated Fund, which has an overdraft of $46.776 billion, was closed on 31 December 2003 because it was not reconciled since February 1988. The new account was opened as of January 2004 to start from a clean position going forward without contamination with the old account, ensuring prompt monthly reconciliation, and avoiding the account going into overdraft. However, no attempt was made over the years to liquidate the overdraft on the old account. In addition, no sooner the new account was opened than overdraft started to build up, reaching $86.101 billion as at the end of 2017. Further, amounts totalling $27.726 billion remained in the Ministries’ bank accounts as of 31 December 2017. These should have been transferred to the Consolidated Fund before year-end as required by Section 43 of the FMA Act. Had this been done, the total overdraft would have been reduced to $128.499 billion.

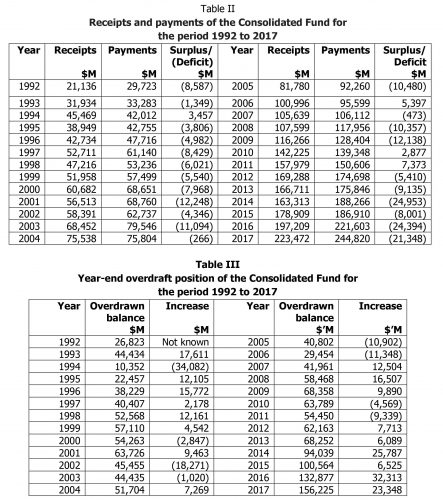

Since 1992 and perhaps earlier, there has been a build-up of the overdraft on the Consolidated Fund attributable mainly to deficit budgeting. This has resulted in expenditure exceeding revenue, with the exception of the years 1994, 2006, 2010 and 2011. Tables II and III show the receipts and payments of the Consolidated Fund for the period 1992 to 2017, and the year-end overdraft position for these years, respectively.

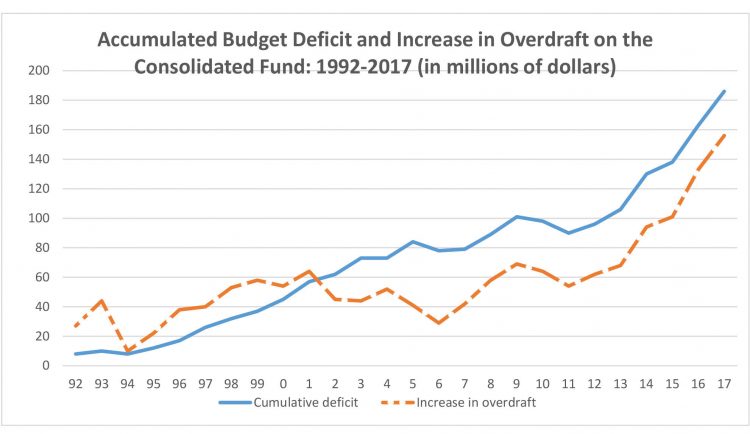

At the end of 1992, the overdraft on the Consolidated Fund was $26.823 billion. By 2014, it increased by $67.216 billion to $94.039 billion, giving an average annual increase of $3.055 billion over the 22-year period. During the period 2015-2017, the overdraft increased by $62.186 billion to $156.225 billion, giving an average annual increase of $20.729 billion. In other words, the overdraft incurred in the three years period prior to 2018 was almost that incurred during the preceding 22 years. This was despite the fact that over the years Guyana received significant financial benefit through the rescheduling and cancellation of its bilateral and multilateral debts as well as through payments under the Highly Indebted Poor Countries (HIPC) Initiative. The graph below shows the correlation between the annual deficits and the increase in overdraft of the Consolidated Fund.

While acknowledging that there may be occasions when deficit budgeting is necessary to spur economic activities and to achieve a higher growth rate, the exercise should be a one-off one, not a permanent feature, for reasons of sustainability and long-term financial viability.

Section 60 of the FMA Act authorizes the Minister to approve advances in the form of an overdraft on any official bank account to meet cash shortfalls during the execution of the annual budget. However, such advances must be repaid in full before the end of the fiscal year. The accumulation of an overdraft on the Consolidated Fund over the years therefore represents a major violation of the FMA Act. It is also evident that the scope of government operations continues to grow year by year without regard to affordability, and at a time when most governments consider down-sizing, with appropriate controls and strong regulatory mechanisms in place, as a more economic, efficient and effective way of delivering public services.

