Introduction

Today’s column continues “counting the cost” of the continued economic setbacks/reverses facing Guyana’s infant oil and gas sector, as a consequence of the 2020 general crisis, as I have portrayed this crisis previously, in some detail. To be sure, I have used an approach that distinguishes both macro and micro-economic appraisals of the cost. To date, the macroeconomic approach was addressed last week. And, that was followed by an introduction to the microeconomic approach.

Briefly, the macroeconomic approach has been based on using downward revisions made this year, as the general crisis unfolded to Guyana’s forecasted 2020 GDP growth rate and compared these to the original Q4, 2019 IMF projected growth rate of 85.6 percent, as a broad proxy indicator of the macroeconomic impact. The result shows that these downward revisions range in value from 40 to 60 percent lower than the IMF Q4, 2019 forecasted growth rate of 85.6 percent!

Last week when I started the microeconomic approach to the assessment, my focus was on the reported sales prices for the Government of Guyana, GoG’s petroleum lifts, and the impact of the 2020 general crisis on the price obtained. As revealed, it is reported that in oil markets, Guyana’s Liza crude has been traded at a price, which is US$1.50 to US$2.00 discount on dated Brent crude. Dated Brent, as noted last week, is the price paid for physical cargoes of crude oil in the North Sea, which have assigned to them specific delivery dates. Guyana’s Liza crude is reported in the crude oil market by SP Global Platts as light to medium sweet. That is, with a Sulphur content of 0.51 and an API of 32.1.

Today’s column principal concern is to examine the impact of the 2020 crisis on global crude oil prices this year; and, consequentially, on the price Guyana’s crude oil sales made by the GoG obtains in the world market.

Price effects

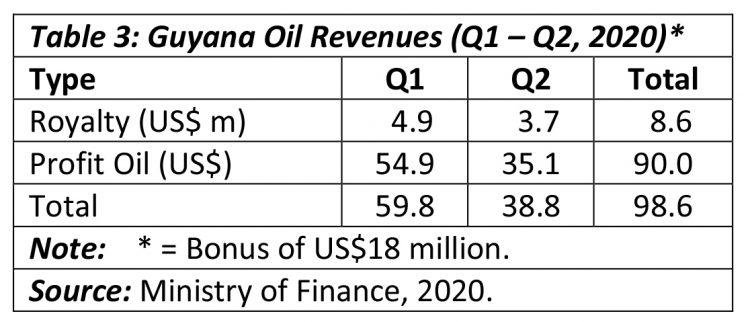

As indicated last week, information provided by the US Energy Information Agency (EIA) reports the actual Brent crude prices for Q1 and Q2, 2020 as US$50 and US$29 per barrel, respectively. As indicated, the Q2 price was 42 percent lower than the Q1 price. Further, EIA estimates that for Q3 and Q4, 2020, prices will increase from the Q2 low of US$29 to US$40 and US$42 respectively.

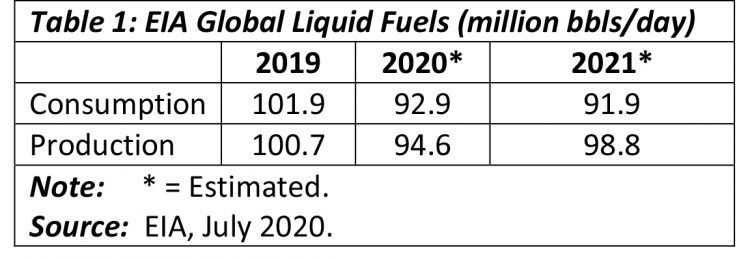

As at July 2020, EIA has forecasted the average 2020 Brent crude price as US$41. The EIA’s base assumptions are 1) a global GDP growth rate of -3 percent for 2020 and 2) a global demand of 92.9 million barrels of oil equivalent (boe) per day, and 3) a global supply of 94.6 million barrels per day (see Table 1). As is well known, estimating crude oil prices in the future is very hazardous. The EIA’s success rate in performing this task is among the most respected for its rigorous methodology.

Table 1 also reveals the global liquid fuels balance of demand and supply as estimated by the EIA; and provides comparative data for last year (2019) as well as next year’s estimate (2021).

The EIA data show a downward shift in global demand of about 10 percent for 2021 when compared to 2019. The production decline over these same years (2019 and 2021) is less, about 2 percent. Indeed, the decline in 2020 is much more significant (about 6 percent) but the recovery in 2021 will be just over four percent.

Significantly, the recent EIA estimated 2020 average Brent crude price of US$41.00 per barrel is 36 percent below the price of US$64 per barrel that was used in the Q4, 2019 IMF/Guyana Authorities forecast of Guyana’s GDP growth rate for 2020. The forecast is built on an estimated production of 82,000 barrels of oil per day in 2020. We have therefore to estimate/forecast Guyana’s output to determine broadly, the income loss generated by impact of the 2020 general crisis on Guyana’s production and export of crude oil during this year.

Guyana’s oil lifts

Guyana’s profit share from Liza output in 2020 is scheduled to be delivered in cargo lifts of approximately 1 million barrels, for around five such lifts for 2020, at a minimum. Thus far three of these lifts have occurred. The prices for Guyana’s first two lifts are US$55 per barrel for lift 1, to US$35 for lift 2. The revenue earned has been US$55 million and US$35 million respectively. The price for the third lift is still to be released.

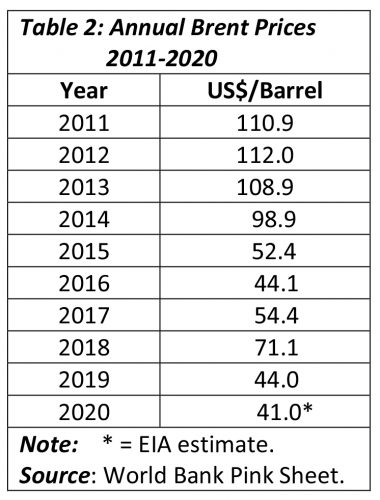

Table 3 provides Government of Guyana, GoG’s Oil revenues obtained for Q1 and Q2, 2020. If we include, the Signature Bonus, the government revenues obtained thus far total US$116.6 million.

Conclusion

Next week I continue with this appraisal of the microeconomic impacts of the 2020 general crisis on Guyana’s infant oil and gas sector.