Monetary Sterilisation Account

Prior to 1993, the proceeds from the issue of short-term (90-day) and medium-term (182- and 365 day) Treasury Bills were paid into the Consolidated Fund. In 1993, the Monetary Sterilisation Account was established at the Bank of Guyana into which the proceeds of the latter are deposited and out of which payments are made as the Bills mature. The Auditor General had commented as far back as 1996 that it appeared inconsistent for the proceeds from the issue of short-term Treasury Bills to be paid over to the Consolidated Fund while those relating to the issue of medium-term Treasury Bills were being kept outside of the Consolidated Fund. In fact, Section 61 of the FMA Act requires the proceeds of any borrowing by the Government to be paid into and form part of the Consolidated Fund.

According to the notes to the public accounts, the purpose of the Sterilisation Account is to remove excess liquidity from the financial system, and the related liability ‘should be exactly offset by the monetary sterilization bank account, creating a fully funded liability’. As of 31 December 2017, the Account reflected a positive balance of G$77.537 billion. It may be appropriate at this time for an analysis to be carried out of this account to ascertain to what extent it is contributing to keeping inflation in check vis-à-vis the associated costs.

Government deposits at the Bank of Guyana

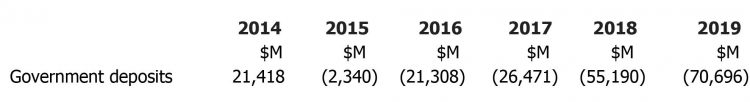

The audited accounts of the Bank of Guyana showed a negative balance of $70.696 billion as government deposits as of 31 December 2019. While no breakdown has been provided, it is reasonable to assume that the balances on both Consolidated Fund and the Monetary Sterilisation Account are included in this amount which is the accumulated net balance on all government bank accounts. The negative balance of $70.696 billion should therefore not be confused with the overdraft on the Consolidated Fund which is estimated at $213.456 billion as of 31 December 2019.

Government deposits at end of 2014 reflected a positive balance of $21.418 billion. Therefore, the reduction in the deposits over the last five years was $92.114 billion and as shown below, corresponds roughly to the increase in the overdraft in the Consolidated Fund over this period:

Current estimated overdraft on the Consolidated Fund

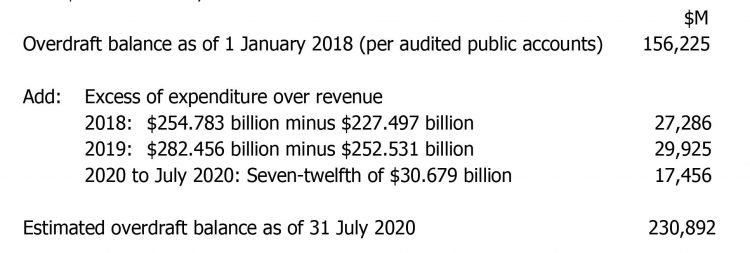

The Auditor General’s report on the public accounts for 2018, although finalized and presented to the Speaker of the Assembly on 30 September 2019, has not been presented to the Assembly due to the dissolution of Parliament. It is therefore not publicly available. The audited accounts for 2019 are not due until the end of September. In order to project the balance on the Consolidated Fund to the end of July 2020, we can use the Minister’s End-of-Year Report for 2018 and 2019. We can also assume that seven-twelfths of the expenditure for 2019 would have been incurred as of July 2020. Using these, the projected overdraft on the Consolidated Fund as of 31 July 2020 is $230.892 billion, as shown below:

Conclusion

The Treasury is not only empty but it has also been operating for the longest while on overdraft financed by the Bank of Guyana, an independent agency with its own legislation. The overdraft has grown exponentially over the last six years. There are also other liabilities that need to be considered, including the public debt which stood at US$1.689 billion, equivalent to G$353.364 billion, at the end of 2019.

It is against this background that the 2020 budget is being compiled, and any anticipated deficit will have to be financed by additional overdraft from the Bank of Guyana. The new Administration has contributed to the sad state of affairs during its tenure in office in the period 1992 to 2014. It now has the herculean task of restoring the financial health of the Treasury.

One suggestion is for budget agencies to engage in cost-cutting exercises aimed at reducing their budgetary allocations without compromising the quality of service rendered. At the same time, a comprehensive review of all government programmes and activities should be undertaken to determine their continuing relevance in terms of their outputs, outcomes and impacts. In the final analysis, the solution to the problems faced by the Treasury is as far as possible the avoidance of deficit budgeting. In this regard, the new legislators have a crucial role to play during the budget debate by asking tough questions such as where the money is going to come from to finance the budget.